Regulus Exchange – The Tokenomics and Its Advantage

In a recent article, I introduced you to Regulus Exchange. If you haven't, you might want to read that article for the full gist. In this article. I'll be looking a little deeper into the tokenomics “token economics” of the Regulus Exchange, with a bias toward my believe in it and the benefits it offers the exchange, its users and its token holders.

Why Crypto Projects Issue Tokens/Coins

The simple main reason why crypto startups issue tokens/coins is to raise funds to develop their proposed solutions; platforms/dapps. Therefore, the success of any crypto project is closely connected with the success of its token, which has an intimate relationship with the price of the token. The value of a token is largely determined by its price. And, when the price increases, the turnover also increase; in which case the project team will have access to the funds needed for development and other things that would guarantee the success of the project, this success flows to the investors/token holders and the users of the platform.

Suffice it to say that the token supply alone does not determine the price of a token, neither does the price of a token alone determines the success of a project, but for a good project with a good team, that delivers on their proposed solution, the token supply and its price can be an important success factor.

Economics Law of Demand and Supply

I am sure we can remember what we learned from our Economics classes; that the lower the amount of an item supplied, while the demand of the item remains constant/increases, the higher will be the price of the item. And, that the higher the supply, while the demand remains the same/decrease the low will be the price, provided all other things remain constant. That is; when the supply of an item is limited and the demand increases, it leads to an increase in the price of the item and vice versa.

If we bring this into the crypto-economics; it means when the supply of a crypto asset is limited, as the demand begins to rise (for example after the launch of the project's platform), so does the price of the asset, which translates to a higher turn-over. Now, for a good project, with a qualified and serious team; when the supply of its token is moderately limited, it’s far easier for the demand to steadily and quickly outgrow the supply, which translates to an increase in the value of the token; when all other things are constant.

I have tried to establish the importance of a token total supply in relation to its price, as an important factor to be considered to determine the potential success of a project. Thus, laying the foundation for the subject matter of this article as it relates to the tokenomics of Regulus Exchange.

Ok now, let’s take a brief look at two of the popular cryptocurrency exchanges and their token supply, as an example of the potential benefits of having a very limited token supply.

BNB Token Overview

BNB is the native token of Binance Exchange. The total supply of BNB at launch was 200 Million, at an ICO price of $0.1152 per token. Binance, understanding the importance of total token supply, decided that every quarter it will use 20% of its profits to buy back BNB coins and burn them out of circulation until there are only 100 million coins in circulation.

In the very short period of its operation, Binance has done really well, and so has the performance of its token BNB; BNB had once traded at an all-time high (ATH) rate of $24.37 in January this year, at the time of this writing, it currently trades above $9. The liquidity that the success of BNB has generated, I believe, has helped Binance to continually innovate and remain amongst the top crypto exchanges.

KuCoin Shares (KCS) Overview

Just like BNB, KCS is the native token of Kucoin Exchange. 200 million KCS was issued at launch at an ICO price of $0.6921 per token. Kucoin also decided that every quarter 10% of its profit will be used to buyback and burn KCS, which will continue until there are 100 million KSC in circulation. KCS too has been doing well, traded at ATH of $20.17 in January this year, at the time of writing, it’s trading above $1.

The Rugulus Exchange (RGLS) Tokenomics

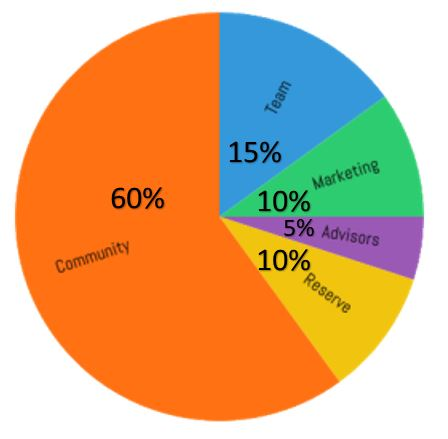

The total token supply will only be 60 million (one of the lowest token supply for a cryptocurrency exchange of its type in the market), the team keeps just 15% of the total supply, 50% of the supply will be locked - 25% will be released 6 months after the launch of the platform, while the remaining 25% released by the end of the first year.

That means, the totality of all the RGLS token that will ever be in circulation is just 60 million RGLS tokens, of which only 30 million (50%) will be available at launch. The reserved 10% will be used to fund novelty and rewards, while the 60% community share will be distributed via Airdrop, Lottery, Dividend, and Bounty. Token holders enjoy 50% discount on trading fees and 40% of the fee collected will be shared amongst RGLS token holders.

Like we previously established, while all other things remain constant (like the team delivered on their proposed solution, the platform is launched according to planned roadmap, the solution meets the requirements of the target users and the demand responds accordingly, etc.), RGLS have a very high potentials for great success viz-a-viz the Exchange itself.

Conclusion

Regulus Exchange is an ambitious, innovative and secure project aiming to serve a very important set of crypto users (those who are always on the move), who have been mostly neglected. For this set of people, it’s crucial that Regulus succeeds to deliver the desired solution, and I believe being a self-funded project with a very limited token supply gives the exchange a good competitive advantage to successfully deliver their solution.

More About Regulus Exchange:

Website: https://regulus-exchange.io/

Whitepaper: https://regulus-exchange.io/wp-content/uploads/2018/09/regulus-whitepaper-1.pdf

Telegram: https://t.me/joinchat/KKumTEW_vhlQVTiPvRR97g

Twitter: https://twitter.com/RegulusExchange

Medium: https://medium.com/@regulusexchange

ANN: https://bitcointalk.org/index.php?topic=5024610.0

ForkDelta: https://urlz.fr/7Ovi

EtherDelta: https://urlz.fr/7Ovk

About Author:

Bitcointalk Username: edundayo

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1004920

Telegram: https://t.me/edundayo

This really shows how the tokens can potentially perform against other projects and exchange tokens.

Definitely!