central banks view on cryptocurrencies as currencies

BIS Annual Economic June 2018 Report

source: Bank for International Settlements 2018

In June the BIS (Bank for International Settlements) issued its annual report. The BIS is owned by 60 central banks worldwide. Its "mission is to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas and to act as a bank for central banks."

source: https://www.bis.org

They took a closer look at BTC, BCH, ETH and ETC and its potential as currencies. In short: BIS said all 4 are no competitors to FIAT and are not able to serve as currencies for daily use right now. The reasons are:

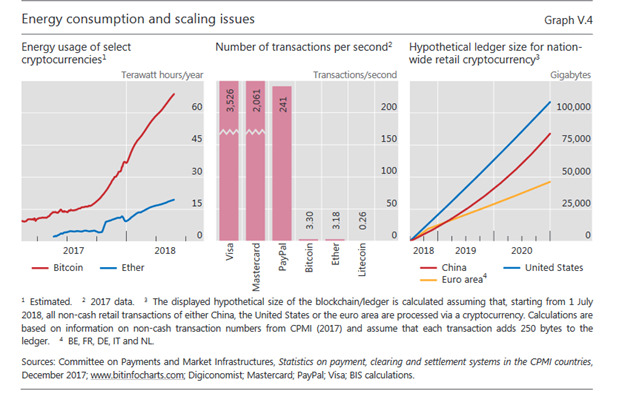

1. scaleabilty

Their argument is that if each of those cryptocurrencies would be used by many people/countries their blockchains would get so big it could only be managed by super computers.

Also transactions are put on queue if the blockchain cannot process them all, which leads to "traffic jam" and soaring fees. "This limits cryptocurrencies’ usefulness for day-to-day transactions such as paying for a coffee or a conference fee, not to mention for wholesale payments."

2. unstable value

BIS says that a currency needs to be stable for daily use. Central banks are able to "...stabilising the domestic value of their sovereign currency by adjusting the supply of the means of payment in line with

transaction demand." Something that cryptocurrencies cant do. So called stable coins like DAI failed to do so. "While engineered to be fixed to the US dollar at a rate of one to one, it reached a low of $0.72 just a few weeks after its launch in late 2017."

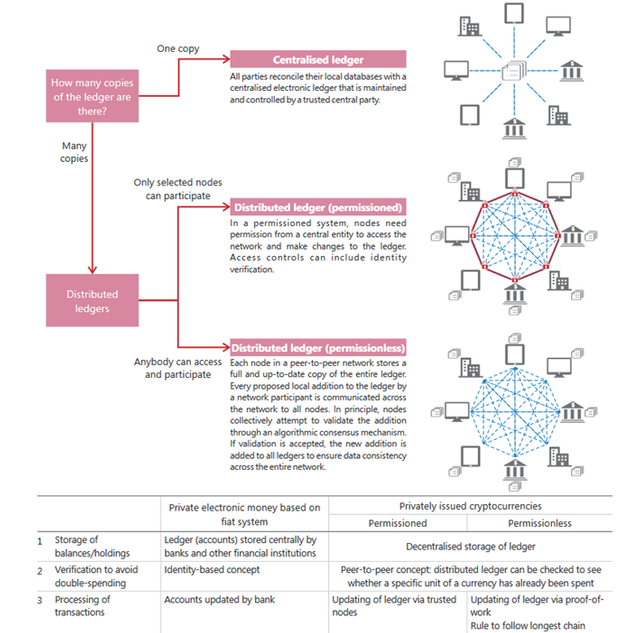

3. missing finalty

"....permissionless cryptocurrencies cannot guarantee the finality of individual payments. One reason is that although users can verify that a specific transaction is included in a ledger, unbeknownst to them there can be rival versions of the ledger. This can result in transaction rollbacks, for example when two miners update the ledger almost simultaneously. Since only one of the two updates can ultimately survive, the finality of payments made in each ledger version is probabilistic."

All the aforementioned cryptocurrencies (BTC, BCH, ETH and ETC) as permissionless ones. BIS favoures centralised or at least permissioned ledgers (e.g. NEO etc.)

source: BIS Annual Economic June 2018 Report

Conclusion

You can say what you want, but BIS got some points here one cannot deny. When it comes to scaleabilty we often had issues with BTC and ETH with slow transactions and high fees and still blockchain tech is far away from being adopted by the masses. And we only have a few users currently.....

Also volatility is a problem for sure. If you want to buy a house with BTC and over night the course drops by 10% this can be a problem for sure. It is just not practical for a currency to ride like a wild horse, leaving you uncertain about the value you possess.

I dont have experience with point 3 (missing finalty), but I heard of it. So this would also be a problem indeed.

So in short BIS says: FIAT vs crypto 3:0

But the tech itself is interesting and could be useful for other purposes

So BIS is not rejecting blockchain (distributed ledger technology) totally:

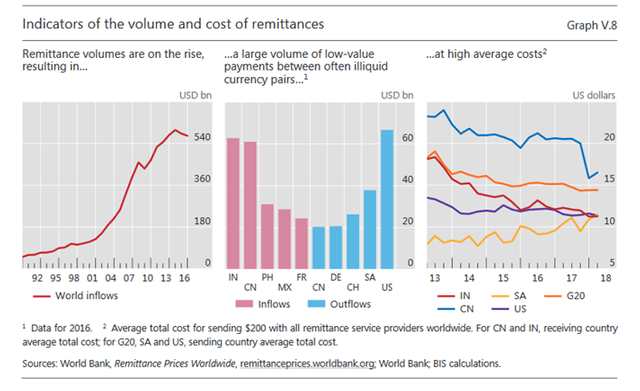

"While cryptocurrencies do not work as money, the underlying technology may have promise in other fields. A notable example is in low-volume cross-border payment services. "

Do you also read XRP between the lines??? :)

"Permissioned cryptopayment systems may also have promise with respect to small-value cross-border transfers, which are important for countries with a large share of their workforce living abroad. Global remittance flows total more than $540 billion annually (Graph V.8, left-hand and centre panels). Currently, forms of international payments involve multiple intermediaries, leading to high costs (right-

hand panel)."

"That said, while cryptopayment systems are one option to address these needs, other technologies are also being considered, and it is not clear which will emerge as the most efficient one. More important use cases are likely to combine cryptopayments with sophisticated self-executing codes and data permission systems. ...

... Some decentralised cryptocurrency protocols such as Ethereum already allow for smart contracts that self-execute the payment flows for derivatives. At present, the efficacy of these products is limited by the low liquidity and intrinsic inefficiencies of permissionless cryptocurrencies. ...

... But the underlying technology can be adopted by registered exchanges in permissioned protocols that use sovereign money as backing, simplifying settlement execution. ...

... The added value of the technology will probably derive from the simplification of administrative processes related to complex financial transactions, such as trade finance. Crucially, however, none of the applications require the use or creation of a cryptocurrency. ...

"

source: BIS Annual Economic June 2018 Report

Thats it for today. I hope I could help you a little with that insight on banks about cryptocurrencies.

I really do not understand what you mean here? why on earth will you draw a conclusion with banks and cryptocurrency? Did you attend the BIS annual Economic summit?

Thanks for asking. But thats not my idea. That information is given in the report. And no I did not attend the summit. I just read their report and took out the essence about cryptocurrencies.

@eminenz great blog friend...

Thank you very much :)