Breaking Down 'Cryptocurrency'

(Article Source/Author: Investopedia.com)

'Cryptocurrency'

[What is a 'Cryptocurrency']

A cryptocurrency is a digital or virtual currency that uses cryptography for security. A cryptocurrency is difficult to counterfeit because of this security feature. A defining feature of a cryptocurrency, and arguably its most endearing allure, is its organic nature; it is not issued by any central authority, rendering it theoretically immune to government interference or manipulation.

[BREAKING DOWN 'Cryptocurrency']

The anonymous nature of cryptocurrency transactions makes them well-suited for a host of nefarious activities, such as money laundering and tax evasion. The first cryptocurrency to capture the public imagination was Bitcoin, which was launched in 2009 by an individual or group known under the pseudonym Satoshi Nakamoto. As of September 2015, there were over 14.6 million bitcoins in circulation with a total market value of $3.4 billion. Bitcoin's success has spawned a number of competing cryptocurrencies, such as Litecoin, Namecoin and PPCoin.

[Cryptocurrency Benefits and Drawbacks]

Cryptocurrencies make it easier to transfer funds between two parties in a transaction; these transfers are facilitated through the use of public and private keys for security purposes. These fund transfers are done with minimal processing fees, allowing users to avoid the steep fees charged by most banks and financial institutions for wire transfers.

Central to the genius of Bitcoin is the block chain it uses to store an online ledger of all the transactions that have ever been conducted using bitcoins, providing a data structure for this ledger that is exposed to a limited threat from hackers and can be copied across all computers running Bitcoin software. Many experts see this block chain as having important uses in technologies, such as online voting and crowdfunding, and major financial institutions such as JP Morgan Chase see potential in cryptocurrencies to lower transaction costs by making payment processing more efficient.

However, because cryptocurrencies are virtual and do not have a central repository, a digital cryptocurrency balance can be wiped out by a computer crash if a backup copy of the holdings does not exist. Since prices are based on supply and demand, the rate at which a cryptocurrency can be exchanged for another currency can fluctuate widely.

Cryptocurrencies are not immune to the threat of hacking. In Bitcoin's short history, the company has been subject to over 40 thefts, including a few that exceeded $1 million in value. Still, many observers look at cryptocurrencies as hope that a currency can exist that preserves value, facilitates exchange, is more transportable than hard metals, and is outside the influence of central banks and governments.

'Bitcoin'

Bitcoin is a digital currency created in 2009. It follows the ideas set out in a white paper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Bitcoin offers the promise of lower transaction fees than traditional online payment mechanisms and is operated by a decentralized authority, unlike government issued currencies. There are no physical Bitcoins, only balances associated with public and private keys. These balances are kept on a public ledger, along with all Bitcoin transactions, that is verified by a massive amount of computing power.

[BREAKING DOWN 'Bitcoin']

Bitcoins are a digital currency created in 2009 which allow users of bitcoin exchanges to make payments and trades at a very low cost. Bitcoin circulation and expansion is governed by Bitcoin software and is programmed to expand as a geometric series, thus limiting the effects of monetary inflation on the virtual currency.

Bitcoins are one of many virtual currencies that can be traded online by users. Bitcoin balances are kept using public and private "keys," which are long strings of numbers and letters linked through the mathematical encryption algorithm that was used to create them. The public key (comparable to a bank account number) serves as the address which is published to the world and to which others may send Bitcoin. The private key (comparable to an ATM PIN) is meant to be a guarded secret, and only used to authorize Bitcoin transmissions.

'Double-Spending'

The risk that a digital currency can be spent twice. Double-spending is a problem unique to digital currencies because digital information can be reproduced relatively easily. Physical currencies do not have this issue because they cannot be easily replicated, and the parties involved in a transaction can immediately verify the bona-fides of the physical currency. With digital currency, there is a risk that the holder could make a copy of the digital token and send it to a merchant or another party while retaining the original. This was a concern initially with Bitcoin, the most popular digital currency or "cryptocurrency," since it is a decentralized currency with no central agency to verify that it is spent only once. However, Bitcoin has a mechanism based on transaction logs to verify the authenticity of each transaction and prevent double-counting.

[BREAKING DOWN 'Double-Spending']

Bitcoin requires that all transactions, without exception, be included in a shared public transaction log known as a "block chain." This mechanism ensures that the party spending the bitcoins really owns them, and also prevents double-counting and other fraud. The block chain of verified transactions is built up over time as more and more transactions are added to it. Bitcoin transactions take some time to verify because the process involves intensive number-crunching and complex algorithms that take up a great deal of computing power. It is, therefore, exceedingly difficult to duplicate or falsify the block chain because of the immense amount of computing power that would be required to do so.

Hackers have tried to get around the Bitcoin verification system by using methods such as out-computing the block chain security mechanism, or using a double-spending technique that involves sending a fraudulent transaction log to a seller and another to the rest of the Bitcoin network. These ploys have met with only limited success. In fact, most Bitcoin thefts so far have not involved double-counting, but rather have been due to users storing bitcoins without adequate safety measures.

'Litecoin'

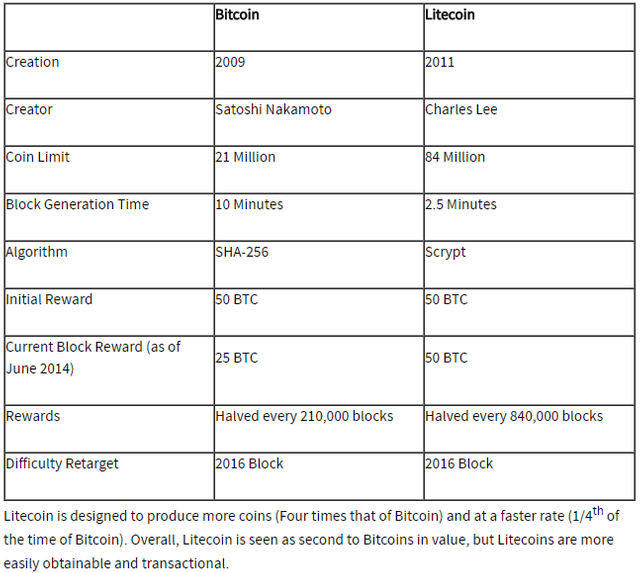

Launched in the year 2011, Litecoin is an alternative cryptocurrency based on the model of Bitcoin. Charlie Lee, a MIT graduate and former Google engineer, is Litecoin's creator. Litecoin is based on an open source global payment network that is not controlled by any central authority. Litecoin differs from Bitcoins in aspects like faster block generation rate and use of scrypt as a proof of work scheme.

[BREAKING DOWN 'Litecoin']

Litecoins were launched with the aim of being the "silver" to Bitcoin's "gold," and have gained much popularity since the time of inception. Litecoin is a peer-to-peer internet currency. It is a fully decentralized open source, global payment network. Litecoin was developed with the aim to improve on Bitcoin's shortcomings, and has earned industry support along with high trade volume and liquidity over the years. The broader differences between the two cryptocurrencies are listed in the table below.

'Trade Hill Exchange'

A Bitcoin exchange launched in June of 2011. Trade Hill Exchange offers Bitcoin trade support for a number of currencies including the Australian and Canadian dollars, the euro, Chilean peso and Indian rupee. The exchange allows for both limit and market orders, and charges commission fees for all trades placed through the exchange.

'51% Attack'

51% attack refers to an attack on a blockchain – usually bitcoin's, for which such an attack is still hypothetical – by a group of miners controlling more than 50% of the network's mining hash-rate, or computing power. The attackers would be able to prevent new transactions from gaining confirmations, allowing them to halt payments between some or all users. They would also be able to reverse transactions that were completed while they were in control of the network, meaning they could double-spend coins. They would almost certainly not be able to create a create new coins or alter old blocks, so a 51% attack would probably not destroy bitcoin or another blockchain-based currency outright, even if it proved highly damaging.

[BREAKING DOWN '51% Attack']

Bitcoin and other cryptocurrencies are based on blockchains, otherwise referred to as distributed ledgers. These digital files record every transaction made on a cryptocurrency's network and are available to all users for review, meaning that no one can not spend a coin twice – the digital equivalent of a perfect counterfeit, this ability would quickly destroy faith in the coin's value.

'Mt. Gox'

One of the world's leading Bitcoin exchanges, launched in July of 2010. Mt. Gox allows users to buy, sell and trade Bitcoins on its exchange while offering support for U.S. dollars, euros and Canadian dollars. Members of the Mt. Gox exchange consider their Bitcoin holdings to be housed in a sort of e-wallet, allowing for quick trading of the digital currency with other traders on the exchange. Mt. Gox charges a commission for all trades executed through the exchange.

'Bitomat'

A Polish-based bitcoin exchange. Bitomat was the first Bitcoin exchange in Poland to offer support for the Polish Zloty, officially going online on April 4, 2011. Using Bitomat, traders are able to make deposits into a virtual wallet, in either PLN or Bitcoins and place buy and sell orders, with the exchange acting as an escrow for the funds.

Bitomat was acquired by the Mt. Gox Bitcoin exchange in August of 2011.

'Britcoin'

A U.K.-based Bitcoin exchange. Britcoin was the first Bitcoin exchange in the U.K. to offer support for GBP trading. Traders are able to trade bitcoins by placing buy or sell orders into an order book and those orders will be matched against opposing open orders in full or partially filled, with Britcoin acting as an escrow for the funds.

As of August 2011 Britcoin had been renamed Intersango.

'Bitcoin Wallet'

A Bitcoin wallet is a software program where Bitcoins are stored. To be technically accurate, Bitcoins are not stored anywhere; there is a private key (secret number) for every Bitcoin address that is saved in the Bitcoin wallet of the person who owns the balance. Bitcoin wallets facilitate sending and receiving Bitcoins and gives ownership of the Bitcoin balance to the user.

[BREAKING DOWN 'Bitcoin Wallet']

A Bitcoin wallet is also referred to as a digital Wallet. Establishing such a wallet is an important step in the process of obtaining Bitcoins. Just as Bitcoins are the digital equivalent of cash, a Bitcoin wallet is analogous to a physical wallet. But instead of storing Bitcoins literally, what is stored is a lot of relevant information like the secure private key used to access Bitcoin addresses and carry out transactions. The Bitcoin wallet comes in many forms; desktop, mobile, web and hardware are the four main types of wallets.

Article Source/Author: Investopedia.com "Cryptocurrency"

http://www.investopedia.com/terms/c/cryptocurrency.asp

http://www.investopedia.com/terms/b/bitcoin.asp.

http://www.investopedia.com/terms/d/doublespending.asp

http://www.investopedia.com/terms/l/litecoin.asp

http://www.investopedia.com/terms/t/tradehill-exchange.asp

http://www.investopedia.com/terms/1/51-attack.asp

http://www.investopedia.com/terms/m/mt-gox.asp

http://www.investopedia.com/terms/b/bitomat.asp

http://www.investopedia.com/terms/b/britcoin.asp

http://www.investopedia.com/terms/b/bitcoin-wallet.asp

(All credit goes to Investopedia.com. I added images and reworded the definitions that were repetitive for an easier reading experience.)

-----

If you found value in this post and would like to support this blog please up-vote & resteem

Thank you for reading!

https://www.mixbtc.io/

Mixbtc.io was created for the bitcoin mixer community with three things in mind, trust, speed, and security.

We understand that using a bitcoin mixer for the first time can be uncomfortable so we recommend splitting larger transactions into multiple ones until you’re comfortable with the process.