Setting up to win either way. AMD Market Watch 7/29/18

In this post I am going to be addressing the huge growth in AMD and what a good plan going forward to take will be.

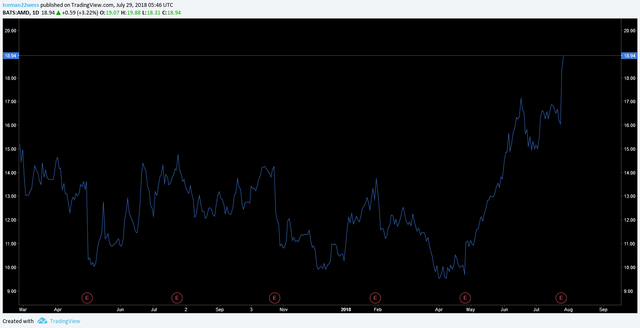

If you have not taken the time to see what AMD has been up to, look at this growth.

Now, the long term isn't why I am interested in trading this. The recent growth this stock has gone though has created a very high volume being traded relative to the price.

Average Volume of a few examples:

SPY - 83 Mil

NDAQ - 953,177

Walgreens -7 Mil

Sprint - 15 Mil

Microsoft - 26 Mil

AMD - 58 Mil (66 Mil current volume)

This really puts the excitement in this stock into perspective. This means that the bid/ask spread will be tighter on a less expensive stock, making it easier to enter and exit a trade quickly with as little slippage as possible.

Now the first thing any sane person would say is either: You are buying the top and going to lose a ton. The move isn't done and you can make quick easy money. These are both fair things to say. The only sure thing is that the VOLUME is up. With volume, comes volatility, the key component in making a trade like this one.

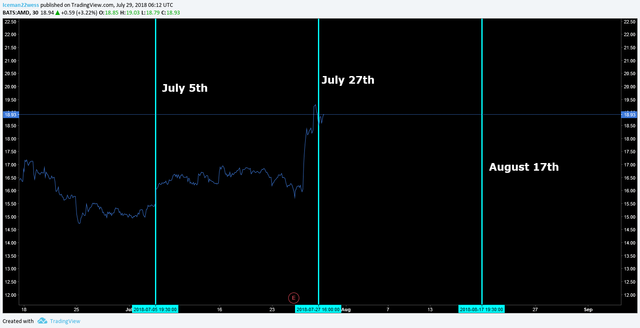

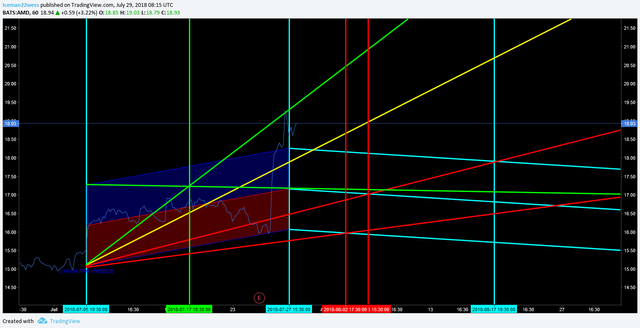

The key date I am targeting in this trade is August 17th (options expiration). So I will be making a chart that attempts to predict price movement to that date, while also looking to profit regardless of the stock price moving up or down.

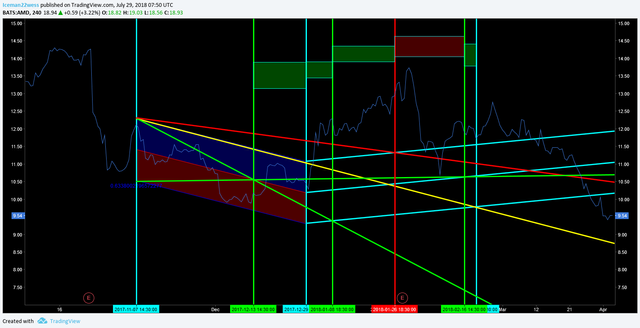

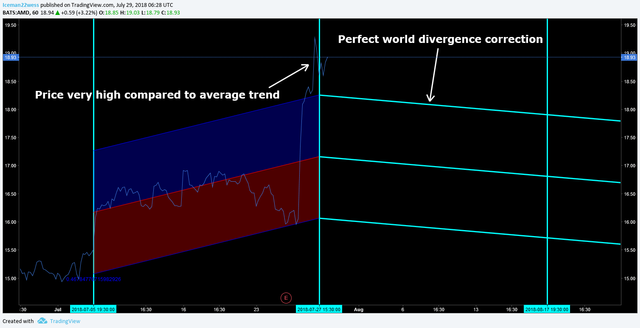

First I will show a few examples of this method on AMD's chart to reinforce the relevance of the data.

At the top I marked with green and red boxes to indicate the sentiment of the direction because the chart has tons of lines going everywhere and I don't expect anyone to understand what they mean.

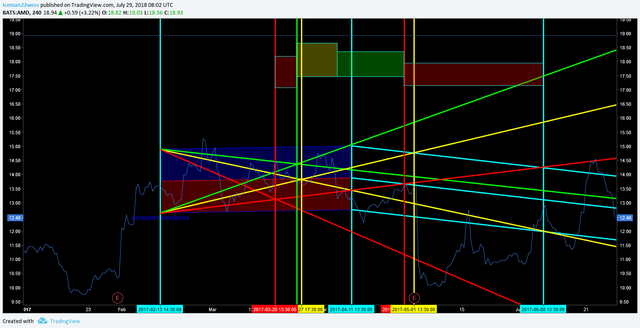

Here's another random location.

Here is the progression of the live chart.

This chart shows that the upward trend ends 8-2 to 8-6. Where the price will be... who knows. Here's where it gets interesting though. Assuming I trade this in the options market...I know that I have until August 17th to finish my trade.

$23 Call = $.06 or $6

$16 Put = $.08 or $8

Taking one of each of these is a total risk of $14. If the price continues to move violently as it has, it takes about a 15% move to make one of these become "in the money". 15% is relative to the start of the chart I am using. If I ignore everything in the chart, I very well could make a few hundred dollars just based on one of those targets hitting before 8-17. That being said, the chart is showing some bearish indicators coming. In order to try to get the best positions on this, I will likely be buying both of those on Monday morning, and then deciding if I want to leverage additional positions when the price reaches the red sell line. The average move in the duration of time I am looking to trade is give or take 10%. This is enough to profit, but not enough for a home run trade. I am looking to make this trade based off of increased volume causing increased volatility.

Thanks for reading,

-Icee-

Please leave me an upvote and remember this is not trading advice.

@resteemator is a new bot casting votes for its followers. Follow @resteemator and vote this comment to increase your chance to be voted in the future!