BTC update

27/06/2019/11:00CET

Well boys and girls, it happened last night. Bitcoins rally was broken. And at a significant TA point. Lets take a look at the charts and see what is likely to happen next...

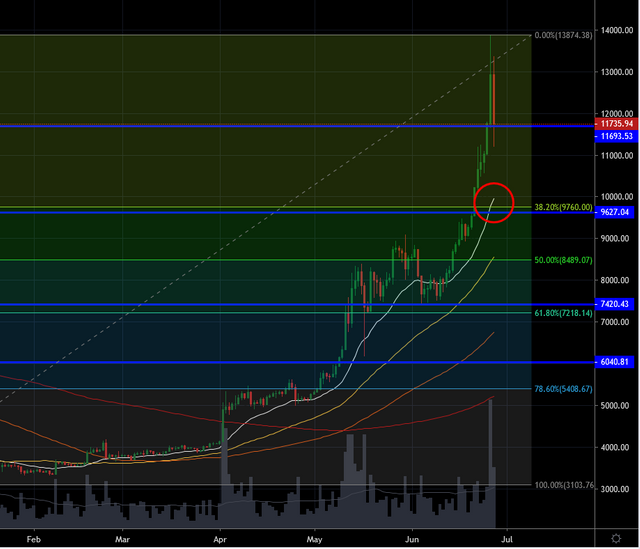

BTCUSD Daily on Bitstamp

- Trading at 11692USD at press time after peaking out at 13880 yesterday.

- In one day we went from 11500 to 13880. A 2380USD rise in 24 hours! 20% rise!!

- Nothing can go on like this!

- Since the peak at 22:00CET, we retraced 2000USD in 1 hour!

- Right now we are at a about a 15% retracement level with a local low of 11200 which almost a 20% drop from high to low.

- Search all you like to catalysts, but the one that is most glaring is the one that was right in front of everyone all along.

- The 61.8% Fib retracement was at 13373usd. We overshot this with our torrid momentum but it was only a 500usd overshoot, and short live. We only had 3 hourly candles that opened and closed above this level.

So what does TA say about the next moves in Bitcoin?

BTCUSD Daily on Bitstamp

- I have said before in previous posts that Bitcoin has a habit of 30-40% retracements during bull markets. Assuming we are in a bull market now, we can look at the 38.2% Fib retracement as a potential support level. It also correlates with a RS line at around the 9600-9800 levels where Bitcoin found resistance back in feb 2018 (off to the left of the chart)

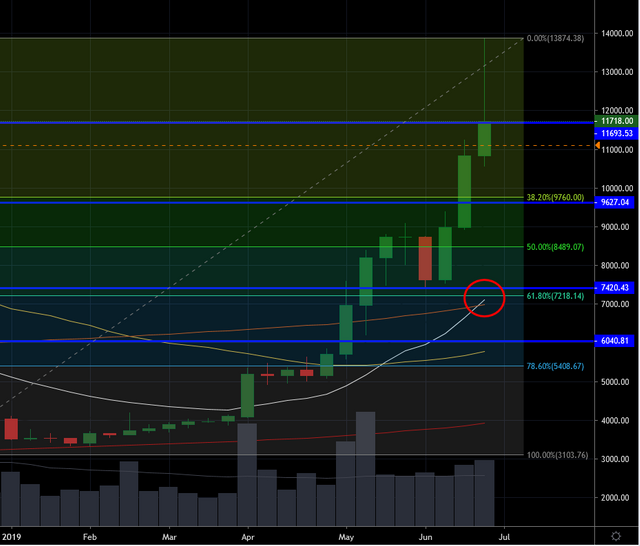

BTCUSD Weekly on Bitstamp

- I have also been saying that the 21WEMA is a reliable support indicator during bull markets.

- Today this lives at 7100usd and conincides with 2 other indicators, an RS line which was significant support in mid May this year.

- And also the 61.8% Fib retracement level again coming into play at 7220usd.

My take

- Patience is now required.

- Studying lower time frame charts indicates that volume spikes are on the red candles.

- We are grinding ever lower with lower lows and lower highs

5min chart

- and at the current trajectory we will reach our first RS line (9600usd) in the last days in the next 24-36h. I am not saying that this is what will happen, I am just making a trajectory statement.

- We could grind around with uncertain feedback from the market for some time, as we have seen in Bitcoin during the first months of 2019.

- So levels to watch for are 9600-9800 and then 7100-7300.

- At the first stop I would advise tolerance till we see 2 consecutive daily candles showing strong reversal at the first stop before wading back into the long side. Even at that I would set tight stops.

- If we go lower to 7100-7300, then I would again wait for a strong reversal signal and hold tight stops on any long positions.

- I have to add here that IF this is our bull markets first retracement, then we should hold 7100 at the very least. A break lower could indicate that this whole rally was a fake breakout and we are yet to find a bottom of the bear market.

- Yes seriously! We must at least give some consideration to this possibility.

- In a previous post I called the bull market on, but despite the certainty with which I declared this, it is always prudent to look over your shoulder.

As always guys, leave comments, have fun and trade safe.

Disclaimer: This post is not financial advice. Before investing any funds do your own research and make your own decisions. Cryptocurrencies are highly speculative.

And finally: Do not invest money you are not comfortable losing.

Help me to make more content like this.

Upvote me, comment and resteem.

Thanks

So it looks like yesterday was a good day for someone to have sold, if they bought during the recent low levels of the last few months. I wish I was smart enough to have participated in such a trade.

I had a ask booked in at 13900 and just missed out!

Frustrating but that is how trading goes.

I am now watching carefully for the levels I talk about.

As soon as we go 4 figures, I think start to dollar cost average into the market. Off course not financial advice mind you.

Alright.