Homelend(HMD)–How Blockchain is Disrupting the Mortgage Industry

One of the things that is at the core of the society is mortgage loans. Why? Well, as humans, shelter is one of the basic needs of life, unlike going on a vacation, or buying a table which you can choose not to do. You can also (usually) choose not to go into debt. Sometimes, having a home shouldn’t be, or isn’t, an option.

For a number of people out there, using a mortgage loan to either rent or buy a place is the only option they have for housing, asides having to live with their families or friends. Only very few actually have the ability to purchase a home with cash.

In parts of the world like the U.S., cash transactions have been seen to account for only one-third of home purchases because even when someone can pay cash, going for a small mortgage loan is a preferable option. This is because mortgage interest payments in some places can be deducted for income tax purposes.

The Importance of the Mortgage Market

From a social and economic standpoint, there is more than enough data that clearly shows how important the mortgage market is. Let’s take the United States as an example, in 2016, the value of mortgage debt outstanding for that year was $14.29 trillion, which is close to the pre-2008 global financial crisis level. According to Market Reports Online, this figure is expected to get to $31 trillion on a global scale in 2018.

On the other hand, comparing a small country like Israel you would find that 37.29% of all debts and 61.53% of household debts come from housing loans.

The Complexity of the Mortgage Market

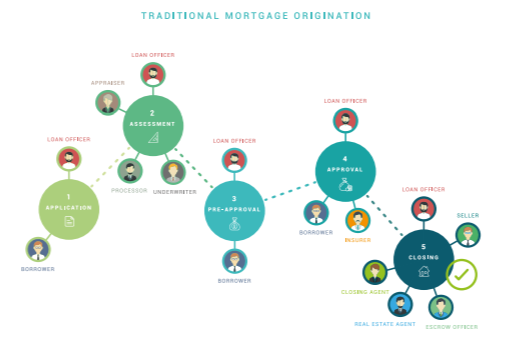

Despite the fact that mortgage loans are important and common, they still remain complex because it involves a bulk load of paperwork, inefficiencies, and overhead costs. The overwhelming number of documents to be gathered and processed, the significant amount of time taken by both the lender and borrower – these are considered when applying for a mortgage loan.

Source: Homelend Whitepaper

All of these processes are still paper-based, unlike other financial areas that have delved into digital technology. Also, many parties are continually being included in the mortgage loan process including the seller, buyer, rating agency, financial institution, broker, appraiser, and so on, which makes it even more complex. Introducing mortgage-backed securities (MBS), while at the same time expanding liquidity and financing sources, has also introduced complexity.

Introducing Blockchain to the Mortgage Industry

Blockchain technology has successfully disrupted many areas of the financial world, however, despite being a large part of the financial world, mortgage lending is still generally being conducted the traditional way.

The mortgage value chain consisting of three distinctive stages; origination, servicing, and securitization, has grown in complexity over the past three decades. Nonetheless, the processes in mortgage lending still remains paper-based making them tedious, slow, and complicated with a variety of negative consequences for the parties involved.

The overwhelming amount of entities involved and the documents needed to be filled during the mortgage origination process are as a result of two factors; the need to gather, analyse, and check information, and the fact that the process has not been sufficiently aligned with technological advancements nor has it been modernized. Both of these factors contribute to increase in cost, but blockchain technology has a huge potential to fix both these issues.

In my next article, I'll look into what blockchain technology has to offer the Mortgage Industry. For more information on Homelend, be sure to check out their website

Disclaimer: As with all investments, you should do your own research. The information provided in this article is focused primarily on bringing the facts out of the white paper to supplement your due diligence. Please do your own research and make up your own mind.

Links:

Homelend Website

Follow Homelend's Twitter

Join the Homelend Telegram Group

Follow the official Homelend Blog

Read the Homelend Whitepaper

Author BTT Profile

ANN Thread