What caused the crypto market crash? Did MTGox actually sell on exchanges?

Simple answer was fear, but what triggered this?

I do not claim to have the answer, but we can see if we can locate the causes. There are two possible triggers:

MT Gox moving funds - as evidenced here MT Gox BTC Wallet

We then have to ask ourselves, where did he move them?

First Address

Second Address

Third Address

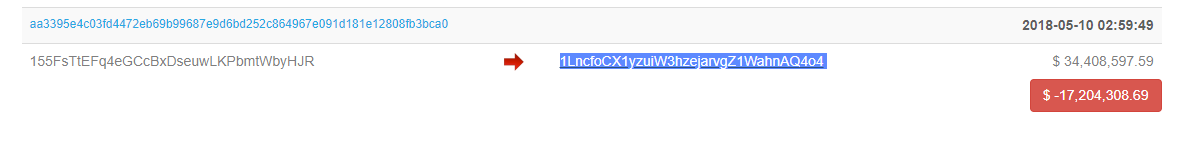

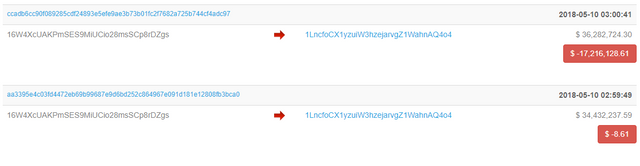

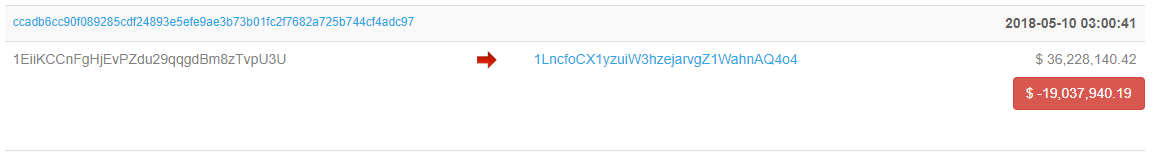

Notice on this one, there appears to be a smaller transaction first to the same BTC address: 1LncfoCX1yzuiW3hzejarvgZ1WahnAQ4o4

Why would you do that, it was A a mistake or B a test payment.

Forth Address

Currently 8214.97 BTC remains in this account. It does not appear to be an exchange account. More likely a cold wallet and if it was sent to an exchange, I am sure they would have cold wallet-ed some of the funds and not kept this in an active exchange address.

What else do we know?

Previous habits:

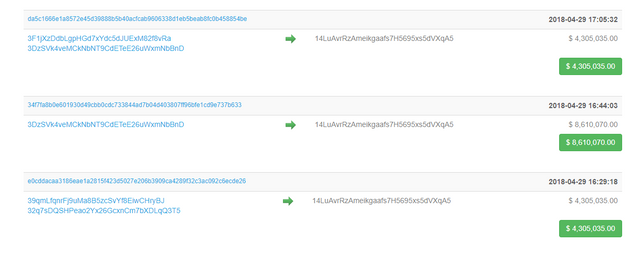

On the 26th April 2018, the Mt Gox wallet moved 16,000 BTC. See below addresses:

| Addresses | BTC |

|---|---|

| 1LXi3x7hyt17cxncscGE887WCrC6XDNZ4P to 14LuAvrRzAmeikgaafs7H5695xs5dVXqA5 | 2000 |

| 1Hm6XDmhKCHz68wDEYTapN9MEanke8iwUk to 14LuAvrRzAmeikgaafs7H5695xs5dVXqA5 | 2000 |

| 1Fu4YgM3Y9CxvioGPqkSzkydAC8MVaPN1D to 14LuAvrRzAmeikgaafs7H5695xs5dVXqA5 | 2000 |

| 1EK8vW7UYaYHKiW4TZmYJKtwcZLM14VjvP to 14LuAvrRzAmeikgaafs7H5695xs5dVXqA5 | 2000 |

| 1CRjKZJu8LvTutnSKq4zTJ4yiqrzMAArYW to 14LuAvrRzAmeikgaafs7H5695xs5dVXqA5 | 2000 |

| 1B6kJM75iu5ty1HAHMMz6tT1HhjoGNTCa9 to 14LuAvrRzAmeikgaafs7H5695xs5dVXqA5 | 2000 |

| 1AZu7TQmKBAes2duNDctYwjAB9nhHczUnA to 14LuAvrRzAmeikgaafs7H5695xs5dVXqA5 | 2000 |

| 18KDS3q6a4YV9Nn8jcyMvNoVPfcrfemeag to 14LuAvrRzAmeikgaafs7H5695xs5dVXqA5 | 2000 |

Total 16,000 BTC

The address that it appears to have gone to, makes large transactions, a few hundred bitcoin to a few thousand BTC almost everyday - https://blockchain.info/address/14LuAvrRzAmeikgaafs7H5695xs5dVXqA5

On first glance, this does not look like an exchange wallet, as majority of users you would expect very small numbers ranging in hundreds or thousands of transactions per day, in all sort of sizes of transfer.

But if you check the address, notice that the majority are huge amounts of money or very tiny amounts - suggesting OTC Trades and test payments. And only in the handful per day.

Lets look at price at the time:

Close according to Coinmarketcap

April 26th - $9281

April 27th - $8987

April 28th - $9348

April 29th - $9419

April 30th - $9240

We have been ranging for the best few weeks between $8800 and $9800, sentiment felt like we were recovering from the January to mid-April bear market. And possibly starting a new bull market cycle.

It does not appear he sold on exchange based on the addresses that could have influenced the pricing.

You would think that 16,000 BTC would affect the market price as much as it did in late December 2017.

He could have also waited till now to sell the BTC, but he passed it to a wallet that had daily large amounts in an out. Again pointing to an OTC trader.

In addition if we are to take his word according this bitcoin.com news article on March 17th saying:

“Following consultation with cryptocurrency experts, I sold BTC and BCH, not by an ordinary sale through the BTC/BCH exchange, but in a manner that would avoid affecting the market price, while ensuring the security of the transaction to the extent possible,”

Remember he represents the trustees and being through courts, one would expect that he would have been advised OTC (Over the counter trade) to avoid possible legal repercussions.

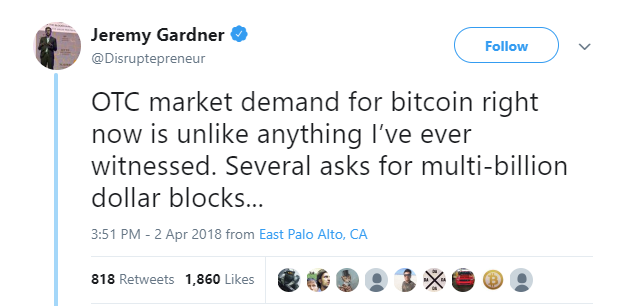

Further OTC demand is big, in fact according to this article the Daily bit, there is not enough OTC BTC to supply demand. Meaning the MT Gox trustee would have got a lot more value via OTC then Exchanges.

Note the original source, which was NY Times strangely no longer available, even though I read it here originally.

In fact within the industry it is a well know issue:

Due to this the MTGox Trustee has bound to be shopped by the OTC Traders, asking to represent the funds. There is no reason for the Trustee to choose exhanges rather than OTC.

What about the South Korean Investigation?

According to Chosun, a South Korean news outlet

"Prosecutors have searched for confiscation and seized the circumstance where Upbeat, Korea's largest virtual currency exchange, pretended to have a coin." (Note Google Translation)

"The prosecution has launched an investigation into virtual money companies that have received funds from a joint check by the Financial Services Commission and Financial Intelligence Unit (FIU). Last month, officials of the virtual currency exchanges such as Kim Ik-hwan of the coin nest were judged on charges of embezzlement and fraud. Kim was handed over to the court for allegedly stealing hundreds of billions of customers' money into his personal account."(Note Google Translation)

Basically it appears that the exchanged may have stolen funds from clients. Did the exchange owners sell what they had left? It would have had to been black market sales, as legitimate transfers to banks, would have been frozen by authorities.

What about the Upbeat customers, if anything they would have been only able to move BTC off the exchange to another address, while the system was still running.

So who sold?

It seems everybody out of fear, so in reality the only BTC that entered the market to be sold, was BTC that perhaps would not be sold normally. So this extra selling pressure, just cascaded on itself.

I expect that the MTGox Trustee will further confirm that he did not sell on exchanges and perhaps we will hear more on the Upbeat investigation, basically saying they froze remaining funds. But it is unlikely that BTC entered the market from these two particular sources.

Let me know your thoughts, I would be interested in the other peoples opinions.