January 28 Virtual currency chart analysis · Bit coin, ether, ripple, bit coin cache, stella, IOTA, light coin, NEM, cardano

After the Davos conference is over, international discussions on regulations related to virtual currencies will be handed over to the G 20 meeting to be held in March. Many national leaders are planning to regulate the virtual currency, but it is difficult to successfully regulate when looking at China's past case. Since the virtual currency exchanges were blocked last year in China, traders are trading in Hong Kong. Each country leader and the central bank should blindly oppose the virtual currency, and should draw a strategy to coexist with this coexistence.

BTC / USD bit coin / dollar

The point of 10,000 dollars has been strictly protected over the last few days, but there is concern that there is no repulsive force.

Just passing down the descent trend line, the momentum of the fall has weakened. It will be in the range of 10,000 to 12,000 dollars in the last few days. It is difficult to predict whether to go up or down from here. If you climb the 20-day index smoothed moving average line at $ 12218 you will rise to the descending trend line 2. Traders may buy after waiting for 4 hours after leaving $ 12,200. In that case we will place a stop loss order at $ 9900. The target will be $ 14,500. As for the lower price, if you divide 9900 dollars it will spur sales. From there we aim for $ 8,000. The next move from here is ambiguous, so it's about the possibilities in both directions. As long as it is within this range, new trade conditions are not available.

ETH / USD Ether / dollar

Although it was supposed to buy if it lowered it to 1000 dollars in the last analysis , it became triggering buying on the 27th.

On the 25th, it set the day high value of 1102.4 dollars, and then dropped to the descending trend line on 26th. Next time we can expect to rise to 1174.36 dollars if we leave $ 1110. Let's reduce the risk by raising the stop loss order from 840 dollars to 950 dollars after exiting 1110 dollars. You may make a profit at $ 1170. In that case, you should further raise the stop loss order set for the remaining position size.

BCH / USD bit coin cash / dollar

Bit coin cash tends to continue to be traded within a narrow range before it largely escapes or falls through. A similar pattern was seen last August and October.

It is currently in the range of 1479 to 1700 dollars. If you cross this range, you will get resisted at 2072.6853 dollars with a 20-day exponential smooth moving average. In the lower price, the 17th day bottom of 1364.9657 dollars and 1141 dollars will be supported. Trade conditions are not available.

XRP / USD ripple / dollar

It continues to be traded within the range of 0.87 to 1.74 dollars. By dividing the 1.09 dollar level, there is a high possibility of lowering to the lower limit of the range.

Currently there are not too many buyers. I would like to refrain from buying new items until rebounding from $ 0.87. The 20-day index smoothing moving average line and the 50-day standard moving average line are likely to be cheerfully crossover, which is a negative sign. Ranges will continue for a couple of days from here.

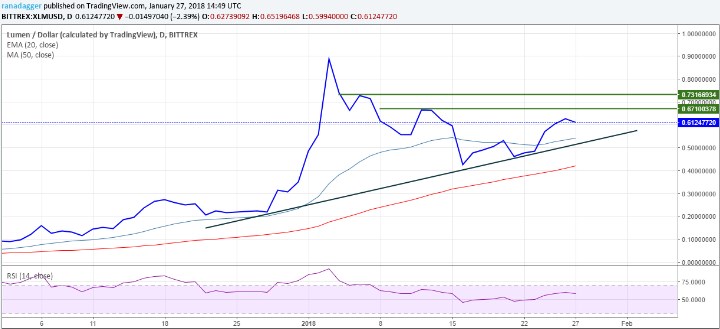

XLM / USD stellar / dollar

Stella currently has a relatively strong movement. The 20-day index smoothing moving average line and the 50-day standard moving average line are both upwards, and the price has been above the above. It is in contrast to most other major virtual currencies currently showing bearish crossover.

If the sentiment weakened, we could get resistance at $ 0.671. Since I do not see an appropriate stop loss value, I would like to refrain from buying until it falls to the trend line. If you surpass the $ 0.671 dollar, there is a possibility to try a high price through a small resistance at $ 0.732. It seems better to take a wait until the low-risk trading conditions are met.

LTC / USD light coin / dollar

On the 26th, it split 175 dollars, but it rebounded and it was higher than this.

It should be noted that the price has not been boosted further. If there is no movement to raise the range significantly within a few days, it will start falling again. The lower price is $ 140.001, the day-to-day bottom price of January 17. If you divide here you can lower it to $ 85. If further going up from here, it will be resisted by a downward trend line of triangle-like value of $ 200 with an exponential smooth moving average line for 20 days. I will adhere to the bearish stance unless it exceeds 225 dollars.

XEM / USD NEM (NEM) / Dollar

On Wednesday, it set the day-to-date bid of $ 0.775, down $ 0.86. However, the bearish faction could not push the price further.

The lower price is the situation where buying is done. I am trying to overcome the descending trend line which becomes a strong resistance. However, even if you pass through here, you will get resisted at the 1 dollar level where the moving average line overlaps.

Beyond 1.21 dollars it will be bullish. I would like to refrain from recommending new buying until then.

ADA / BTC culutano / BTC

Also failed to surpass 0.00006, the buying conditions indicated in the previous analysis were not triggered.

Currently it is likely to lower to the 0.00005 level which is the lower price support value. If you break here, you can not exclude the reduction of 0.00004730, then 0.00004070.

We will not refrain from constructing a new position until bull dislocation.