Rewards Tokens in Retail : from Copper to Blockchain

We all like rewards. B.F Skinner’s findings revealed that rewards were a powerful motivational tool because the pleasure circuit in the brain responded most powerfully to what he called “intermittent reinforcement”(Amar, 2015). In simpler words : It makes us feel accomplished and recognized.

So it is not a surprise that retailers and service companies have found a way of using this “intermittent reinforcement” to their advantage by creating rewards programs.

If you are reading this, you are probably among the 82% of people who are a member of a loyalty program (Autry, 2018).

Companies offer a range of rewards programs, from Unilever’s coupons, Tesco’s cashbacks, or Pampers’ sample boxes, all the way to Sephora’s “weekly wow” discounted products. It is a way to keep the customers loyal and coming back for more.

Rewards programs have completely revolutionized the way customers and companies interact. The first known traces of customer loyalty rewards were recorded in 1793 (Miller, 2018). American retailers would give customers copper tokens when they made a purchase so that they could later be redeemed for products on future purchases (Schneider, 2017). This copper coin helped retailers know who their returning customers were and let them create a privileged bond with each shopper (Friend, 2017).

Today the copper coin has been replaced with apps and cards, and could evolve again into virtual coins. Depending on the industry, it costs businesses between five and 25 times more to acquire a new customer than it costs to sell to an existing customer (Gallo, 2014).

Rewards programs have two objectives: brand loyalty encouragement and customer data collection (Black, 2017).

Brand Loyalty encouragement: Customers are more likely to return to the same coffee shop knowing that if they buy enough coffee, they will eventually get some for free. These repeat customers (who have shown to spend 67% more than new ones) will have a personal relationship with the brand and maybe become brand advocates (Black, 2017).

Customer Data Collection: the data acquired through the program is used to track and understand spending habits, which can then be used to determine if marketing efforts and business changes were a success or failure. With enough customer data, retailers can adapt to their customers needs or even anticipate them. Just look at how Target knew a man’s teenage daughter was pregnant before he did!

In 2012, the parents of a teenage girl found out their daughter was pregnant because Target’s marketing systems had tracked the daughter’s purchasing habits and concluded that she was expecting a baby. Target then began sending her coupons geared towards pregnancy items (such as baby cloths and cribs)(Hill, 2012). Although this example may have been a little awkward for the family, this type of marketing (in different situations) generally provides the best shopping experience and boosting of sales.

With the rise of social media engagement and half of consumers engaging with brands on at least five channels (also known as omni-channel shopping habits), retailers are now able to have a personal relationship with their customers and reward them in other forms than just loyalty programs (Perera, 2017).

In Facebook, Instagram and Twitter, retailers have found platforms to play with direct rewards (Miller, 2018). By incorporating social media to their reward model (such as a hashtag gets you a free product), they gain a new way of interacting directly, intimately and publicly with customers.

Just think of the legendary 16-year-old from Nevada, Carter Wilkinson, who asked Wendy’s fast food on twitter how many retweets would he need for a year of free chicken nuggets. When Wendy’s responded with “18 million”, two months later, Wilkinson become the author of the world’s most retweeted tweet, with his demand for nuggets shared more than 3.4 million times. Although the tweet did not reach the 18 million that was originally requested, Wendy’s agreed that breaking the twitter record would be enough to get all the chicken nuggets Wilkinson wanted (Titcomb, 2017).

The Retail rewards wall

Current rewarding systems (including loyalty programs), are far from perfect. They are expensive, they face many challenges and are often limited.

Expensive:

Deloitte (2017) brings to light the costs that rewards programs face, such as low redemption rates, time delays and management costs (in several fields including transaction, system and customer).

In 2016, a study by Bond Loyalty questioned 19,000 people about 280 loyalty programs across all industries. The results showed a little over 50% of the people in question were active members, however, of that group, one-fifth had never redeemed their rewards.

Besides the main purpose of the study (to see if loyalty to the brand affected business), the report calculated that the unredeemed rewards accounted for a large liability on the company balance sheet. In other words, not only was the creation and management of the loyalty program expensive, but when customers have not yet redeemed the rewards it creates an extra financial cost to the company.

Challenges:

Privacy: Customers may not be comfortable sharing personal data, in fear that the data will not be properly managed. According to the identity management company, Gigya (2017), 68% of consumers are concerned about how brands use their personal data. A similar number (69 %) have concerns about the security and privacy risks surrounding the increased adoption of IoT (fitness trackers, smart watches and connected cars)(Langberg, 2017). Only 51% of Americans still trust loyalty programs with their personal information (Colloquy, 2017).

Liquidity: Shoppers can only redeem the points they collected with the entity that distributed them, which makes these points harder to use or trade. An extreme example of this is experienced when a coupon you collected at checkout in store can’t even be used on the retailer’s own website.

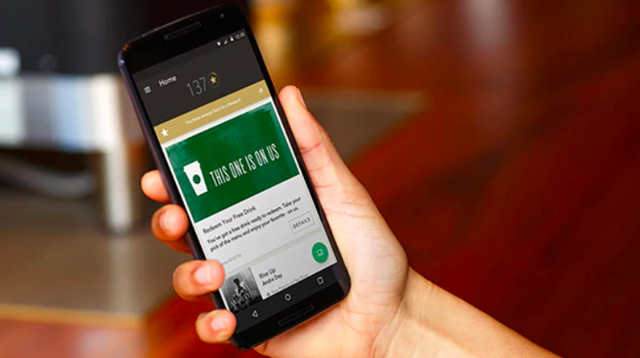

Trust in face value: Retailers have the power to modify what the face value of a reward point is. For example, in 2016, Starbucks changed its loyalty rewards program. The changes included the way stars are distributed to consumers, as well as the amount of money they need to spend to earn free beverages (Snyer, 2016). The customer responses were not positive:

Not so loyal: On average, consumers belong to eight loyalty programs — the majority of which are ruled by points, discounts and financial rewards. The benefits that retailers are promising are more about increasing frequency and spending than influencing emotional loyalty and devotion to a company. As a result, customers do not hesitate to switch from one brand to another, especially if lower prices can be found elsewhere(Collins, 2015). Loyalty membership growth continues, however, it has slowed to 15% compared to the 26% growth rate achieved in 2015 (Colloquy, 2017).

Limitations:

Physical retailers are limited in the types of behaviors they can reward, and mostly stick to rewarding purchases.

Other companies/industries have found innovative ways of rewarding their customers: when an online shopper is browsing Amazon and leaves the page, Amazon can send a personalized coupon by email to help motivate the visitor to turn into a buyer. When creating an Uber account, riders can get their first ride for free while other riders are rewarded with free rides by getting new customers to sign up (referral programs).

However, physical retailers have no way of rewarding a first visit or a first purchase, as they are unable to know that it’s really the first time a shopper is coming to his store. What if a retailer could give you a 20% discount off your basket only if it’s the first time you are visiting his store?

Jumping on the blockchain Wagon

Retailers are trying to find new solutions to continue growth and development with their rewards programs.

A solution can be considering pairing reward programs with blockchain.

By implementing blockchain technology, retailers would give out tokens, which are tradable and practical digital assets.

This token could be a way for retailers to get past the limits that they currently face:

Expensive

A blockchain-based rewards program would reduce set-up and system management costs as each marketing campaign will be a simple smart contract posted on the blockchain.

Traceability and transparency will make reporting easier, faster and cheaper. Therefore, will be able to iterate more quickly and the ROI of campaign will thus be optimal.

From an accounting point of view, merchants will not have to carry their future obligation to deliver goods and services against those points. “There’s no liability on merchants’ balance sheets anymore” as they reside in a shared network said Ribbit.me co-founder Sean Dennis.

Finally, the cost of on-boarding customers would be significantly reduced in the case of a multi-retailer program, dividing the acquisition effort between several brands.

Challenges

Privacy & Security: The blockchain technology also solves data security issues. When data is transferred across a blockchain system, the transaction is open and viewable to all, while the information of the sender is secure and encrypted. Therefore the blockchain tokens would provide the necessary data for the businesses, while giving guarantees to the consumer that their information would not be misused.

Liquidity: With blockchain technology, the customer would be able to manage all types of rewards from a single wallet. With crypto-exchanges the customers would have a way to directly trade tokens (for cash or other tokens), increasing the overall liquidity of the rewards. For customers, the ability to use points with different retailers would increase redemption transactions.

Trust in face value: in a scenario where several retailers participate in the same decentralized rewards system, by definition there is no central entity deciding what the tokens are worth. Without this “central bank role”, traditionally held by the retailer minting the points, the token value is only determined through offer and demand.

Limitations

A blockchain-based reward protocol would provide the basis for an entire ecosystem of applications (dApps) that could provide insights into consumer data and therefore enable the rewarding of certain behaviors mined from this data. For example, IoT can be used to collect information about in-store behavior, Web 3.0 browsers can detect online patterns, etc.

What do you think of blockchain as a form or rewards program?

Drop us a line

References

Amar, M. (2015). Why do consumers love rewards?. Ifeelgoods | Reward seamlessly. Retrieved 6 March 2018, from https://www.ifeelgoods.com/consumers-love-rewards/

Autry, A. (2018). Customer Loyalty Statistics: 2017 Edition. Blog.accessdevelopment.com. Retrieved 5 March 2018, from https://blog.accessdevelopment.com/customer-loyalty-statistics-2017-edition#retail

Black, K. (2017). KPMGVoice: Why Customer Loyalty Programs Are So Important. Forbes. Retrieved 1 March 2018, from https://www.forbes.com/sites/kpmg/2017/09/13/why-customer-loyalty-programs-are-so-important/#8f904262bd44

Collins, E. (2015). Your Loyalty Program Isn’t Creating Loyal Customers. [online] Adage.com. Available at: http://adage.com/article/digitalnext/loyalty-program-creating-loyal-customers/297029/ [Accessed 6 Mar. 2018].

Fromhart, S., & Therattil, L. (2017). Making blockchain real for customer loyalty rewards programs. Deloitte center for financial services: Deloitte. Retrieved from https://www.finextra.com/finextra-downloads/newsdocs/us-fsi-making-blockchain-real-for-loyalty-rewards-programs.pdf

Friend, M. (2017). The History and Future of Loyalty Programs. Future of Business and Tech. Retrieved 28 February 2018, from http://www.futureofbusinessandtech.com/business-solutions/the-history-and-future-of-loyalty-programs

Hill, K. (2012). How Target Figured Out A Teen Girl Was Pregnant Before Her Father Did. [online] Forbes.com. Available at: https://www.forbes.com/sites/kashmirhill/2012/02/16/how-target-figured-out-a-teen-girl-was-pregnant-before-her-father-did/#3e29578f6668[Accessed 6 Mar. 2018].

Miller, L. (2018). The Evolution of Loyalty Programs. Loyaltymarketing.com. Retrieved 1 March 2018, from https://www.loyaltymarketing.com/simpliblog/the-evolution-of-loyalty-programs

Perera, R. (2017). The Rise Of Social Media In An Omnichannel World. [online] Digitalist Magazine. Available at: http://www.digitalistmag.com/customer-experience/2017/12/28/rise-of-social-media-in-omnichannel-world-05670598 [Accessed 6 Mar. 2018].

Schneider, H. (2017). THE HISTORY OF LOYALTY PROGRAMS (1st ed., pp. 1–14). Retrieved from https://www.kobie.com/thought-leadership/history-of-loyalty.pdf

Snyer, B. (2016). Customers Are Furious With Starbucks’ New Rewards Program. Fortune. Retrieved 5 March 2018, from http://fortune.com/2016/02/23/starbucks-rewards-program-changes/

Titcomb, J. (2017). A teenager asking for free chicken nuggets has become the most retweeted tweet of all time. [online] The Telegraph. Available at: https://www.telegraph.co.uk/technology/2017/05/09/teenager-asking-free-chicken-nuggets-has-become-retweeted-tweet/ [Accessed 6 Mar. 2018].

U.S. Customer Loyalty Program Memberships Reach Double Digit Growth at 3.8 Billion, 2017 COLLOQUY Loyalty Census Reports. (2017). Colloquy. Retrieved 6 March 2018, from https://www.colloquy.com/latest-news/u-s-customer-loyalty-program-memberships-reach-double-digit-growth-at-3-8-billion-2017-colloquy-loyalty-census-reports/

Here is where you can keep up with our latest developments :

https://t.me/UniversalRewardProtocolOfficial

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.