More on Correlations - S&P, BTC, Overnight Funds Rate

In my previous post I showed what was a surprising (to me) correlation of 0.79 between the S&P 500 and BTC prices.

@tcpolymath made a good point that it might be related to interest rates.

So I downloaded the data series for the overnight rates from treasurydirect.gov and re-ran everything.

Then to make things a bit clearer, I graphed all 3 series on the following chart:

I had to normalize the data from 0-100 so that they would all fit on the same chart because Excel can only seem to do 2 vertical axes instead of the 3 that would be needed.

If you're really hankering for the specifics, the range on the S&P is 2357.03 - 2872.87, BTC's range is 1724.24 - 19114.2, and the funds rate range is 0.67 - 1.82.

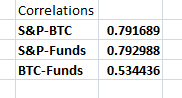

The correlations work out like this:

So S&P is tightly related to both BTC and the funds rate, but BTC and the funds rate are only moderately correlated with each other.

My basic hypothesis would be that rising short term rates would be a damper on the stock market, but that doesn't seem to be the case here. With the exception of the sharp drop in January, the S&P and the funds rate seem to go hand in hand.

BTC follows a similar pattern as the S&P, but shifted a little bit in time. The peak in BTC occurs about a month before the peak in the S&P, but we are seeing some divergence over the last month or so. Perhaps focus is shifting among big money.

Looks like it's time to do some shorting in the equities market. I wish I had any free time to figure out a strategy but maybe I'll just buy some index puts.

Well the VIX got hammered back to 11 recently so maybe worth a flier or two.

Upvoted ($0.12) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.