B.protocol

What is B.protocol ?

B stands for backstop

.jpeg)

B.Protocol is a liquidation engine for DeFi lending platforms, using user-based backstop liquidity pools to handle liquidations in scale .

What is user based backstop ?

User based backstop is used to handle liquidation process by the crowd.

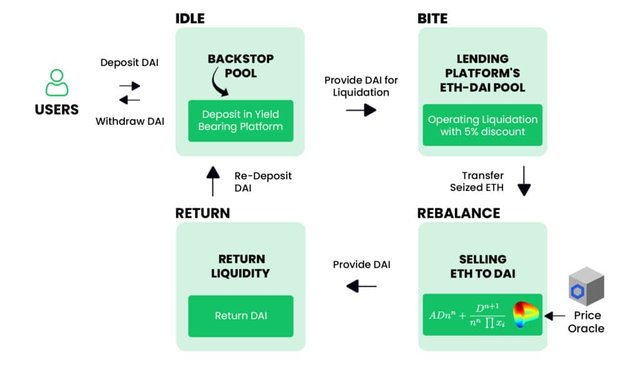

The liquidation process occurs across four steps :

●Deposit- Users makes deposit into the backstop pool.

● Biting - Once a liquidation is triggered on the supported lending platform, the backstop funds are automatically used to repay the risky debt in return for its collateral, plus a bonus liquidation penalty.

● Rebalancing — The seized collateral is then being automatically sold back to the original asset that was deposited in the backstop pool. This is made using the Backstop Automated Market Maker (B.AMM), which is designed to handle any size of liquidation with minimal price impact. This is unlike regular liquidation bots that just “dump” on Uniswap or any other AMM!

● Redepositing — The rebalanced funds, plus the profits made from the liquidation bonus, are then being redeposited into the backstop pool for any further liquidations to happen.

How it improves the liquidation mechanics vs the current liquidation systems in DeFi

1 B.protocol pool makes provision for safety net to Defi lending platform ensuring constant coverage . After liquidation happens, an automatic re-balance process begins which converts the seized collateral from the liquidation, back to the original asset.

2 B.protocol pool is more capital efficient for users , it offers 65% to 95 % collateral factors …. allowing a nice x10 to x20 leverage for their users compared to x3 to x5 in lending platforms , which is too conservative.

3 B.protocol pool is truly decentralized . users funds are used for liquidation .

4 backstop.is open for any user to participate in and lending platforms are giving it priority. The platform is more committed to liquidators, it doesn't share profit between miners

5 Profits are always activated for the Backstop depositors. When idle, funds are deposited on yield protocols to maximise their yield. When liquidation occurs, they are instantly withdrawn to take advantage of the liquidation proceeds.

6 It has a proven track record with two successful integration into makerDAO and Compound , recently launched integration into liquidity protocol . All where audited successfully.

7 B.protocol pool is crucial Lego piece in DeFi infrastructure.Integrating it in Lending platforms will allow DeFi to scale in a secure, democratic and sustainable way.