Half-Year Recap January - June, 2018

Half-Year Recap January - June, 2018

As we move into the second week of July, it’s time to take a look back and analyze just what has happened so far in 2018.

Q1 Trends

It what may seem like an age ago, the market ran all the way to an all-time high valuation of $830B in January. However, this was short-lived and the beginning of 2018 saw the market consistently retract and fall by approximately 70% in value, as the total cap hit $251B at the end of March. In general, the first quarter of 2018 proved to be an extremely difficult period for the vast majority of the crypto community as the market embarked on a serious downturn and proceeded to enter a prolonged bear market that saw most investors lose anywhere from 50% to 80% of their portfolios.

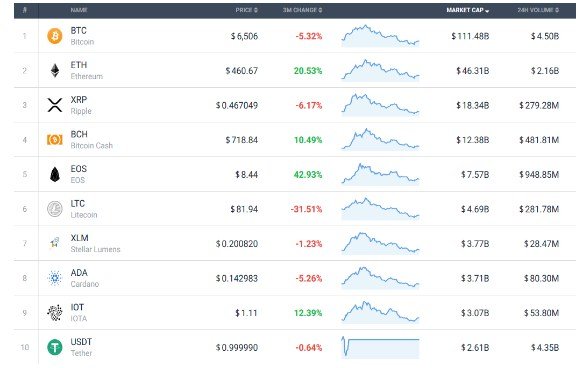

Ripple’s XRP was the main offender and fell by -77% in value, while Bitcoin Cash was down by -71%, IOTA by -69%, and Cardano’s ADA by -67%. Bitcoin lost 51% of its value while Ethereum was down by 45%. Despite ups and downs, EOS proved to be the most resilient currency as it declined in value by "only" 22%. Q1 came to an end with the total market valuation standing at around $265B.

Q2 Trends

The second quarter of the year began with the market retaining a total value of $263B on April 1. Things improved in May as the valuation hit $423B at the beginning of the month before declining to around $255B at the end of June.

In general, the market capitalization fluctuated from a max valuation of $471B on May 5, to a minimum of $232B on June 29 (-51%), within a range of $239 billion. Bitcoin’s capitalization fluctuated from a max of $169B to a minimum of $100B (-41%), within a range of $69B.

The second quarter of 2018 was generally more positive for the crypto market and the month of April proved to be a turning point, as the total market capitalization increased from $250B to $430B and reached a level last achieved in late February. This stimulated growth in cryptocurrencies such as Bitcoin Cash, Cardano, EOS, Stellar, and Tron which all increased by over 100%. However, May saw the return of another extended bull market which saw the top ten cryptocurrencies all drop significantly in value over the period.

Q2 proved to be a mixed bag in terms of results and EOS grew by over 35%, while Tron increased by 13%, and Bitcoin Cash was up by 9%. Litecoin was a big loser and declined in value by over 30%, while Cardano fell by 11%, Ripple declined by around 9% and Stellar and IOTA were both down by 7% and 6% respectively. Bitcoin fell by around 8% in value, but managed to improve its dominance to over 40% in April for the first time this year as BTC dominance hit 45.0% at the start of the month. Ethereum was a big winner and grew by approximately 14% over the second quarter of the year.

Half-Year Conclusions

The total market capitalization has dropped from a figure of $607B on January 1, to $255B on June 30, which represents a decrease of 57%. Over the same period, the price of Bitcoin has fallen by 54% and dropped from $13,900 to $6,300, while Ethereum has dipped by 43% and moved from $773 to under $450.

While things improved over the second quarter of the year, the market has still declined significantly and has spent the majority of the year immersed in a bear market. At this point, no one can be sure which way the market will go as news regarding governmental regulations and major hacks have had a severely adverse effect on prices. At the same time the recent news that 22 European countries have agreed to partner in developing blockchain technology, the CBOE announcing record trading volumes in Bitcoin futures, and the SEC declaring that Ethereum will not be classed as a security mean that there is always the possibility that the market may become more bullish at some point in 2018.

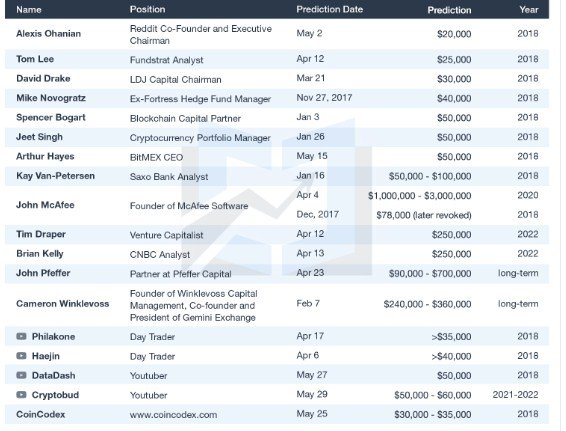

On June 29, Bitcoin was trading lowest since the beginning of the year and 70.9% lower than the all-time high from December 17, 2017. Was $5,780 the lowest point for the year? Well, based on the experts' Bitcoin price predictions, there's not much room for a downside if we want the predictions to come true.

Do you kno da wei?

no