Below $500? Ether Price Seeks Floor After 40% Drop

The 40 percent month-on-month decline of ethereum's ether cryptocurrency has pushed the long-term price floor down to $300, the technical charts indicate.

As of writing, the world's second largest cryptocurrency by market capitalization is changing hands at $534, as per CoinMarketCap.

Stepping back, ether's sharp reversal from the Feb. 6 low of $555 (prices as per Coinbase) and the rally to near $1,000 in the subsequent days meant the cryptocurrency had established a strong price floor below $600. That now looks to have been pushed down.

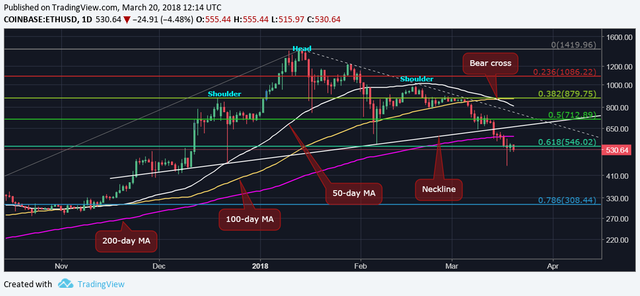

As seen on the chart above, ETH left lower highs around the key descending trendline, as the rally from Feb. 6 lows ran out of steam and sellers took over after the cryptocurrency fell below its 100-day moving average (MA) on March 6.

The transfer of power from bulls to bears pushed the price down to $450 on March 18 - the lowest level since Dec. 11.

During that process, the cryptocurrency also witnessed a head-and-shoulders reversal on March 14 - indicating that the rally from the December 2016 low of $5.81 has ended and the bears have regained control. Further, a 50-day MA and the 100-day MA bearish crossover was confirmed on March 15.

So, ETH will likely find acceptance below $546 (61.8 percent Fibonacci retracement of December 2016 to January 2018 rally) and extend the drop to $300 (78.6 percent Fibonacci retracement) over the next couple of months.

View

The price floor looks to have dropped to $300.

That said, oversold conditions in the near-term may help ETH defend the March 18 low of $450.

Only a convincing move above the head-and-shoulders neckline resistance (former support now seen at $661) would abort the bearish view.

A move above $982 would signal a long-run bearish-to-bullish trend change.

The head-and-shoulders breakdown has opened the gates for a drop to BTC 0.045 (78.6 percent Fibonacci retracement).

In the short-term, oversold conditions could yield a minor corrective rally to the neckline resistance, currently seen around BTC 0.072.

A long-term bullish reversal is seen only above BTC 0.0895 (Feb. 26 high).