Vitalik says Centralized Exchanges Should Burn in Hell: Is He Right?

Vitalik Buterin, creator of Ethereum, recently made headlines for- in no uncertain terms — stating that centralized exchanges should ‘burn in hell’. Now while this headline grabbing soundbite, from a usually much more modest Buterin made obvious soundwaves within the Crypto sphere, it brought upon a much wider debate as to whether he might be correct. With increasingly astronomical listing fees and claims of manipulation, has the time come forth for centralized exchanges to make way for newer solutions? Are decentralized exchanges really the answer?

Ethereum Founder Vitalik Buterin Hopes Centralized Exchanges ‘Burn in Hell’ https://t.co/taGQQ97vPP

CCN (@CryptoCoinsNews) July 7, 2018

Digital Asset Exchanges

✅In the minds of most people, technology was to give birth to a number of innovations and it did just that. Blockchain is probably one of the greatest the world has witnessed in the 21st century. It has shaped various aspects of the world’s economy especially through the birth of cryptocurrencies and digital assets. These hold some weight which is equal in value to fiat currency that most of the world is used to. Digital exchanges arose from the need to have a system where digital assets can be traded for other digital assets or fiat currency. A number have sprung up over the years with Binance, Okex and Huobi Pro being among them.

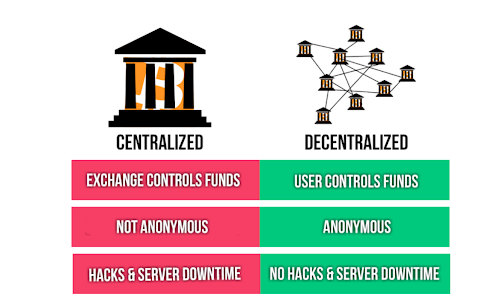

There are two categories of exchanges; centralized and decentralized exchanges. Each have their own advantages and disadvantages. The centralized vs. decentralized debate has been ongoing for some time now. This article sheds light on these two systems equipping its readers with information useful when they will be selecting where to trade in.

Centralized Exchanges

✅Centralized exchanges have a trusted party that takes control over the assets, in this case digital assets, of their clients once the deposit of digital assets have been made into their system. In centralized system, the trusted party takes the weight of managing digital assets off their clients. The assets are safer and are more likely to be recovered by the trusted middleman incase of situations such as loss of private keys or other security pass keys. Huobi is one of the centralized exchanges in the digital asset market provide safe, secure and transparent exchange services. You can sign to for Huobi to gain access to their great digital exchange services

Advantages

✅Centralized digital asset exchanges carry advantages which include the following:

➡️Better liquidity

Centralized exchanges operate on the basis of trust placed on the middleman. The middleman, which are exchange platforms in this case, are connected to a large financial network which makes it easier for them to liquidate the digital assets they have control of. Request for liquidation of assets can be quickly fulfilled once it has been made by a client. Furthermore, it is easier to liquidate with a variety of options being provided in centralized exchanges compared to decentralized exchanges.

➡️Easier to use

Centralized exchanges are far much simpler to use compared to their decentralized counterparts. Their function is similar to most centralized financial systems such as banks. The steps are so simple anyone can easily join and start trading. In the vast majority of exchanges sign up is very simple followed by almost instantaneous KYC procedure and users are can immediately start participating in the exchange by depositing digital assets from their digital wallet into the exchange.

➡️Adherence to regulations

There are a number of criteria that have to be met before a centralized digital asset exchange is allowed to carry out its services. These regulations include the types of digital assets that can be exchanges (those that meet the digital asset framework) to prevent hosting assets that may hold little or no value. This also means that digital asset exchanges are bound to some legal framework and therefore legal action can be taken against them in a case of fraud or other forms of breaking the law.

There are different regulatory bodies responsible for formulating these laws. The increase in popularity of digital assets meant that regulations had to be put in place in order to prevent any fraud through unscrupulous exchanges set-up to swindle people. These regulations act as a stamp of approval, giving these centralized exchanges credibility confirming that at least the services they are providing are legitimate.

➡️Ease and speed of transaction

As earlier stated, the access centralized exchanges have through the trusted ‘middleman’ allows them to deliver their services at a very fast rate, some in a matter of hours or even less. Transfers are easily done as the same party is involved in handling and controlling digital assets from all the clients of the exchange.

Disadvantages

Centralized exchanges come with perks in convenience, usability and practicality. These fit well with the result-oriented age we are living in. However, centralized platforms also have some few drawbacks which include:

➡️Control of the assets is left to the exchange. Any unforeseen circumstance or wrong move by the exchange could affect all its clients.

➡️Personal information is also required before signing up. Centralized digital asset exchange will require personal details to tie their clients to their accounts in a similar way as banks do. This removes the element of anonymity which is something some investors value.

➡️There is risk of downtime. Due to the centralized nature of these exchanges, if anything were to happen to the trusted party, then it would affect the entire system.

Decentralized Exchanges

✅Decentralized exchanges have a different set up compared to centralized digital asset exchanges. The trusted middleman or third-party is eliminate forming a ‘trustless’ system where the users are the controllers of their own digital assets. The exchanges occur in a peer-to-peer fashion such that the buyer and the seller are directly involved in the exchange. There are different ways to achieve this trade which include:

- The use of a multi-signature escrow system.

- The creation of proxy tokens.

Both work effectively to ensure the transactions are carried out successfully.

Advantages

✅Blockchain has brought made the language of decentralization famous in the tech world with some people being enthusiastic about it while others are shooting down the idea. Here are some of the advantages of decentralized exchanges:

➡️Probably the most obvious advantage is in its trustless nature. As an investor, you have control over your digital assets since they are stored in your wallet and not by a trusted third-party.

➡️Similar to blockchain technology, decentralized platforms are characterized by a high level of privacy. No user details are required for transactions to take place. There are also no requirements for users to give out their identity or personal information to parties in the platform. This may be done in special cases where transfers may involve other financial bodies but even then, personal information is only revealed to the trading party alone.

➡️Decentralized digital exchange platforms can also run continuously without fail due to their decentralized nature. Their nodes are spread meaning hacks are extremely difficult and server downtime is nearly impossible in ideal conditions.

➡️Decentralized digital exchanges are run by users. The community forming them come up with the guidelines and regulations. More freedom is given to users to decide on how best to run the exchange compared to centralized systems which have a decision-making body.

Disadvantages

➡️For those who have never used decentralized digital asset exchanges, they will need time to understand how they work. This may be a problem considering the fact that these platforms are trying to attract new clients.

➡️Some decentralized digital asset exchanges would require that their clients be online whenever conducting any transaction.

➡️Most decentralized exchanges only provide basic features in their platform. Attracting more clients would require more lucrative services which, at the moment, are not provided by most decentralized platforms.

✅Depending on what an investor is looking for, both centralized and decentralized systems can work. In as much as Vitalik Buterin insists that centralized exchanges should be done away with, both systems provide conveniences that favor a particular section of the population. No system can truly check all the boxes for investors but they can always go for the one that checked the most boxes.

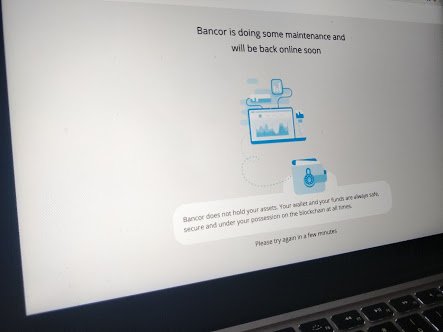

Reality Is Not Ideal

✅On paper, hacking decentralized exchanges should almost be impossible due to the spread-out nature of the nodes. However, recently, Bancor, a decentralized digital exchange platform, was hacked and the hackers made away with US$ 23.5 million in different digital assets. Security is one of the major selling points of decentralized digital exchanges, however, this incident has proved that their might always be a way to infiltrate even the most robust of systems.

It is up to the consumer to decide on the best platform for them, weighing the pros and cons of centralized and decentralized platforms and making an informed decision on where to trade their assets in. Investors can however still be grateful for the options that innovation has allowed them to have. Both systems can suit their digital asset investments quite well.

If you enjoy my writing on ICO's and new blockchain projects be sure to follow me:

loved your article/ especally the burning desigh of exchanges

Thanks for your kind words @nibupraju:)

Resteemed your article. This article was resteemed because you are part of the New Steemians project. You can learn more about it here: https://steemit.com/introduceyourself/@gaman/new-steemians-project-launch