Electra (ECA): Midday Update - Minor Degree Wave 5 + Mid-Term Analysis

Good afternoon to everyone!

Before I being, I want to remind you to always remember that Technical Analysis is not a crystal ball that reveals the future, though it does help us remain aware and make informed and calculated decisions. Further, this post is indented only for educational purposes.

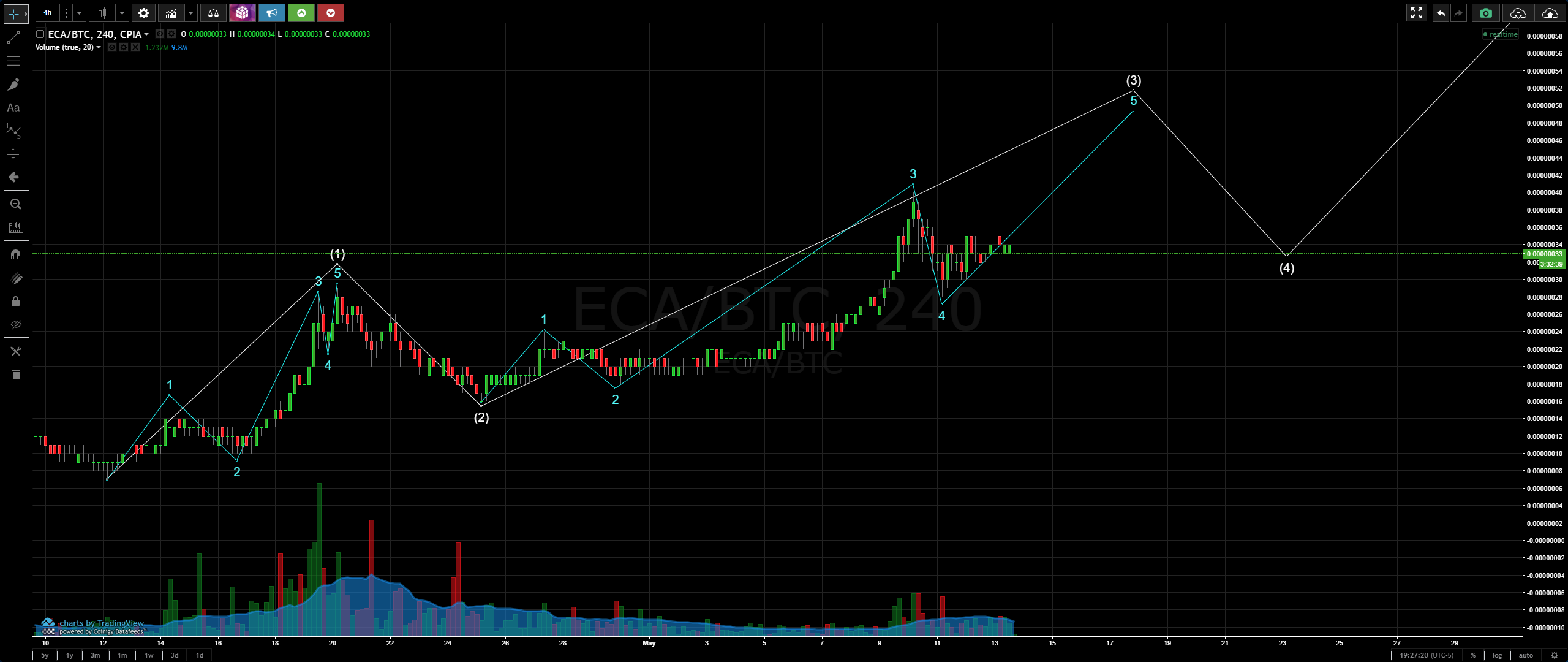

Let's get into it by checking out the most recent price action in the scope of the last few weeks:

As you can see from the chart above, we are completing minor-degree wave 5 which will also represent our higher-degree wave 3.

Since this above chart was observed, we've had some more recent price action:

Again, the top of our minor-degree wave 3 was 40 sats. From there, we save three waves downwards (labeled A, B, and C in the chart above). Notice that our minor-degree wave 4 touched precisely at the 50% Fibonacci retracement level of 28 sats:

From this low, up we go to complete our minor-degree wave 5. Price action has put in wave 1 and what I believe to be wave 2 as well. Reminder that Elliot Waves theory states that wave 2 cannot put in lower low than the beginning of wave 1. This could change, but since price action has not taken us below 28 sats, I will keep the bottom of our wave 4 at 28 sats, and our recent low of 29 sats as the bottom of our lower-degree wave 2.

So the big question: where are we going from here? Once our wave 5 is complete, we should see a major correction due to the fact that the top of our wave 5 is the top of our higher-degree wave 3. With a higher degree comes a more serious correction. This coming correction is represented by the wave in white and is highlighted in a yellow ellipse:

Let's get into some more intricate technicals in order to consider some implications of our current price action, and what this could mean for the future.

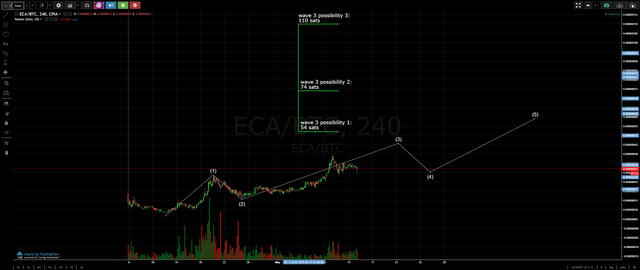

Elliot Waves theory states that if wave 3 is less than 1.62x the length of wave 1, then wave 5 tends to over-extend itself. The length of wave 1 was 22 sats. According to Elliot waves, wave 3 is either 1.62x, 2.62x, or 4.25x the length of wave 1. Therefore, the length of wave 3 could have resulted in the following values. The length is the length of the wave, whereas the value is the actual price point:

1.62x wave 1: Wave 3 length = (1.62 x 22) = 36 sats, wave 3 value = 52 sats.

2.62x wave 1: Wave 3 length = (2.62 x 22) = 58 sats, wave 3 value = 74 sats.

4.25x wave 1: Wave 3 length = (4.25 x 22) = 94 sats, wave 3 value = 110 sats.

I've labeled these possiblites in the chart below:

I will say it again: if wave 3 is less than 1.62x the length of wave 1, then wave 5 tends to over-extend itself. 1.62 x wave 1 is 36 sats, PLUS the bottom of wave 2 (16 sats)...therefore, our wave 3 must hit 52 sats or else we can expect wave 5 to over-extend itself. Given the fib ratios, our wave 3 is not expected to hit this minimum of 52 sats. (if you would like to read a more in-depth analysis that explains why I think this, check out this blog post)

IF this analysis is correct, wave 5 should over-extend itself. When we have an over-extended wave 5, we now lump together wave 1 and wave 3. The bottom of wave 1 is referred to as wave 0.

SINCE we have not completed wave 3, we do not yet have a length to estimate the length of our over-extended wave 5. I have created a hypothetical situation in this blog post if you would like to check it out. In that post, I make up a few values in order to estimate what could happen in the event that our wave 5 is over-extended.

For the time being, all I will say is this: When over-extended, wave 5 follows the following criteria: 0.62x wave 0-3, 1x wave 0-3, or 1.62x wave 0-3. I will wait until our wave 3 has completed in order to project potential values for an over-extended wave 5.

Personally, I do think this is where we may be heading, though there is no way to know for sure until we are in the middle of it. Thanks for reading, and I hope you found this to be educative!

Cheers!

Legal Disclaimer: I am not a financial adviser nor is any content in this article presented as financial advice. The information provided in any posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Hodl gang #eca