List of Cryptocurrency Indices and Where to Find Them

Despite the hundreds of cryptocurrencies and tokens floating the market, we have yet to settle upon a go-to performance index, like we do in other markets.

There are a couple of reasons for this:

- People are torn in terms of the best way to calculate any index

- A true leader has yet to emerge when it comes to overall popularity

Investable indices already exist, but they are highly fragmented and usually only available to certain groups based on geography or net worth of the investor.

Indices are calculated in many different ways. Here in the US, calculation for the Dow Jones Indistrial Average (based on a sum, then a factor) couldn't look more different than the S&P 500 Index (market cap weighted).

Below you will find a current list of cryptocurrency indices, some admittedly better than others when it comes to measuring the performance of the market as a whole. Some allow investment, some do not.

Hopefully, you will find these as useful as I have.

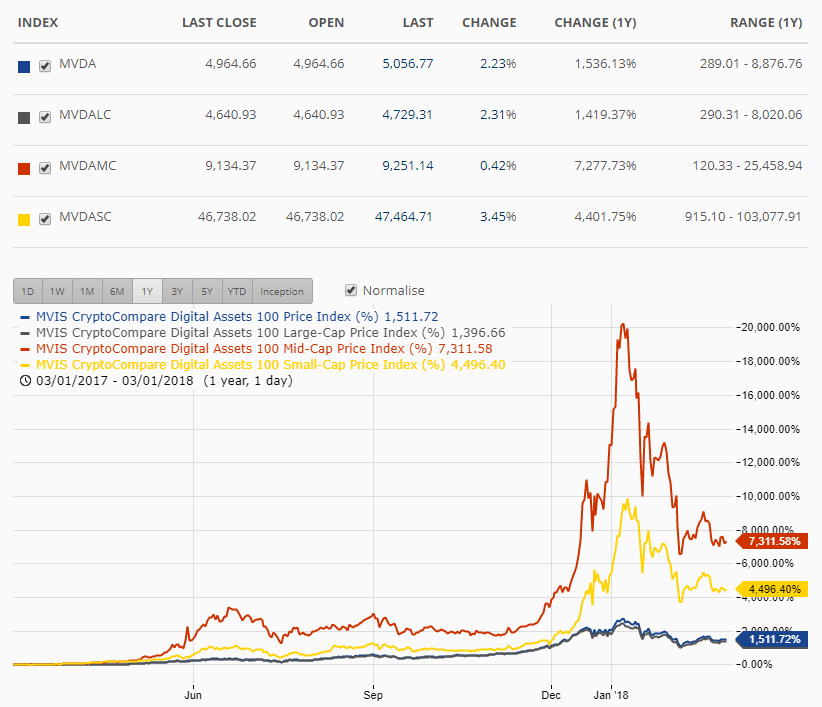

MVIS Investable Indices for Digital Assets

Link: https://www.mvis-indices.com/indices/digital-assets

Robust selection. Available on institutional platforms, including Bloomberg. Professional metrics and wide selection of components. Registration is free for more detailed insights. Fragmented sets allow you to evaluate large versus small cap, among many others.

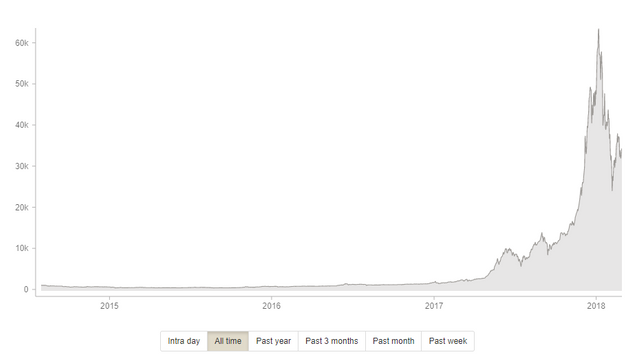

CRIX Crypto Index

Link: http://crix.hu-berlin.de/

Observation-based only. Uses Laspeyres (common) methodology for calculating weight/values. Effective joint effort via SKBI at Singapore Management University and CoinGecko.

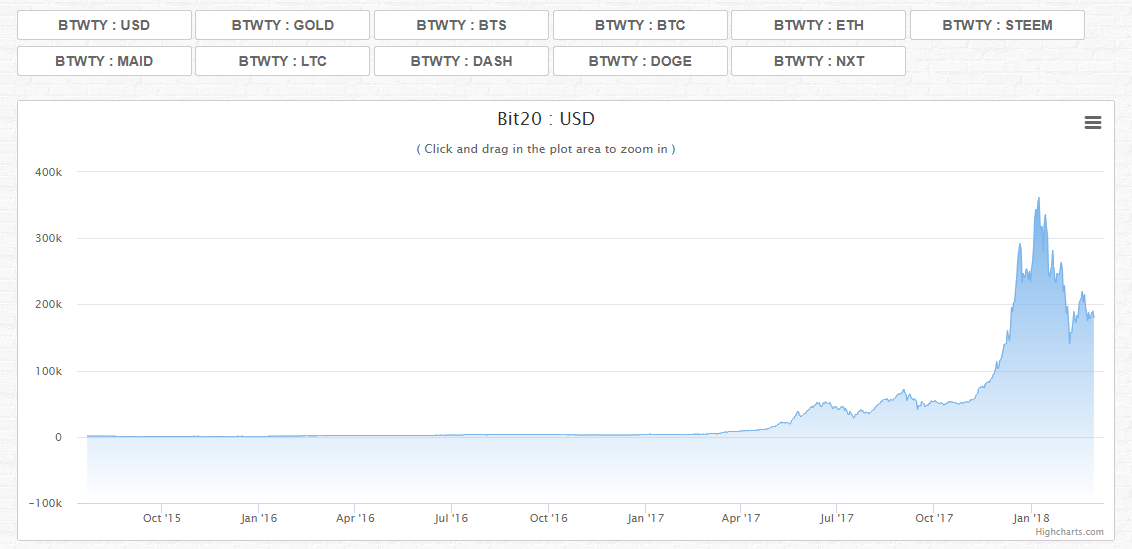

BitTwenty

Link: http://www.bittwenty.com/

A simple index of the top 20 assets. Composition is questionable but clearly market cap weighted based on constituents. Available via OpenLedger (BitShares). They are here on Steemit as well https://steemit.com/@blocktivity . Also publish http://www.blocktivity.info/, a tool which ranks cryptocurrencies via blockchain transactions and other metrics.

BitWise

Link: https://www.bitwiseinvestments.com/

Investable index. A couple things I am not nuts about here: only 10 assets, and the monthly rebalancing (quarterly simply performs significantly, and I mean significantly, better in historical backtesting). Monthly is almost always way too short for long-term holds. I have the numbers, will post when I find time. For a tracker, fine, but for an investment vehicle, I wouldn't touch this. 25k minimum investment to accredited only. The team only consists of two people with tech pedigree behind them.

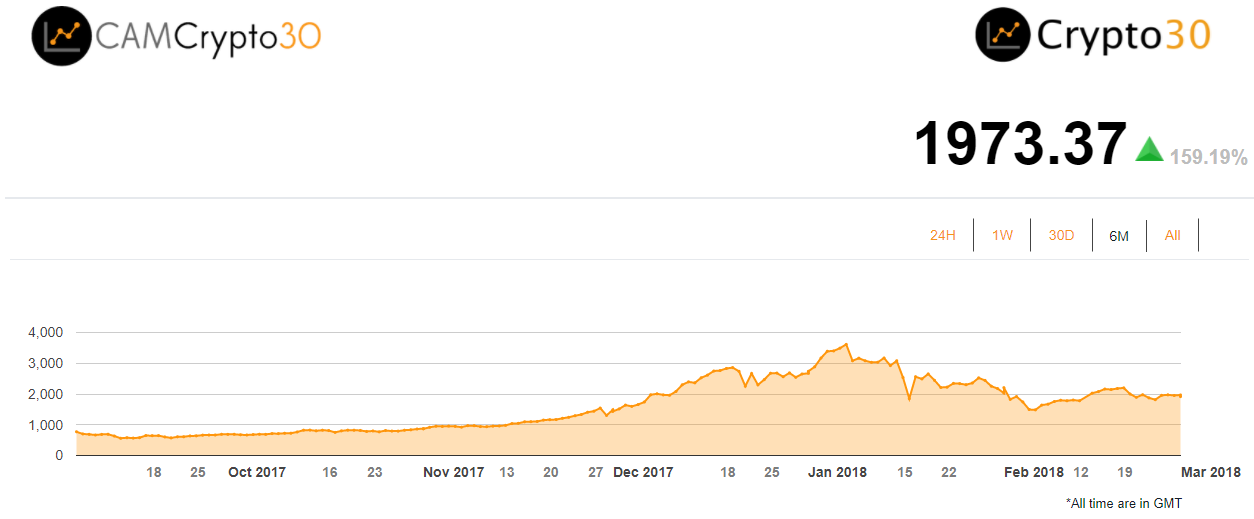

Crypto30

Link: https://www.crypto30.com/index/

A simple tracker of the top 30 assets. Rebalances monthly based on methodology used in the Russell 2000.

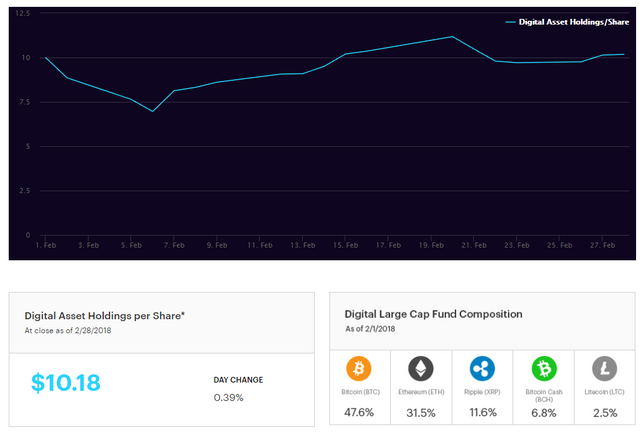

Grayscale's Digital Large Cap Fund

Link: https://grayscale.co/digital-large-cap/

Investable OTC product for institutional investors. Weighted by market cap. Only 5 assets (not so good), but rebalances quarterly (good). Likely to trade at a premium to the assets themselves based on the nature of the structured vehicle.

Some of my past posts:

Common Bitcoin Metcalfe Models, Explained

Correctly Predicting the Price of Crypto: Logarithmic Regression Model for Bitcoin (or any basket)

Masternode Manipulation - A Work of Art

Please let me know if you would like me to add anything in the comments section.

Follow me if you would like to see more like this.

Please upvote if you have found this list useful! Thank you!!!

Congratulations @swinn! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPGood work! Indexing is a a necessary step this industry will need as it grows. Indeces, then tradeable instruments based on these indeces, etc...

I can see a family of indeces with underlyings such as an equal weight index, market cap weighted index, protocol token only index, commodity token index, application token index, you get the point... and, of course, new categories we don't know yet.

I look forward to reading more from you! @swinn