The Long-Term Bullish Case for Monero (XMR)

If anonymity and decentralization are at the core of the cryptocurrency revolution, it’s hard to imagine a future without Monero (XMR). The privacy-conscious coin is using some of the most advanced technologies in cryptography to preserve fungibility and protect free speech in an age where blacklisting and government encroachment are all too common. XMR is well positioned to not only survive the bear market, but thrive in an age where privacy is paramount.

XMR as Free Speech Money

Developers behind Monero have introduced several notable upgrades over the years, each designed to improve anonymity, privacy and functionality. Riccardo Spagni, one of Monero’s core team members, recently told Naomi Brockwell that there are five features that set XMR apart from its competitors:

Dual stealth address

Ring signatures

Hidden IP addresses

Hidden transaction values

Privacy opt-out

Basically, Monero protects the privacy of both senders and receivers of each virtual currency transaction, obscuring everything from IP addresses to the amount of XMR being sent. Privacy is the default but users can opt out if they so desire.

Some of these upgrades, including stealth address, ring signatures and confidential transactions, were implemented just in the last year. Monero has also implemented the Bulletproofs protocol to overcome the inefficiency of “range proofs.” Although range proofs are essential for private transactions, they require a great deal of mining resources for verification, which increases the cost. Bulletproofs scale in size differently to current proofs, thereby saving space in each XMR transaction. It has been estimated that BulletProofs results in an 80% reduction in transaction sizes, which leads to a commensurate drop in fees.

Monero’s latest hard fork on Oct. 18 played a significant role in reducing cost. XMR transaction fees witnessed a 97% drop following the implementation of Bulletproofs.

Crptocurrencies – Monero vs. ZCash: Privacy Coins Compared

These upgrades suggest XMR is being developed as a unit of exchange as well as a store of value, raising the prospect of one day becoming a base currency for virtual transactions. That’s the opinion of Genson Glier, co-founder and CEO of BlockToken.ai. In his view, XMR “will find its value correlated with cryptocurrencies based on next-generation consensus algorithms in a similar manner to bitcoin.”

“I expect Monero may become like bitcoin: a base currency akin to the USD, SDRs and gold.” – Genson Glier

Technology vs. Marketing

Monero shares another similarity with bitcoin in that its growth has nothing to do with marketing and everything to do with technology and grassroots development. The protocol’s developers have made it abundantly clear that their main focus is unlocking fungibility through mathematics, cryptography and blockchain technology. At the same time, the protocol uses a small inflation rate to incentivize mining and grow the network. Long-term, Monero targets inflation at roughly 1%, which is not unlike gold.

Monero never relies on expensive marketing campaigns, ICOs, or venture funding. It has an open-source, grassroots community of developers, users, creatives, and freedom fighters. We the community do not believe that Monero, or cryptocurrency for that matter, can solve all of the world’s problems. We do believe that Monero can solve one important one: transferring money to anyone privately and without central authority.” Monero Outreach (Nov. 6, 2018).

New projects and improvement protocols are first posted on the community forum, which allows developers to comment, upvote and pledge their own XMR coins to fund certain initiatives. This makes Monero a truly decentralized network, which is one of the core value drivers behind cryptocurrencies. The community also boasts the Monero Research Lab, where security researchers, developers and mathematicians explore new improvement protocols centered on privacy and security.

Current Market Reality

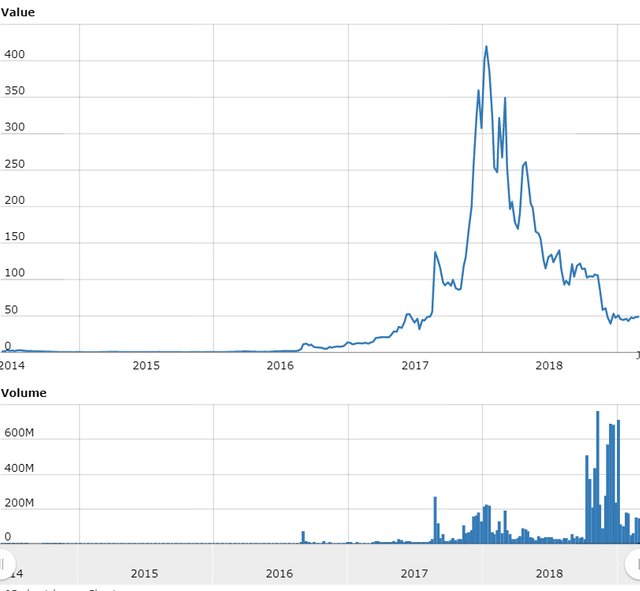

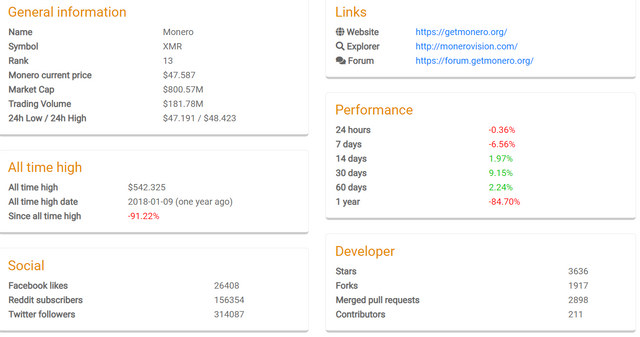

Like other cryptocurrencies, Monero has not been immune to the brutal bear market that emerged more than one year ago. The Monero price peaked at $542.33 on Jan. 9, 2018 but has since fallen more than 91%, putting it among the worst performing cryptocurrencies.

The cryptocurrency was valued at less than $50 on Saturday, according to CoinMarketCap. At $830.3 million, Monero ranks eleventh among active cryptocurrencies in terms of market cap. Like much of its large-cap peers, XMR has seen a sharp rise in trading volume since the beginning of the year. Exchange-based volumes peaked north of $75 million last week as the price approached $57.

Despite strong fundamental drivers, XMR cannot break out of its current trading predicament independently of the broader market. In other words, its short-term outlook is tied to market sentiment and the performance of bitcoin, which continues to exert a gravitational pull on altcoins and tokens.

That being said, Finder.com’s February survey of the blockchain industry forecast a 57% gain in the XMR price by the end of 2019. XMR gained more than 12% in February, not unlike bitcoin.

From the perspective of the bulls, Monero has enjoyed a steady appreciation of smart money since the fourth quarter. In other words, big players have been slowly accumulating XMR, which could pave the way for significant gains in the near future. A similar trend was observed for Ethereum, which allowed the no. 2 cryptocurrency to establish a firm bottom that has since been protected.

Looking further down the road, Monero’s status as a store of value market is one of its strongest value propositions. Along with bitcoin, Monero applies a “unique value proposition within deep and viral markets,” according to Satis Group.

“Not only is XMR far more active in codebase development and resistant to centralized mining efforts, it is fungible.” – Satis Group (August, 30, 2018).

Satis believes XMR has a ten-year trajectory of $39,584. While this type of prediction offers little value to investors, it is derived from compelling valuation metrics – i.e., the quantity theory of money, the growth of offshore deposits and the primacy of store of value assets. If you subscribe to the theory that cryptoassets will be valued based on offshore deposits, then it’s not far-fetched to assume that privacy networks will be the largest beneficiaries. This is just something to think about as you weigh the opportunities and costs of Monero and other privacy coins.

Goodluck!