Our generation's gold fever

I have known the Bitcoins and the principles behind them since the end of 2012, where my interested cousin introduced me to the concept. At that time, a bitcoin was around 40 dollars.

I think the whole cryptocurrency thing is right now what i want to call a generations' gold fever , an investment that a generation is afraid to miss.

The foundation of bubbles

Fear of missing is when you buy something without research, you are afraid that you do not get along with the wave. If Bitcoin was worth $ 100 today and people knew it would rise a lot, everyone would buy it. It was originally used about the young people's use of social media and the need to constantly be online because they fear that others experience something they are not part of.

Earlier bubbles where I can draw clear parallel are the Tulip bubble, Mississippi bubble, Beanie Babies bubble and Dot-com bubble

There have been many other bubble's where people because of fomo ended up losing everyting because of no knowledge but bought because of recommendations from friends, media etc.

I personally think that the market will always be here. There has already been so much infrastructure built and so great interests in these cryptocurrencies.

Photo: images.google.com

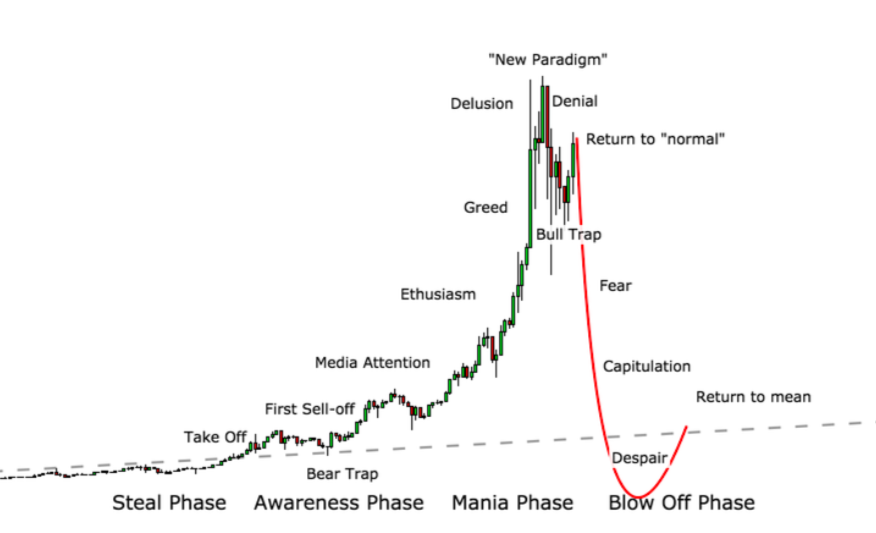

In this graph of the "phases of a bubble" as Dr. Jean-Paul Rodrigue has made can you see almost all previous bubbles have behaved. A graph that also largely fits the price of most cryptocurrencies.

Thank you for sharing the video @tradewonk! This video is a very detailed explanation of the crypto world and how the blockchain really works. Some crypto terms are also explained in this post thank you, I am learning a lot. I appreciate that your always giving us inputs about cryptocurrencies @tradewonk. Its fun to know more about crypto.😊❤

It is a gold rush out there and quite a bit of free money. Synapse.io has a 100 token (approx $10 USD) airdrop for anyone interested in signing up through the badcryptopodcast link.

https://steemit.com/bitcoin/@lordprime/free-airdrop-for-100-synapse-ai-tokens-worth-usd10

P.S. I have no affiliation but I do think the badcrypto team is a good group

Thank you!

You're very much welcome! :)

Another well thought out post. I am still somewhat new to crypto, so have seen FOMO used a lot but never knew what it meant till now. I too think many big institutions will get involved, not only banks but companies like Amazon (Overstock and Newegg are already accepting crypto).

I remember a couple months ago when Bitcoin was shooting to the moon, that was what captured my attention. I studied and studied and couldn't find any logical reason it was doing so. If anything the more i studied the more outdated it appeared, seeming to be expensive to transact and slow in processing which was supposed to be some of its advantages for use.

I am so glad I found you on here, you are helping me understand perspectives that are not all pump and hype. Thank you.

At some point cryptocurrencies will only be as good as the project it's attached too. Right now FOMO is guiding valuations for most and it's a double edged sword. It can yield great profits, or absolute nightmare loses.

Despite this volatility, regulations won't kill off cryptocurrencies IMO, they'll just add enough control so that governments and financial institutes can take a nice slice of the crypto market pie.

I believe banks and financial institutes are suffering from a FOMO right now too. Just look at Goldman Sachs buying up a crypto exchange, or how banks are happily signing up with Ripple. They all want in, they just don't want to overpay or be the ones left outside with no power in the market.

That's my opinion anyway. It's a very exciting time.

It is indeed!

Good article, cryptocurrency will outlived it will be the major currency used In both public and private sectors and a reliable investment instruments to watch, let have hope better days ahead

Thank you!

I tend to agree there are so many newbie investors in crypto who dont know the first thing about the blockchain. All they know is that others have made millions and its the latest buzz word. All this does is artificially inflate the price - this happened at the end of 2017 and now these investors are scared at the first sign of trouble - if they truly understood what they were investing in they wouldn't sell so easily.

Thanks for sharing

Hopefully the last big crash will be a learning experience for everyone to always exercise due diligence to research and invest responsibly. Cryptocurrencies, in my opinion, have no other way to go but up. There may be these mania and correction phases, but it is headed to mass adoption soon before we know it. It's really hard to take away the value from Bitcoin since it has been used for almost a decade, and the resources required to mine this currency is no joke. Perhaps, we already found the rock bottom at 6k.

12-0.70 18"

This comment has received a 0.66 % upvote from @speedvoter thanks to: @crypto-econom1st.

Awesome article.Much obliged for sharing it

Thanks for this crypto currency news providing.... i appreciate this post. Keep it up

Just like with all bubbles, the only ones who profit are the ones early in the game who don't get greedy and cash in before it bursts.

Also, you don't lose money if you never paid money. I joined Steemit when the value was at 10$ but didn't really "lose" anything after it dropped because I never bought any SBD.

steemit doesnt have a value and even if you meant steem it never was at 10

by value I meant SBD value, and it had peaked at 12$ during December