Why is Bitcoin’s price down to two-month lows?

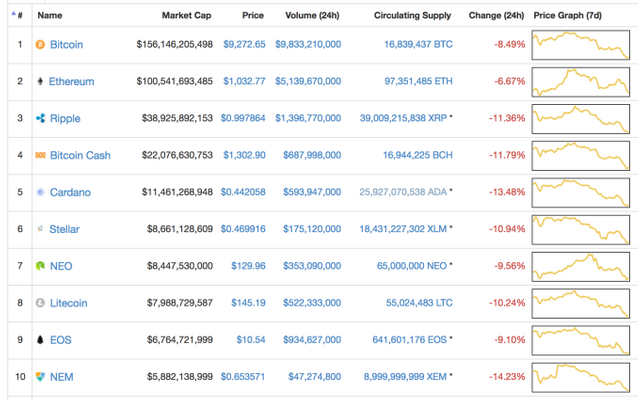

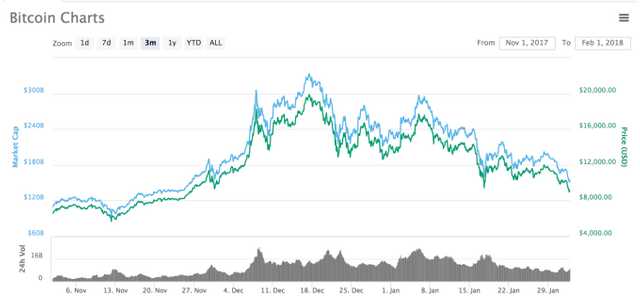

Crypto investors are seeing red this week. Bitcoin plunged to two-month lows on Thursday, dipping below $9,000 for the first time since November. At the time of writing, Bitcoin had bounced back up to the $9,200 level, down from weekly highs just above $12,000. This week has seen coins across the board in the red — a sign that investors are jumping ship to fiat currencies this time instead of swapping into altcoins as we’ve seen in the recent past.

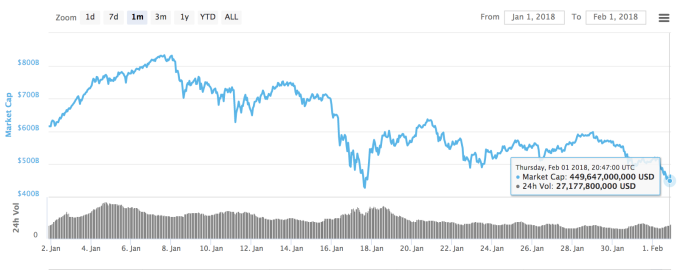

At the time of writing, the total cryptocurrency market cap weighed in at $459 billion, down from January highs around $830 billion. It’s a contraction to be sure, but not a low for the last 30 days (that low came on January 18).

Is this the bitter end for Bitcoin? For cryptos? Well, no, probably not. Get your head screwed on right and you’ll see that (for better or worse) many coins have seen unprecedented growth in the last six months to a year, even with Bitcoin’s price halved from holiday highs closer to $20,000. On this day last year, Bitcoin was sitting pretty at $982. At the height of December’s craze, most reasonable crypto-watchers could agree that the price was overheated and there was only one way for it to go in the short term. Still, in the thick of the current correction, Bitcoin’s longer-term growth is anyone’s guess.

Cryptocurrency die-hards expecting the price to bounce back, even partially, will see these tanking numbers as the perfect entry point for getting in low and maximizing gains. Late speculators who got in during the mass crypto hysteria of the holiday season aren’t likely to have such steady hands, a factor that’s likely contributing to the slide.

So what’s causing the slide to begin with? As usual, no one thing can be blamed for Bitcoin’s current downturn, but recent skittishness around a subpoena for Bitfinex and concerns around Tether — a kind of cryptocurrency counterpart to USD that matches the dollar one to one — probably factor in. Recent news that Facebook would ban ads for ICOs probably didn’t help either. And it seems like every day a new Ponzi scheme gets busted, throwing yet more doubt on the credibility of plenty of less than legit ICOs.

Even beyond news cycle highs and lows, Bitcoin has seen a few mid-January dips before, though 2017’s Bitcoin behavior certainly broke from any seasonal patterns of the past.

Still, these growing pains are far from surprising. As cryptocurrencies mature — assuming they continue to do so — regulatory “bad” news will become more common. Countries across the globe will continue to struggle to accommodate their citizens’ sudden interest in digital currencies — or not, in the case of India, which just decided to ban them outright. Unsurprisingly, headlines like these inspire a sense of foreboding among cryptocurrency enthusiasts wondering which country will be next to come down hard. Fear, perhaps justified fear for many speculators with plenty to lose, amplifies each new regulatory revelation. But for cryptocurrencies to grow out of the current scam-laden chaotic era, a thorough house cleaning is healthy.Bitcoin and other cryptocurrencies have also looked less responsive to positive news in the latter half of January compared to their relative buoyancy during December’s dizzying highs. Then, every little positive news blip seemed to push the prices higher.