Will Cryptocurrency Ever Become Real Money?

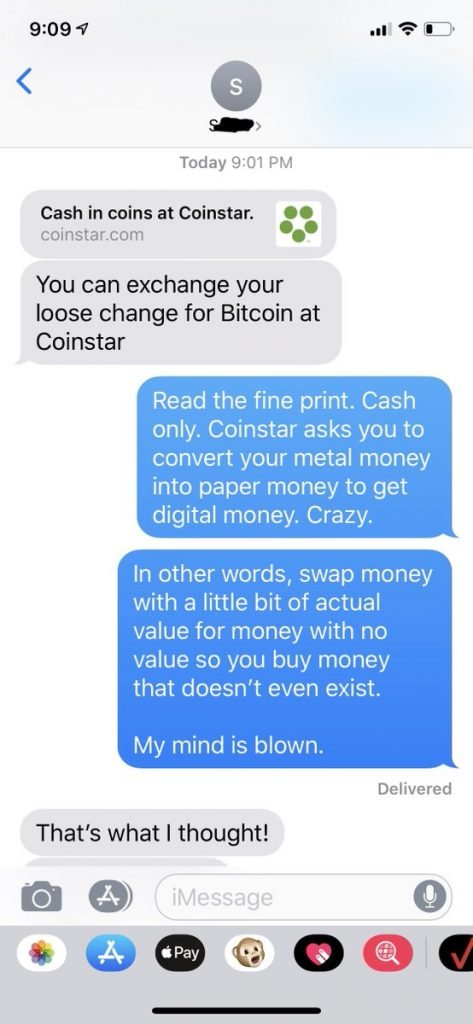

Bitcoin sucks and alt-coins are worthless. Cryptocurrencies are all scams. They aren't real money!

Is that what people really think?

No. Most people don't think about cryptocurrency at all.

They also don't ever think about whether any money is "real" or not. All they know is they have something they can use to buy things. That's really all that matters. Gift cards are not transferable. Frequent flier miles are not money at all. Gold is not legal tender anywhere. Nobody cares. You can use your gift card to buy things, redeem your miles for airfare, and sell your gold if you ever need cash. That's good enough.

When I talk to people about my book, Consensusland, about a country that runs on cryptocurrency, the first question most of them ask is "what's cryptocurrency?"

After I explain, many people nod and change the topic. They don't care. Those who care often ask "is that real money?"

I usually say "yes" and continue the conversation but in my head, I wonder, "what do you mean by real money? Is real money only coins or paper you can hold in your hand, distributed by your government, and useful only within your home country?"

If that's the definition, then cryptocurrency is not real money. You can't hold it in your hand. It's created and governed by a computer program, not a government. You can use it anywhere.

Therefore it has no value. It's not real.

Yet, for most of us, money exists as numbers displayed on an screen, pictures printed on a piece of paper, or chips embedded into plastic cards. Most of my cash is an IOU from a bank (my checking account). Is any of that real?

What is "real" money?

What makes money real?

In most economies, the government. If the government says the money's real, it's real. Simple as that.

How does government do this? How could such a system work? Why do people accept it?

Because the government says they have to. In the U.S., our government forces everybody pay taxes with dollars. It also forces lenders to allow people to repay their debts with dollars. As long as people have taxes and debt, they will need dollars. People use dollars for other things because it's easy and convenient and they know everybody will take their money. After all, everybody needs to pay taxes and repay debt.

(We also benefit from having $6 trillion worth of dollars held as reserves by central banks, foreign governments, and international businesses, but the other 180+ national currencies don't have this benefit.)

Few realize this whole system falls apart without government intervention. Your dollars have no intrinsic value. You can't redeem them for anything. If you travel to another country you have to pay somebody to exchange your money. Outside of your country, your money is worth only as much as somebody else thinks it is.

This is what people mean by real money. Cryptocurrency is not real money.

If cryptocurrency is not real money, then what gives it any value?

Cryptocurrency has value because of the blockchain it runs on. If that blockchain does something valuable, your cryptocurrency will have value. People will need it. People will use it. People will accept your cryptocurrency as payment or buy it from you.

Voilà---value!

How do you trust the blockchain will work?

You could examine the source code. You could test its protocol. You could trust your friend's assurance that "it's safe." You could use it and if it works, trust that it will continue to work. The proof is in the pudding.

Nobody can force you to use a bad one, nobody can stop you from using a good one. As a result, you do not need to rely on government intervention to make your money valuable. Your cryptocurrency is a token you exchange to get what you want. It's like Dave & Buster's tickets. Your cryptocurrency has value because people need to use it to get what they want.

This is a revolutionary concept that will change the way we think of money, much the same way fractional reserve banking did many centuries ago. I'm sure for some people, it seems odd to have a money system based on lending the same flake of gold to 5 different people by writing an IOU to each and hoping they don't all ask for their gold at the same time. A seemingly risky way to manage wealth, but it worked better than the system that came before it. Now, people now accept fractional reserve banking as completely normal, despite its flaws. Very few people even think about it.

The same will happen to cryptocurrency, and for the same reason we use cars instead of horses and electricity instead of steam power. Cars and electricity have lots of problems. Horses and steam power are better for some uses. Yet cars and electricity are a normal part of everybody's life, horses and steam power are not.

Each of these things has its own value. It does something special. That's all it needs to do.

One Thing You’re Getting Wrong About Cryptocurrency

Over time, as more people use cryptocurrencies instead of local currency, the idea of holding "real money" will seem quaint and inconvenient. Just as you probably have several credit cards and gift cards and loyalty cards, each with their own terms and uses and rewards, you will probably have several cryptocurrencies, each with their own terms and uses and rewards.

You will think of cryptocurrency as something you use when you need to do something, not a source of wealth or power or profit. E.g., STEEM for engaging with your social network, BAT for advertising and possibly shopping online, QSP for auditing smart contracts, other cryptocurrencies for other things you want to do.

The idea of buying cryptocurrency simply to resell it for a profit will seem as interesting as buying theater tickets simply to resell them for a profit. Some people will do this but most will just see the show.

Many years from now, you will live mostly on cryptocurrency. You will buy local currency when you need to pay taxes, repay certain types of debt, or do business with old people and hermits. You will track the prices of various cryptocurrencies and possibly speculate on their future value, but none of your friends will. You will build businesses or buy from merchants that run exclusively on a blockchain, swapping your favorite currency instantly, on-demand, as needed using an app or decentralized exchange (you can do this now).

Some cryptocurrencies (e.g., STEEM) will offer opportunities for passive income as “savings” for retirement, which you would include as part of your investment portfolio like you would buy dividend-yielding stocks or variable annuities today. In fact, it's possible your stocks and annuities will themselves be issued as cryptocurrency or a smart contract linked to a cryptocurrency.

Your children will grow up thinking this is normal and your grandchildren will wonder how on earth anybody could have lived their entire life with only one single currency that existed solely for the purpose of paying taxes and repaying debts, had value only within a defined geographic area, had no protections against theft, debasement, corruption, or mismanagement, and could not be redeemed for anything except different denominations of itself.

At that point, the only "real" money will be the kind you can't hold in your hand.

—

Mark Helfman is a cryptocurrency commentator and author of Consensusland, a novel about a country that runs on cryptocurrency.

Posted from my blog with SteemPress : https://markhelfman.com/2019/04/05/will-cryptocurrency-ever-become-real-money/

Interesting.

The way i define "real money" is that 1 BTC today is equal to 1 BTC tomorrow.

The biggest problem with The US$ is that $1 today is worth $0.99 tomorrow, and $0.98 the next.

Or, savers are punished. And that destroys the economy.

Yes but it doesn't destroy the economy, it destroys the purchasing power of wage-earners and anybody else who relies on money rather than real assets to fund their lifestyle. It punishes people who sit on their money instead of buying things, building income-producing businesses, or investing in things that grow in value.

I agree with your point about BTC and it's something so few people understand. I actually mention the basic concept you're talking about, purchasing power, on my website: https://markhelfman.com/cryptocurrency-as-an-investment/

Inflation is healthy for modern economies, it encourages investment and productive activities. The problem is people assume money = wealth, which is not true. Money is a way to get what you want. Inflation makes it harder for you to use money to get what you want. Inflation destroys the value of your money.

If you consider "modern economies" as equal to "consumerism" then, yes, inflation is healthy for them.

I consider all of them to be an abomination.

Further, inflation is a tax, by the people that control the money, onto all the poorest people. Inflation slowly sucks the life out of an economy until nothing is left. Everything that is worth owning is owned by the money controllers.

Yes, modern economies run on consumerism. Inflation moves wealth from those who make money to those who own things that make money. Cryptocurrency itself changes that dynamic in a very fundamental way. Our notion of wealth will have to change too.