Big money fails to understand Blockchain! Forbes writer tries but no cigar

Today, February 19, 2018 Bernard Marr's article "The 5 Big Problems With Blockchain Everyone Should Be Aware Of" was published on Forbes.

Forbes Screen Shot

This sounds like terrible news for Bitcoin but as I will outline his points, his information is badly outdated and parts of it are actually totally irrelevant, misinformed and easily debunked.

First of all, who is Bernard Marr? According to his Forbes profile he is basically a business consultant on big data. He has published several books including: ‘Big Data in Practice’, 'Big Data', 'Key Business Analytics' and ‘Key Performance Indicators.' So he appears to be somewhat of an important name in this area and he has published many articles but only started publishing about Bitcoin and blockchain a month ago. I am relatively new to this space as I have started only 4 months ago, but this man only has about a month under his belt. I for one am totally skeptical of anyone talking about blockchain or Bitcoin, let alone someone who has just entered this space. There are people like andreas antonopoulos or Charles Hoskins who are big names and they have been involved for years. But the business community, tends to trust their own much more than they do unknown outsiders even though those outsiders, which is very telling of the psychology money and cryptocurrency. Many people will trust family members or familiar news personalities over people who actually know what they're talking about.

Let's see what arguments his "great wisdom" puts forth:

1. Blockchain has an environmental cost

So this is a very important point and many people have raised this issue. However, it is only an issue that has arisen as the popularity of blockchain exploded in 2017. Prior to 2017 the total electricity consumption was negligible. Let me illustrate:

Coinmarketcap.com

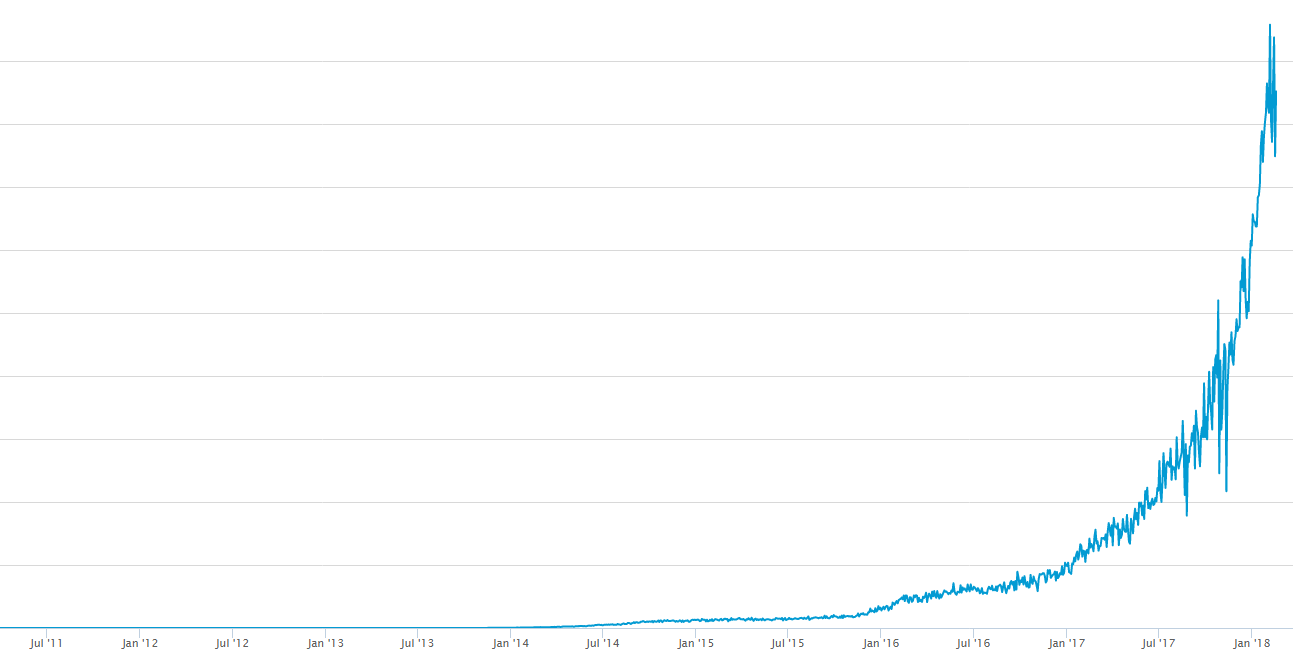

What this graph shows is the volume of transactions taking place on the Bitcoin blockchain. Prior to May 2017 we almost cannot see the transactions. Here's a more accurate representation:

This shot from blockchain.info shows us the hashrate. The hashrate is basically the computing power that is used to create the blocks that form the transactions and allow the Bitcoin funds to be sent. In order to generate the hashrate a processor has to work intensively for 10 minutes on the block. This is what costs electricity. So looking at the hashrate you are essentially seeing the electricity consumption and what we see is a year-to-year tenfold increase from 2.3M to 22.5M.

Wow Bitcoin really is an enviromental hazard, right? Well not really. Considering that this has only recently taken place, no one was prepared and was thinking about it. But in the past 6 months a plethora of possible solutions have emerged. In fact, the primary solution that is buzzing around is the Bitcoin Lightning network and from what I've seen on the test net, these instantaneous off-chain (meaning they do not require more hashrate) transactions will not consume more energy. Also, in these months proof-of-stake, which is an alternative to the power hungry transaction verification, has been building up into development and many proof-of-stake blockchains (e.g. NEO) or hybrids (Cardano) have been growing and developing. And there are plenty more examples like segwit (already used by Coinbase), NANO and IOTA which represent ways that Blockchain can scale without further hashrate growth and most likely a reduction. Marr suggests that the solution are smaller enterprise based blockchains, but is that the real solution to the power consumption. I would argue that this is completely bonkers argument conflating two separate issues. One, of enterprise solutions requiring internal nets, and the other of energy consumption.

Conclusion: This is a major issue for the crypto community. But the fact is that there are so many projects with so many solutions, it is really a question of which project will be the one to be adopted. At this point, it looks like Bitcoin's lightining that will have the biggest impact. Sorry, Bernard, maybe after another month of learning about how Bitcoin actually works you'll tackle this question more knowingly.

- Lack of regulation creates a risky environment

Oh boy, how true is this one. Bitconnect-type pyramid schemes, all kinds of nonsense coins (to be polite), hacking, centralized exchanges screwing things up, and many other issues come with the massive growth and the massive lack of understanding.

Lack of regulation does present a huge risk because we are not sure how governments will actually end up regulating crypto. But there is nothing conclusive at this moment and one of those examples is the South Korean government coming out with major anti-crypto declarations and then backtracking. Some governments overtax, and others under tax. Some are fair, and others are unrealistic. So it remains to be seen how things progress. Until regulations are clearer and more realistic, it will mean a high degree of risk to all levels of investors, particularly big ones.

- Its complexity means end users find it hard to appreciate the benefits

This is 100% true. But this was 100% true when smart devices first came out and when the Internet first came out. It was true when cars were first built and when trains were first built. Marr is pointing out the obvious. This is a nascent technology. I would say a much bigger issue than the fact that it's complex, is whether it will succeed it all in realizing its projects. A project cannot be successful if it is not easily accessible. But fortunately, the crypto community has been aware of this eons before Marr wrote his article.

- Blockchains can be slow and cumbersome

Short answer: See point #1. Longer answer: Marr says "due to their complexity and their encrypted, distributed nature, blockchain transactions can take a while to process" and he is completely wrong. In fact, the complexity has nothing to do with the slowness of the transactions. The reason for Bitcoin's slowness is it's security, not it's complexity. One would argue that IOTA is much more complex and difficult to understand, yet it is not as stable and predictably reliable as Bitcoin. Bitcoin is in fact by far the simplest blockchain. Sorry, Bernard, got it wrong again.

- The “Establishment” has a vested interest in blockchain failing

Marr's argument here is that Bitcoin will fail due to technological roadblocks. I remember reading about the electric car and a documentary entitled Who Killed the Electric Car which made us think back in 2011 when it was published that we'd never see the electric car because of the established car companies and the oil industry. I remember the tobacco industry holding back laws that would reduce smoking in public in the 90's. But as science comes to fruition, as more certainty emerges and more assurance even the most established players will hold things back. They will be a barrier until their are the main driver of the future with major car companies now producing electric vehicles. But as a result to their conservativeness new players emerge.

Are these big problems that we should be aware well, as you say, some yes, some not so much. I wouldn't call blockchain a panacea, but it certainly has the ability to impact many industries. Considering the pace of growth and current stage, I would expect any major progress until the next couple of years.

My major obstacles to blockchain development at this point are two-fold:

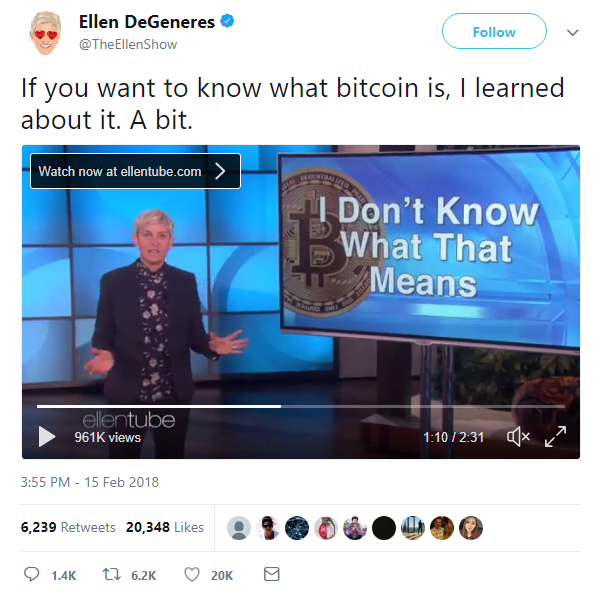

In investment: The lack of understanding of what it is, how it works and what it can do. People simply don't understand it. Check out Ellen Degeneres talking about it.

The lack of talented developers with experience, creativity and capacity for productivity.

If you watch these two major issues, once they are solved there will be major progress in the blockchain sphere. So if you're investing for value (disclaimer I have invested in Bitcoin and several other cryptocurrencies), it is my personal opinion that these issues will cause major positive movement for both Bitcoin and probably a lot of ALT coins as well.

Thanks for reading and I hope Bernard Marr takes on the difficult task of actually learning what's what because his voice matters. He can either help #1 progress or hinder it. His latest article, in my opinion, did not help reveal the real issues and is actually erroneous in some ways so really it did more spreading of misinformation that education.

Coins mentioned in post: