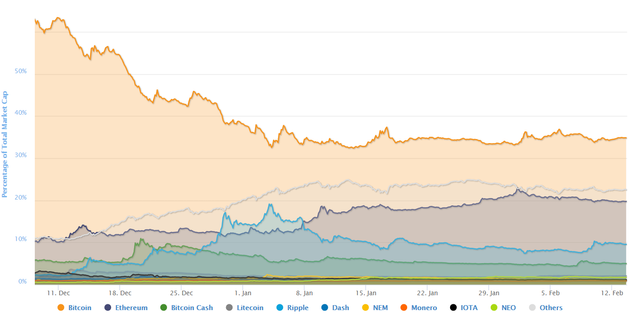

How the entire health of the cryptocurrency industry is connected to Bitcoin; illustrated in one picture.

Ever wonder why the entire market seems to tank when Bitcoin goes down?

When I first got into crypto trading, this theme completely baffled me. While I understood that Bitcoin was the heart of cryptocurrency and many times reflected the sentiment of the industry, the graphs and charts of the altcoins mirrored that of Bitcoin in an almost eerie fashion. Although it’s perplexing to understand at first, the root of this confusion comes down to not truly understanding how the values of your altcoins are calculated. Let’s break it down.

How to Calculate Fiat Value of Altcoins

Understanding the value of Bitcoin is pretty logical. Someone opens their wallet and pays for it. Whatever value society is willing to pay for Bitcoin is the price. However, 99% of the altcoins in existence cannot be purchased with fiat (USD). Therefore, the value is calculated by their price, in RELATION to the coins that CAN be purchased for fiat. I love fruit; here is an analogy.

Let’s say you go to a grocery store that sells apples for $5.00. One day, you forget your wallet, and do not have any money. You make a deal with the store to give him 10 grapes for every apple they provide you. In theory, 10 grapes equal 1 apple. Or, 1 grape equals $0.50, relative to apples. Fair enough.

![]()

One month goes by and suddenly there is a shortage of apples at the store, and the price per apple goes to $10! You go back to the store, and on your original agreement, trade your ten grapes for one apple. Same trade, except one major difference; the fiat value of your grapes is now twice as much. Your grapes, relative to the apple is the same; but relative to USD, they are worth twice as much ($1.00).

The crypto industry works the same way. When we cannot calculate a USD trade, we value the altcoin in relation to the pairs which are available. With this stranglehold, many other projects are at the mercy of Bitcoin. At the time of writing this, Bitcoin dominates the market with 35% total dominance. Even with this staggering number, the number does not truly reflect how much it controls the market. While its difficult to get accurate data online, Bitcoin holds 80-95% of all trading pairs on top exchanges like Binance, Bittrex, and Poloniex. If you want altcoins, usually, you have to go through the beast.

If things were to change, how would it be possible?

Imagine if every time your spouse ate a cookie, you gained a few pounds as well. Wouldn't really be motivated to workout, would you? This co-dependency on one major currency also adds a lot of unnecessary risk and volatility into the space. For us to break out of this pattern and create a more independent market, a few major things needs to happen.

More Trading Pairs

Binance is my favorite exchange to use at the moment. Not because of the super snazzy name of the founder, but because of the amount of ETH/ALT pairs they let me use. As more and more companies adopt this pattern, and diversify the ways in which you can trade, this will spread out capital connections a bit.

Atomic Swaps

While Blockchains are an amazing technology, we haven't quite figured out how to get them to properly communicate with each other in an efficient manner. In real life, if I wanted to trade you watermelon for oranges, there wouldn't be a problem. While this is not currently possible to do in the crypto world, a lot of people much smarter than I are working on something called an Atomic Swap. Edgy name, I know.

Atomic swaps, or atomic cross-chain trading, is the exchange of one cryptocurrency to another cryptocurrency, without the need to trust a third-party. A relatively new piece of technology, atomic cross-chain trading is looking to revolutionize the way in which users transact with each other. For example, if Alice owned 5 Bitcoins but instead wanted 100 Litecoins, she would have to go through an exchange, i.e. a third-party. However, with atomic swaps, if Bob owned 100 Litecoins but instead wanted 5 Bitcoins, then Bob and Alice could make a trade. In order to prevent, for example, Alice accepting Bob’s 100 Litecoins but then failing to send over her 5 Bitcoins, atomic swaps utilizes what is known as hash time-locked contracts (HTLCs).

Conclusion

There are a lot of great companies attacking this problem. TenX, Ethos, and Bancor just to name a few. While it is frustrating at times to see a project you really enjoy seem to be cut in half when Bitcoin drops, I am a firm believer this obstacle will change in the coming months/years as the industry matures.

My name is Zachary Dash, a crypto enthusiast and entrepreneur from Austin, TX. Everyday, I publish exclusive and original crypto content onto steemit. If you find value in this information and would like to support my mission to inspire the mainstream adoption of crypto, please upvote this post or donate directly.

I hope you found some value in this article.

Here are a list of some other Steemit exclusive crypto articles:

Lisk: Don't let the name fool you

Substratum: Net Neutrality's Backup Ninja

Opus: Decentralized SoundCloud

UTRUST: The Paypal of the blockchain era

More About Me

Excellent illustrations and descriptions of our current crypto currency status. I am supporting @socky in his quest to have Binance list SBD. The atomic swaps sounds very compelling.

I agree. Binance is one of my favorite platforms and if they list SBD would be awesome :)

How could anyone ever say no to someone with a name like @socky ? Thanks for your feedback! Illustrations took a lot more time than expected, but definitely brought everything together. Excited to add more value in the coming weeks.

Do you have an explanation as to why a coin value in BTC also goes down when BTC dips.

So assume there's a coin called ALT that's worth 0.0005 BTC. Let's also assume that BTC is at $10,000. That makes the USD price of ALT to be $5.00.

So there are two possibilities here:

If it's the first scenario, then when the USD price of BTC drops, the price of ALT should increase to compensate. So if BTC goes down to $8,000, the price of ALT should rise to 0.000625 BTC, so it's still worth $5.00.

If it's the second scenario, then when the USD price of BTC changes, it shouldn't affect ALT's price in BTC. The USD value of ALT will change of course, as you've described in this post, but it should still be worth 0.0005 BTC.

But what we're seeing in practice fits neither of those scenarios. What we see is that when the USD price of BTC increases, the price of ALT increases in both BTC and USD. Same with decreases. You can look at almost any CoinMarketCap graph showing both BTC and USD prices to confirm this.

There are occasions where ALT will move independent to BTC, for example if ALT gets listed on Binance, or if ALT is a large coin with a high-volume USD pairing like ETH. Those exceptions are understandable, but what I'm struggling to explain is why ALT moves in sync with BTC most of the time.

One theory I have is that a drop in BTC's price represents a general negative outlook of cryptocurrency, so holders of ALT are keen to cash out with the rest of the market. Since ALT often won't have a USD pairing, the holders will sell the ALT for BTC, which they'll then use to cash out to fiat. The selling on the ALT/BTC market would cause a drop in the price of ALT in BTC.

Do you have any thoughts or better ideas to explain the market behaviour I described?

Your example is extremely easy to demonstrate by cheking the satoshi value of Tether. If BTC drops 10% the satoshi value of Tether goes UP 10% maintaining the price at more or less $1 ...something like that.

$1.00 USD (-0.19%)

0.00010781 BTC (-7.73%)

0.02562210 OMNI (-6.83%)

I think this observation is fairly accurate. It has to do with the pricing in BTC (btc/alt pairs) and the general sentiment which is represented in BTC price movements.

Interesting perspective and article @zacharydash Thank you for sharing :)

Thanks for the feedback!

Thanks for info very helpful. Will follow you.

That’s very interesting and got to know you have publish everyday. Draw my attention on the logical value in thinking of Bitcoin or entire industry. Will keep looking your view, awesome work cheers!

Well-written article! At times it's even confusing to me as well and I have to keep re-reading explanations. This was the best I've seen so far! Looking forward to reading more!

-kfx

@zacharydash Thank you for that great article. I have always wondered how each alt coin and blockchain would connect with each other. I will now have to start looking up Atomic Swaps and see what is happening there. There are times when I wish I had this kind of interest and passion for the Internet when it started to show up in mainstream in the 90's as I do with Crypto now. This new world we are paving for future generations is exciting.

Many thanks Zachary! great explanation and solutions offered! I often find myself trying to calculate the fiat value of past trades, and feel there should be an easy tool to assess value of previous trades. I follow you on fb group as well :)