The PRIVI Protocol - blockchain-based system with stateof-the-art technologies and intelligently blending

About the project

PRIVI is a customizable social network for DeFi. It allows individuals and communities to customize a suite of built-in financial tools that simplify financial tasks. This will provide an opportunity to create a new social hierarchy with the ability to customize and expand opportunities for all members of the community.

The problem in the banking sector

The DeFi sector was the logical response to negative interest rates, ultra-soft monetary policy, and a tightening AML procedure with the ability to freeze accounts. Today, the traditional banking system offers low returns to investors with strict regulation and many territorial restrictions.

Using DeFi tokens allows you to get rid of banks and significantly increase your profit.

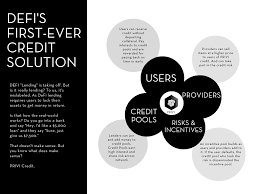

DeFi is financial instruments in the form of services and applications built on the blockchain. The main task of decentralized finance is to become an alternative to the banking sector and replace the traditional technologies of the current financial system with open source protocols. That is, open access to decentralized lending and new investment platforms for a large number of people. And let them receive passive income from cryptocurrency assets, as well as save on fees for transfers, loans and deposits.

Most of the existing DeFi are built on the Ethereum blockchain and the number of new applications in the field of decentralized finance is growing steadily.

Despite the fact that the decentralized application sector is just developing, there are already quite a few benefits. The main thing is that any user can get one or another financial service, for example, lending, bypassing the bank. Decentralized landing protocols minimize risks and open access to borrowed funds 24/7. New products are especially relevant for borrowers from countries with expensive bank loans.

The procedure for creating your own digital asset and bringing it to the market has become noticeably easier and has become available to almost everyone. Payment processing does not last for several days, but a maximum of a couple of hours, interest rates and commissions have become much lower. Also, users have new ways to make money on cryptocurrency.

For developers, the simplicity of creating applications becomes a clear advantage due to transparency and open source, in addition, projects in the decentralized finance sector can be developed on any platform that interacts with smart contracts.

Members can profit from providing loans or liquidity to other platform members. Such DeFi tokens are essentially financial instruments in the form of applications and services built on blockchain technology, eliminating intermediaries in the form of the same banks in the traditional financial services market.

How it will work

• Each community can use the functionality, with different financial or social instruments.

• Communities form a well-functioning coordinated DAO.

• These DAOs make decisions about how the community should be regulated

• A token with corresponding rules and privileges will be created for each community.

• DAO discusses and votes on the tools to use

• If the vote is accepted, the community asks the PRIVI developers to implement this feature

• The community pays for this feature with PRIVI tokens, which they can easily exchange with community tokens

• PRIVI DAO decides which functions to work on in the first place, based on the preferences of PRIVI DAO

• This feature may be patented by an individual Community, or it may be made publicly available to everyone to use

PRIVI Staking results in:

Reduced network fees

Governance rights

Discounts on DATA purchases

Distribution of tokens

Public Sale

76.2%

Presales

14.9%

Foundation

5.9%

Mining

3%

How users can generate PRIVI tokens

• Swap fees in liquidity pools

• Staking rewards

• Lending and Investment interest

• Royalties for NFT's

• Insurance validator premiums

PRIVI is needed for:

• Swap fees in Liquidity Pools

• Creation of Pods, NFT's, Social Tokens

• Loan collaterals and matchmaking

Conclusion

Crypto lending, including DeFi-based, is a rapidly growing and developing area. It is becoming a popular alternative to bureaucratic traditional finance, where the yields of instruments fall against the background of extremely low interest rates.

DeFi gives finance the flexibility and ability to earn a small percentage in a bear market and borrow funds at an acceptable interest rate. In addition, decentralized markets for synthetic assets are steadily developing, opening up new opportunities for traders.

Be that as it may, this segment is still underdeveloped and not so large. Its advantages over the traditional banking system with expensive loans and low-income deposits are undeniable. This means that there is a potential for market growth, and considerable at that.

I think that the project will be able to make it much easier for its users to work with DeFi tools.

Source

https://priviprotocol.io

https://priviprotocol.io/whitepaper

A sponsored article written for a bounty reward @alterego087