DeFi 2.0: How Lattice Exchange Is Creating More Opportunities for Scalability and Interoperability to Thrive in the DeFi Industry

Have you always wanted to trade Decentralized Finance (DeFi) assets, but you are not sure if you are making the best decision considering how fragmented the market can be? You are not the only one facing that issue, because thousands of investors could have invested in DeFi assets if things were the way they ought to be.

As it stands, the future of Decentralized Finance (DeFi) critically relies on decentralization, security and liquidity. Those and many more are what Lattice Exchange wants to bring into the current DeFi industry to create more opportunities for potential DeFi investors.

My Bounty0x username is FunmilolaO and in this article, I will show some of the outlined policies that Lattice Exchange is banking on to open up the DeFi industry for more opportunities. But, before we look at some of these working instruments of the Lattice Exchange, I will like us to go through some of the current DeFi solutions to see the areas that Lattice Exchange will improve on.

Current DeFi Solutions

In a bid to create more advanced DeFi solutions, Lattice Exchange pointed out the following to be some of the current DeFi mechanisms that are tenable in the DeFi system.

- Simplified AMM Algorithm

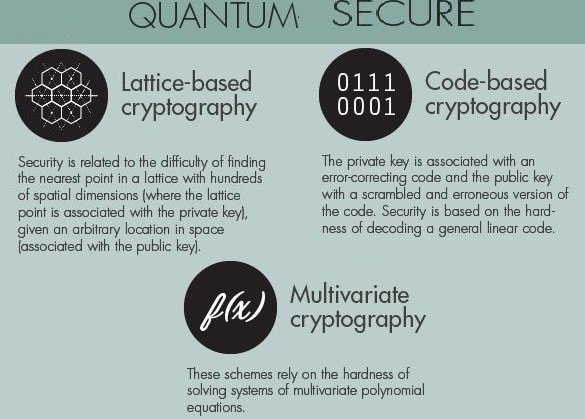

While Decentralized Finance (DeFi) transactions are decentralized, they also need to be secured.

The overt simplicity of the Automated Market Marking (AMM) algorithm used by current DeFi platforms may not always work in favour of the investors because low liquidity of price movements and fluctuating prices. - Slow-Paced Transactions

Ironically, transactions aren’t always as fast as claimed on DeFi systems. Instead, such transactions are not only slow, but also attract high transaction fees. - Impermanent Loss

You may loss more money than you make when trading DeFi assets partly because of high load times and mainly because of inability to cancel pending transactions, especially when trades are taking a swing.

How Lattice Exchange Addresses the DeFi Challenges

Lattice Exchange’s commitment is to create a scalable and interoperable blockchain network that thrives on robust Decentralized Finance (DeFi) architectures. More so, you will now realize that it is quite easy to trade DeFi assets only that the mechanisms to make that happen weren’t available all these while.x-apple-ql-id://2979A938-BA0C-42EF-8C74-12B1E89C6B69/x-apple-ql-magic/D35571C2-3D61-408B-AD42-4CC0D3FC40C5.png

By and large, Lattice Exchange aims to overcome most of the current challenges kicking against the burgeoning of the DeFi industry.

Below are some of the current facilities used by Lattice Exchange to make DeFi transactions scalable, more secured and interoperable across different blockchain networks.

- Multiple Scalability Networks

Scalability is at the core of the different working products used by Lattice Exchange. The platform quite understands that the faster transactions are, the more costs will be saved and the more potential investors will be convinced to trade DeFi assets on the platform.

The attainment of scalability can be achieved through various means, including:

Dynamic Partitioning

Concentrating DeFi transactions on a mono platform isn’t always the best, considering that lags and security breaches are becoming prevalent.

Instead, Lattice Exchange uses dynamic partitioning that sees to the effective distribution of data and transactions at a go. The partitioning uses concurrent consensuses that run at the same time, mathematical proofs and seamless data distribution to distribute data.

Microservice Architecture

Scalability of Decentralized Finance (DeFi) transactions cannot be done from one perspective alone. That informs the reason for the deployment of microservice architecture on Lattice Exchange through which the dedicated ecosystem of applications on the exchange will communicate with other (multiple) blockchain networks.

Smart Routing Algorithm

Gone are the days when DeFi transactions are limited to one platform alone. Now, you can use the dedicated Smart Routing Algorithm of Lattice Exchange to facilitate trades across different blockchain-based platforms. - Connecting Real World Applications on Blockchain

In the new DeFi system created by Lattice Exchange, it is now easier to map or connect real world applications on blockchain networks.

Thanks to the security of the dedicated Hypergraph Transport Protocol (HGTP), you are confident that real world applications can now be connected to blockchain via the secured communication layer of the protocol.

Exponential Increment in DeFi Market Opportunities via

Constellation Protocol

The Constellation protocol powers the Lattice Exchange. The exchange, in turn, uses the protocol to propel Decentralized Finance (DeFi) assets trading into the future. So, it is safe to safe that Lattice Exchange is bound to create more market opportunities for DeFi investors by leveraging the Constellation protocol.

Below are some of the possible outcomes of implementing the protocol in the DeFi industry:

Network Optimization

Customization will now be the order of the day thanks to the concurrent consensus of using math to organize the network and the data therein.

In addition, there is provision for orderly and strategic arrangement of data via topological ordering.

Free Transactions

Another attribute of the fusion of the Constellation protocol and Lattice Exchange is free transactions that are made possible because of the cost-effective peer-to-peer payment system and the platform’s addition of fees to facilitate transactions.

Final Thoughts

The second breakthrough of Decentralized Finance (DeFi) systems will be massive because of the traction already gained and the structures in place on platforms like Lattice Exchange.

If you have always wanted to enjoy maximum security, interoperable transactions and scalability of DeFi trades, it is time you port your assets to Lattice Exchange where all those and many more are assured.