POOLZ. Providing liquidity for investors using defi protocol.

The crypto-industry ecosystem is developing by leaps and bounds. It’s becoming more attractive not only for investors who view the crypto market as a way to get maximum profit in the shortest possible time and also make financial payment more flexible with ease but also for ordinary users who value crypto currencies for their fast transaction functionality, anonymous calculations and absence of any kind of intermediaries.

Crypto currency platform from studies that show that many people like the idea of “finance without borders”. That is why the number of people actively using cryptocurrencies is steadily growing and approaching the psychological mark of 50 million people. Cryptocurrencies’ number growth dynamics is also rapid. If in 2010 the number of cryptocurrencies could be counted on the fingers of one hand, then in 2018 their number exceeded 2000 and has greater chances of reaching 2500 by the end of the year.

In recent times there have been issues with investors and blockchain cryptocurrency innovators.

Poolz brought together interface permits venture proprietors to dispatch and oversee liquidity barters that are effectively discoverable by financial specialists on the stage.

Poolz sets out on a drawn out mission to upset and completely decentralize liquidity barters.

Liquidity means how quickly you can get your hands on your cash. In simpler terms, liquidity is to get your money whenever you need it.

Liquidity might be your emergency savings account or the cash lying with you that you can access in case of any unforeseen happening or any financial setback. Liquidity also plays an important role as it allows you to seize opportunities.

Poolz is a Layer-3 swapping protocol evasion that makes the whole blockchain easy for investors.

Unexpectedly, liquidity pools, depend on mechanized market making, executed by the Poolz convention. In this circumstance, any agreeable partaker can play market producer and will buy tokens at faries limit and still get compensated by the convention. Likewise, this accompanies the trustless assurance of a Defi convention.

Poolz has a guideline and pool generator, which is normally utilized by the venture proprietor, for new tokens that can set principles. The boundaries for this standard incorporate a few choices, for example, DAO convention and blockchain wallet, pool types, length of time the symbolic pool will be accessible for the pool or closeout, the swapping scale itself and a few others.

The primary concern Poolz does is to use Solidity as the engineering for working up the back completion of the stage's Smart Contracts. Through that medium, the assets of the customers will be held in auditable Smart Contracts.

Pool is classified into two(2) types,

Direct Sales Pool(DSP) and Time lock Pool(TLP)

Direct sales pool is basically for investors after they must have made a swap, Time Lock Pool, just as the name implies, Token will be locked for a certain amount of time, and later be released to investors.

Advantages for POZ Token Holders

Admittance to select pools: as of now referenced, each pool on the stage is restricted to POZ token holders for an underlying span after its dispatch.

Admittance to more readily trade proportions: Exclusive pools likewise offer exceptional limits for POZ token holders, in this manner improving the potential returns for liquidity diggers.

Pool Token Analysis

Poolz Token(POZ) is a ERC20 token based on the ethereum blockchain, POZ token serve for several purposes, POZ can be used for payment and the settlement of debts. POZ holders will have some bonuses as time goes on.

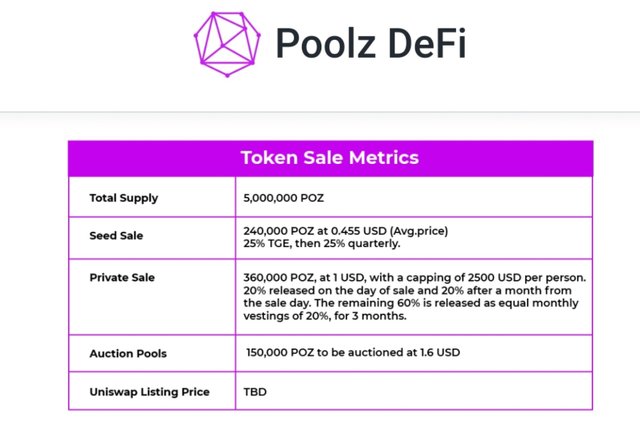

Token Information

-Token Name: (POZ)

-Total Supply: 5,000,000 (POZ)

- Initial Circulation Supply: 5.64%

- Initial Market Cap: $643K USD

- Seed Sale: (240,000 POZ) 1 POZ per 0.455 USD quarterly

- Private Sale: 360,000 (POZ), 1 POZ per 1 USD, with a limit of $2,500 per person. 20% issued on the day of sale and 20% a month after the sale, The remaining 60% is issued monthly 20%, for 3 full months.

- Auction Pools: 150,000 POZ to be auctioned at 1.6 USD per POZ.

- Uniswap Listing: TBD.

Token Allocation

- Private Sale and Public Sale: 750,000 (POZ), or about 15% of the total supply which will be allocated for private sales and public sales

- Team and Advisors: 500,000 (POZ)

- Swapping Rewards: 1,850,000 (POZ)

- Liquidity Fund: 150,000 (POZ)

- Staking Rewards: 1,750,000 (POZ)

Staking Rewards: 1,750,000 POZ (35%) will be distributed as marking rewards, to be coursed as Average Annual Yields (AYY) POZ holders who stake their tokens in a viable marking wallet. These tokens will be safely secured an openly auditable Multi-Sig Wallet and will come into dissemination over a time of 10 years, with a most extreme covering of 175,000 tokens for every year.

Conclusion:

Poolz is worked as a DAO protocol on ethereum

poolz is to take the liquidity pool reasoning above and beyond, into opening the chance of liquidity pooling for blockchain new businesses needing subsidizing and that underlying business sector passage liquidity and to do this over all open blockchains.

For more information please visit.

Website: https://poolzdefi.com/

Lightpaper: https://docs.poolzdefi.com/whitepaper/litepaper

Whitepaper: https://docs.poolzdefi.com/whitepaper/whitepaper

Twitter: https://twitter.com/Poolz__

Discord: https://discord.gg/RgPjgUY

Telegram: https://t.me/PoolzOfficialCommunity

Medium: https://medium.com/@Poolz

Article Written By

Bitcointalk Username: Stovemaras1

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=1969183

Proof Of Authentication

https://bitcointalk.org/index.php?topic=5280470.msg55597884#msg55597884