2020, the year of DeFi

Source: https://news.8btc.com/chinas-digital-currency-encryption-law-and-defi

Writer: Olusegun Ogundeji

2020 has been touted as the year of DeFi going by untested indicators. They include the sudden rise in the Google Trend search for the DeFi mechanism. If this translates to expectation, more people from Asia, Europe and the US, will get involved in DeFi-related protocols based on a better understanding of the opportunity its concept presents as a new way for crypto to co-exist as an alternative market alongside traditional markets. DeFi gives users, especially the younger ones, the opportunity to participate in a market with characteristics that were not possible in the past.

“As blockchain infrastructure and protocol being gradually improved, DeFi (Decentralized Finance) will soon be a more popular topic among developing countries,” says Chris Schneider, the CMO of a new crypto exchange in Singapore which uses self-developed system with bank-level security and high performance engine to ensure better user experience, Sky.io. “Large number of end users will benefit from this, when their needs of getting loans, saving, investing, preserving value and marking cross-border payment can be satisfied.”

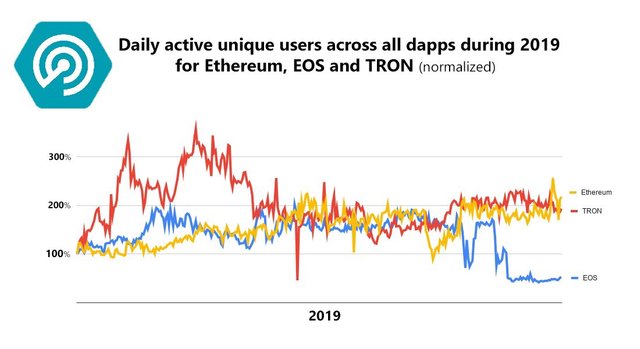

The DeFi mechanism seemingly works well presently — and is expected to gain mainstream interest in 2020 — though it may not yield more than 5% interest gain for users who pull real assets into smart contracts to earn staking rewards. However, the return will either rise or be less with time depending on the number of users (more users if the concept appeals to people) as well as the competition that rocks the DeFi space. That is, for the concept to be sustained in the market, the number of users has to increase as more projects compete among themselves — especially if a way to pull Bitcoin into the Ethereum fold can be figured out.

Aside the sustainability, there are also suggestions that the DeFi structure is still a huge risk that could lose users’ funds particularly in the event of a failure with a smart contract. The lack of an insurance cover tops the list and, where available, the fact that the insurance service providers are not trustless and also require KYC from users make it an undesirable option for some.