How to use derivatives

Introduction

Derivatives are a popular bogeyman because of the role they play in ultimately helping people lose money. Sometimes in vast amounts. They became a byword for irresponsible trading during the financial crisis of 2008 when lots of very wealthy idiots working in the financial industry and who subsequently really should have known better lost billions of dollars by making risky bets and just assuming that the prevailing trend of the day (the last 00's bull market) would not change.

More recently the next great bogeyman appearance of derivatives is with the realisation that up to £41trillion of derivatives are at risk if the UK leaves the EU without a deal.

This is of course a nightmarish sum of money. However, when we see headlines like this then it's worth asking how this could be and what we're actually describing.

Having traded derivatives for a while I figured I could also merge this into a how-do guide for beginners.

What Are Derivatives?

The clue is in the name. Derivatives are financial instruments which derive their value from the value of another underlying de facto asset.

So for example, a derivative based upon the price of potatoes will of course reflect the price action of physical potatoes in some way.

Derivatives exist as contracts between a trader and a counterparty (usually a regulated and legally authorised broker) and they allow traders to perform trades upon assets without ever actually owning the assets in any de facto sense.

How does this work in practice?

Well, lets say that I want to trade plutonium. However, the downsides of this should be obvious. I can hardly keep it in the fridge. Storage would be expensive. The asset price itself is rather prohibitive. And so on and so forth.

So, to perform a trade upon the price of plutonium, I instead go to a broker and establish a contract with them based on what I think will happen to the price of plutonium over a period of time. This allows me to trade the price action of plutonium without actually having to own it.

CFD's

One of the most common ways to do this in Europe and the UK is via Contract for Difference (CFD) derivatives whereby the trader and the counterparty open a contract between themselves to exchange the difference in price that occurs over the lifetime of the contract.

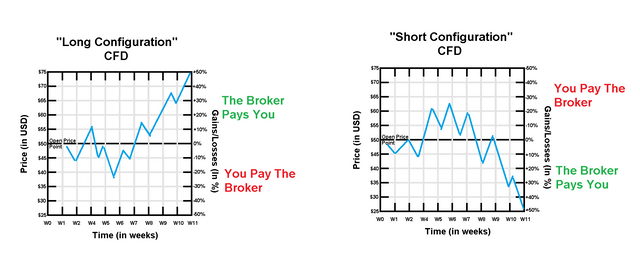

If your position moves the way you expect it to, you profit and the broker pays you "the difference" upon close of contract.

If however your position moves against you, you lose money and instead, you pay the broker "the difference" upon close of contract.

So in practice it is a contract to exchange differences in the price action of assets which is realised in raw cash.

You can set CFD's in both long and short configuration to profit from both gains and losses upon an assets price.

Here's a couple of diagrams to help visualise this.

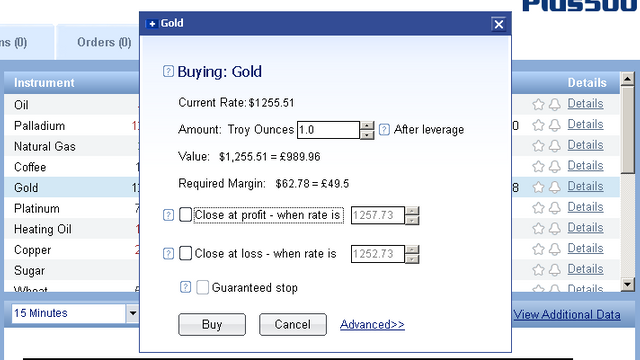

Another advantage of CFD's is that you usually do not have to cover full asset price. This enables you to get to grips with assets that are otherwise more expensive than you would usually be able to afford. Instead, usually the broker will demand a sum equivalent to a deposit upon the contract and shore up the remainder of the contract value with money contributed from the broker.

This is what is known as margin and we now look at one of the primary ways in which people lose money by trading derivatives.

On Margin

No matter what sort of derivative you trade, you will usually come up against the concept of margin.

Usually, in a CFD, you will put down a deposit on the contract and the broker will shore up the remainder of the position using margin.

So margin is essentially borrowed cashflow which is sourced from the broker.

Here's an example of a a CFD from Plus500 which clearly shows the deposit and margin of a buy position upon gold.

If your position turns against you too far and you stand a risk of losing your deposit, your broker will demand you shore up the position to prevent yourself from chewing into the part of the contract which the broker covers. This is what is known as a margin call

I.e. Literally, if you lose too much money, the broker will call you or text you and demand that you contribute more money into your position to shore it up. At this point you have the choice to either lose your deposit OR contribute additional funds to the position to shore it up.

Now it should be said that margin calls are one of the primary ways in which the horror stories about people losing more than 100% of their initial deposit using derivatives materialise in practice. However, it should be borne in mind that margin calls are essentially optional as to whether you comply with them or not. You can literally just close up at 100% loss and leave it at that.

Horror-story losses usually come about due to people complying with margin calls (or even repeated margin calls) during a period where the market is continuously moving against them. So in reality, the lesson is that you should not comply with a margin call if your position is not worth rescuing and you should always balance the future profit potential up against the additional funds you contribute if you decide to follow-through with one.

Leverage

Another advantage of derivatives (and especially CFD's) is the fact that you can very easily leverage your trades.

Leverage in a derivative contract is a means by which you can compound your gains (though potentially also your losses). In the early days it was (and still can be) established by copying the contract so that each movement of the market is amplified by a multiplier.

If your leverage your trade by a ratio of 1:2 then a gain of £5 across two contracts would yield £10. Thus it's quite simple. x2 the leverage means twice the gains.

For a more extreme example, especially common in FOREX, ultra high leverage settings of x25 and above offer the advantage to profit from much smaller movements than would traditionally be traded. For instance, a movement of 1% instead becomes a movement of 25% when a 1:25 leverage ratio is applied to the trade.

Now it should seem obvious, that compounding gains via leverage also stands the chance of compounding your losses and this is of course another reason why derivatives get a bad rep for horrific losses. However, responsibility as always falls to the trader to pick a leverage ratio suitable to the trade and to factor in the risk from the market making any adverse swing away from the direction they forecast it to be moving in on the whole.

Best Practice

I believe that once you understand all this in you will eventually start to look at the market visually in such ways which automatically factor it in. I.e. once you get a feel for how far you can push potential losses without damaging margin calls and learn to set stop-losses and take-profits respectively, you will automatically take on a conservative-enough position to avoid such situations where possible. Likewise with leverage, you need to learn to use it responsibly and only do so in situations where possible compounding losses are unlikely or at least would not be disaster scenarios.

In reality, despite the terrible reputations that derivatives have, derivatives allow those without substantial liquid funds to trade relatively expensive assets in a regulated environment. So bottom-line is that they extend market access to those who would otherwise often be without it. Yes people lose money on them (sometimes, LOTS of money) but this is a matter of personal responsibility and ultimately, the usefulness of these instruments outweigh the ills they cause.

Getting Started

I advise anyone looking to get started to find brokers who will give them cash to play with in order to test run the accounts. Any decent brokerage will do this.

As such I can recommend https://www.etoro.com who are good for beginners as (although being somewhat expensive) the contracts are safer due to no margin calls being implemented.

As a Brit, another common place to get started is https://www.plus500.co.uk/ however one must bear in mind that margin calls are implemented here.

As far as I'm aware both brokers give away demo accounts with real funds to use. So test drive some brokers and find out for yourself if you like trading with derivatives. They are especially worth learning if you have limited funds per position and as long as you can teach yourself how to manage the additional features and risks effectively you can use derivatives to amplify the potential profits (though also, the potential losses) from any trade you make.

Hello @intellivestor! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko

Congratulations @intellivestor! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!