German Bank says BTC "should" be worth $90k in 2020

A German Bank says bitcoin is likely going to go a lot higher in the coming months

A bank out of Germany, BayernLB recently published a report about bitcoin and gold.

The report specifically talked about valuations for the precious metal and how those have also been applied to bitcoin prices with astonishing accuracy so far throughout its brief history, by comparison anyways.

Gold has been around, since, well, forever. Bitcoin has only been around for about a decade.

The report can be seen here:

The Stock-to-Flow Model says bitcoin is going a lot higher

People may be wondering how they are coming up with such a wild price prediction for bitcoin in such a short time frame...

Let me first say that it isn't a prediction per say, but more of an "if-then" statement.

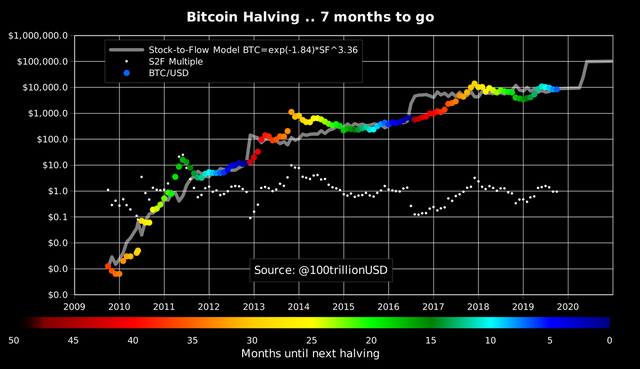

IF bitcoin continues to follow its stock-to-flow model/ratio, THEN the price will be $90k somewhere around its next halving, which takes place in May of 2020.

(Source: https://twitter.com/100trillionUSD/status/1178974437036740609)

Cool, what's a stock-to-flow model?

Stock-to-flow models are used to quantify the hardness of an asset. The harder the asset (in the model) the more likely it is to be used as money.

There are many reasons for this that I won't go into here, but they are listed in that report I linked above.

Bitcoin has already shown that it is very hard, very similar to that of gold, and likely to only get "harder".

It's interesting to note that gold and bitcoin appear to be very "hard" and work well as money partly because there is almost no (or very little) industrial use cases for either.

In very basic terms, the stock-to-flow model comes up with a ratio for a commodity (such as gold) by taking the amount of the asset that is held in reserves, and dividing it by the amount of the asset produced annually.

Interestingly enough in bitcoin's case, this model has been more than 90% accurate for all of bitcoin's move since it was created.

This model will really be put to the test during the next halving, because if bitcoin is not somewhere near $90k around the halving, it will be the first time ever that bitcoin failed to continue to move up in accordance with its stock-to-flow model.

We will find out either way in less than 8 months.

Stay informed my friends.

What will this happen to the traditional financial system?