Stablecoins are the Key To Crypto Adoption

One of the very first things that I learned in my Monetary Theory courses was that money is a “stable medium of exchange” that functions as a “store of value”. In other words, money allows us to receive payment for something today, hold the money, and purchase something in the future. In an ideal world, we would be able to purchase the same amount of goods and services whether we waited 10 days or 10 years to spend our money. We have seen the price of Bitcoin fluctuate by about 30% over the past month, and this has convinced me that stablecoins are the key bridge that will lead to widespread crypto usage.

As many of you know, I am a huge fan of cryptos. They have privacy benefits, are decentralized, and have the ability to empower individuals across the world. That being said, I have to be realistic. The very definition of money directly implies that it must be stable. If we want the average person to actually use crypto in day to day transactions, we have to offer them a stable crypto that has a steady value.

Volatility is an Obstacle to Adoption

I fully admit that the huge price swings over the past month are out of the ordinary for cryptos, but I think that it is important to put this volatility into perspective and think about the perception that the “Everyday Joe” has about cryptos. On 26 October 2019, Bitcoin briefly traded at a high of $10,071.47 (Coindesk). Less than a month later on 22 November 2019, it had reached a low of $7,123.56 (Coindesk). In under a month, BTC logged almost a 30% decrease in value. This is fine for a speculative investment, but is completely unstable for a form of money. As an investor, I expect volatility, and understand that price swings are a key to making trading profits. I am confident that BTC will go back up in price, and this presents an opportunity for supporters to “buy the dip” and earn profits as BTC rises again in price.

However, this article is addressing the monetary suitability of BTC for mass adoption. Volatility in investments is acceptable, but the ideal money should remain relatively stable. Don’t get me wrong, there are a lot of flaws with the existing fiat monetary system, and all fiat currencies lose value over time, but this is a slow, predictable loss of value. By contrast, the loss of value in crypto assets can be unexpected and unpredictable, which is the antithesis of a stable monetary system.

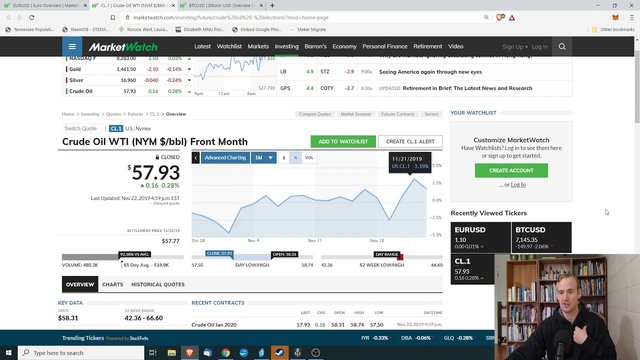

Just as a basis of comparison, the Euro to USD exchange rate ended the month less than .5% difference from where it started (MarketWatch) while Bitcoin was losing almost 30% of its value. Commodities are considered one of the riskier investments, and even oil proved more stable than bitcoin over the past month and only changed in value by about 2.2% (MarketWatch). The point that I am making is that “money” should be inherently more stable than an investment, but over the past month, BTC has proven to be much more unstable than even risky investments like commodities. I willingly admit that the existing fiat monetary system is unstable and that all fiat currency is slowly eroded by inflation, but if BTC is even more volatile than the existing system, what does that say about Bitcoin’s suitability as a day-to-day monetary payments mechanism?

Bitcoin Isn't Bad...Its Just Not Money

This simple answer is that Bitcoin is not ready for mass adoption as “money.” Yes, BTC has enormous potential as an investment. Yes, Bitcoin and other cryptos are great for moving large amounts of money across borders without huge transaction fees. Yes, BTC and other cryptos are perfect for permissionless peer to peer transactions, but it is absolutely imperative that cryptos become less volatile and more stable if we expect the average everyday user to use them in everyday transactions instead of considering them as anything more than a wildly speculative investment.

Admittedly, there are many obstacles in the way of day-to-day crypto adoption such as the threat of government regulation and the crypto learning curve, but in my opinion, the single biggest obstacle is the extreme volatility. This is the reason that I believe stablecoins will be the key to driving crypto usage as a medium of exchange. Stablecoins combine the benefits of cryptos with the “stability” of traditional fiat and offer the best of both worlds for average customers.

There are many different stablecoins offered by different organizations, but the common theme is that they all maintain a peg to some fiat currency. In other words, holding the USDC stablecoin is equivalent to holding USD at least as far as purchasing power is concerned. Holders of USDC or other stablecoins don’t have to fear that they will wake up one morning and find that their crypto has lost 30% of its purchasing power vs the national currency.

Again, I want to separate the monetary vs investment uses of cryptos. At least from a monetary standpoint, removing this volatility by pegging crypto to the national fiat currency is a benefit for users. At this point, some may ask “Why go through all the hassle of stablecoin cryptos if I could just hold the national currency?” Even though stablecoins are pegged to the value of the national currency, they offer many additional benefits.

Why Stablecoins Will Shine

Bitcoin is famous as a decentralized, peer-to-peer version of electronic cash. This means that Bitcoin transactions can be sent between individuals without the permission of a third party payment processor or the consent of an oppressive government. This ability is something that is unique to cryptos, and simply holding the national fiat currency would not allow users to have access to this functionality. However, a fiat pegged stablecoin, such as Dai, gives users the ability to partake of all the benefits of crypto while also transacting with a relatively stable medium of exchange.

With Dai, (or USDC, Tether, etc) users can take advantage of the extremely low fees for transferring funds across international borders. Stablecoin users can make payments directly to a merchant’s wallet without having to use a third party such as PayPal or Stripe. As with other cryptos, stablecoins allow users to securely store their funds in their own wallet even if they don’t have access to a traditional bank. My point is that users of stablecoins are not giving up any of the benefits associated with traditional cryptos. Stablecoins offer all of the security, privacy, decentralized, permissionless benefits of traditional cryptos while ALSO maintaining a more stable value.

It is true that traditional cryptos do offer a host of benefits over fiat, but they also offer significant risks. I would argue that most people would appreciate the privacy and security of cryptos like Bitcoin, but would be adverse to the huge swings in price. This creates a situation in which the customers don’t know if the risks outweigh the benefits of using crypto and leads to inaction. We know that most people are resistant to change and unless a new idea is clearly better the status quo will remain intact. In my opinion, stablecoins offer this better option because they convey many of the same benefits of traditional cryptos while also minimizing the major volatility risk of cryptos.

Reference Data:

https://www.marketwatch.com/investing/currency/eurusd/charts

https://www.marketwatch.com/investing/future/cl.1/charts

https://www.coindesk.com/search?q=btcusd&s=relevant

Image Credit: https://www.pexels.com/@pixabay

▶️ DTube

▶️ YouTube

Congratulations @parttimeeconon! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

I appreciated reading your article and stablecoins is the key for mainstream adoption.