Financial bubbles 💣

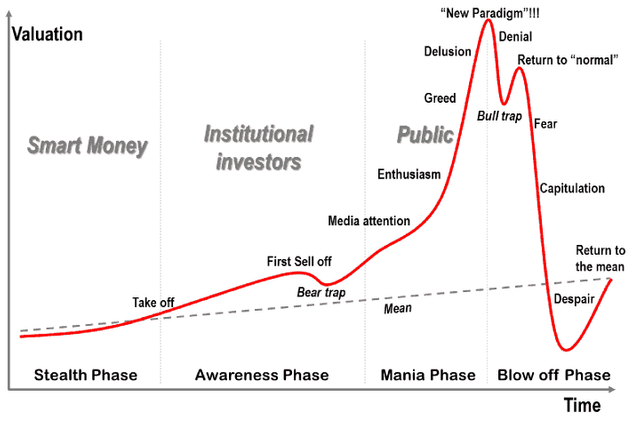

Hello steemians I hope you are very well, today I come to tell you about a very interesting topic Financial bubbles is a subject that we should all have knowledge to try not to get caught in the bubbles when they explode, throughout history there have been several bubbles leaving a large number of people in bankruptcy, usually when the bubbles explode a deep economic recession comes leaving the hunger and despair in the population.

Henderson so you tell us the financial bubbles are dangerous but what are they?

Well there is no definition as such, but if they have a particular characteristic and is the prolonged and exponential increase in the price of a product or asset, they usually originate because there is an excessive desire in the market to buy or invest in a product since due to manipulation of information or unfounded expectations, investors are made to believe that the value of the asset will continue to grow and that makes many people aware of the "profits" that this asset is leaving, in a short time the effect snowball when least expected until the least trained person in economics is talking about investing in this asset because it will generate a profit in a "safe" way

In history we have been able to witness different bubbles

Bubble of tulips.

In 1935, a huge increase in the prices of tulip bulbs began, companies wanted to buy as many as they could, many people asked for big loans, they mortgaged their assets to start producing tulips, it was so incredible the price increase of tulips that It is estimated that the highest value that was reached by tulip bulbs would be about 150 thousand dollars.Bubble of the South Seas.

So called because this bubble was produced by only one company, the company South Sea Company obtained a commercial monopoly with South America that made it so massive both poor, middle class and rich, invested in buying shares of that company, the shares were they fired but in a short time they realized that it was not going to be so lucrative that the company would reach those values by action and they collapsed, leaving thousands of people in bankruptcy in England and the country was in crisis.Bubble of .com

This goes back to 1997, it was living the future with everything that represented the internet, at that time all companies related to this technology began to rise in price, all wanted to be assembled in the new economy because it was a "get rich quick" problem began when it was detected that many companies launched their initial offer of shares wanting to relate to the internet simply by placing any name on the company but ending with .COM only to inflate their prices speculatively, in 2000 they it produced a massive sale of shares, bankrupting millions of people.Real estate bubbles.

These have happened in different countries and are usually originated by the same characteristics, first a real estate boom begins, product of bank loans to construction companies, in the street the money seems abundant there is a lot of work then people start buying the properties already finished or in pre-sale through bank loans, some time goes by and everything is going well so banks start offering more credits (because you will have only one house if you can have 2 or 3).

But the time comes when the big companies notice that there is not enough demand in the properties they are building and they do not see profitable to continue getting into debt with the banks, some constructions are stopped, some dismissals begin, at that moment many people are indebted from 20 to 50 years, paying several mortgage loans and starts to lack money to pay the loans since some tenants of the house that bought by loan were left without work or in the worst case they were left without work, the domino effect begins and the market plummets, the value of houses falls quickly while people try to sell them for much less than what they bought, trying to get out of loans and in this way like the other bubbles are affected thousands or millions of people .

Many called BTC bubble and I think if we analyze it technically if it behaved as such, the incredible price increase at the end of last year, everyone talking about the BTC and they were buying or wanted to buy and boom the crack, step to cost $ 20 thousand to $ 6 thousand in just over a month, the only difference I notice is that although many people lost money most were aware that the money they invested in BTC was a risky investment, then the effect was not devastating for the economy of the people or good at least not for the majority.

See you later, steemians and remember HOLD !!!

I invite you to participate in my contest Dream holidays are still on time.

Here you can see my previous post

Buying an Antiminer T9 + 10.5T with PSU

Comparing the current market of cryptos to one year ago

May 30 Days Writing Challenge: If You Will Get 1000 STEEM Tomorrow, What Would You Do With It?

Este Post ha recibido un Upvote desde la cuenta del King: @dineroconopcion, El cual es un Grupo de Soporte mantenido por 5 personas mas que quieren ayudarte a llegar hacer un Top Autor En Steemit sin tener que invertir en Steem Power. Te Gustaria Ser Parte De Este Projecto?

This Post has been Upvote from the King's Account: @dineroconopcion, It's a Support Group by 5 other people that want to help you be a Top Steemit Author without having to invest into Steem Power. Would You Like To Be Part of this Project?

Sí, se habla mucho de que el BTC es una burbuja pero en estos tiempos parece más una serie de rumores que se crean porque los sistemas económicos viejos quieren quitarle toda veracidad a las criptomonedas para que ellos no pierdan el control que habían tenido del mundo.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by henderson from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.