Economic graph of the day #5. Worker's share in global wealth

Hey everyone!

Today we will touch a matter of great importance. We will return to it many times over and over again in my EGotD because I personally think it is the most important trend in a world right now. To cut things short to one word, it is automation.

Why is it so important? Because it will end the world as we know it. Today world economy is still shaped by mass industrial production. Billions of people (workforce as we, economists call them) are employed by producing all the stuff we buy and use every day. Even if "golden billion" of developed countries is employed mostly in service sector and white-collar jobs (post-industrial economy, ha-ha) it is still only one billion out of seven and a half. In the field of employment things didn't change much from times of the First World War.

Developing countries relied and continue to rely heavily on industrial tranformation. It was the lift which rises a society to a club of developed countries. Their moves were pretty the same:

- achieve foreign investments in order to build new industrial capacities using cheap labour as competitive advantage

- move large portion of population from low-productive agrarian sector of economy to highly productive industry

- sell end products on world markets

At first Japan and then Eastern Tigers and China move the same path.

And what now...

Now robots are taking this opportunity away. No investor in the world will build a factory in developing world if it could build it in developed one with compared costs. Robots have constant costs in India and in Europe.

Well... I think I'm out of the scope of a short daily post already. It's time for graph.

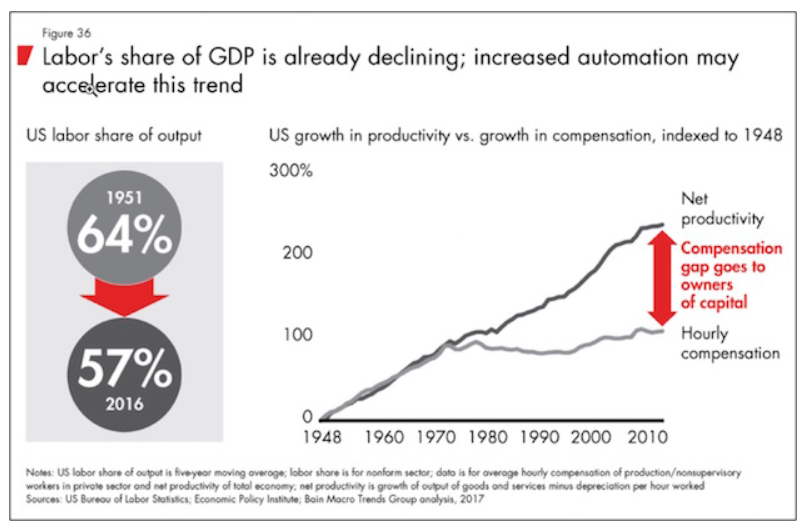

And here we go. From 50s to late 2010s share of labour in global wealth fall from 64% to 57%. That means that workers earn 7% of total worth of global goods and services less and owners of capital 7% more.

Also the gap between rise of productivity and rise in wages has never been so wide. And there is no evidence the process to slow down.

Hope I dodn't frightened you too much. Thanks for your attention and see you soon.

There's also another driver for the gap in that graph: credit. Without the credit-binge of the past 30 years, none of these manufacturing booms and capital appreciations would not have been sustainable for very long!

And that credit bubble is coming to an end now. This is why the central banks have been propping up the markets with never-ending injection of credit! They know the jig is up! The Western populace is up to their eyeballs in debt.

Well, credit expansion is a factor, who would argue. While rates lowering, capital allocation shifted to industries with less marginal returns. But growth of capital also boosted overall productivity and wages.

Considering credit bubble, it won't going to an end. From now on it will be permanent. So what - Japan lives in credit bubble for 30 years now.

To be honest, I'm far from the economy. I understand the workforce is decreasing every year?

Or I not so translated post?

Yes, automation processes make the workforce cheaper. And many factories need a very small number of workers now. Automation is good, but because of it the income of a large number of workers decreases. I correctly understood your post?

Right!

Automation will displace one third of workers and dramatically boost overall performance. But behind this growth are dozens of millions families pushed to the edge. We still ought to find ways to ease such a social disaster,

Automation and robots are good, but people are too many and they need work. This is a big economic dilemma...

Oh, I'll go to order a coffin.

Although stop! I had decided to cremate.