Think Like A Rich Person: Money lessons from Rich Dad #4

This lesson will be touch upon a very important and perhaps the most important topic of financial education: the definition of assets and liabilities.

The problem of the poor and middle class is that they do not understand the difference between these two notions.

Take the hypothetical John. John goes to work, earns good money, and can already afford to buy his new house. He believes that his house is his most important asset.

He takes a mortgage for 30 years, buys beautiful new furniture, household appliances. He equips the yard around the house.

Everything is fine!

John is happy... until the first bills come.

He have to pay for:

- mortgage

- loan for furniture

- loan for household appliances

- property taxes

- maintenance of the house and things

- bills for light, water, electricity, etc.

The whole his salary goes to pay for all this things. Or even more (if John did not count everything in advance). John works more and more, pays the bills and goes into a vicious circle of debts. Robert Kiyosaki calls such a process the Rat Race.

But what if John suddenly lose his job? ...

In order not to fall into the trap, it is important to realize the difference between liabilities and assets.

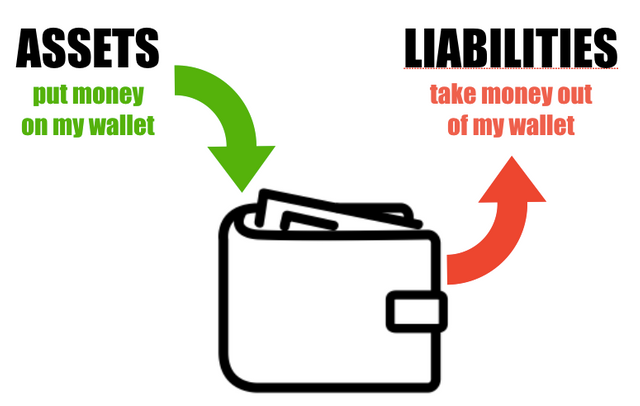

An asset put money on my pocket. A liability take money out of my pocket.

The people don’t understand that their trouble is really how they choose to spend the money they do have. It is caused financial illiteracy and not understanding the difference between an asset and liability.

First, let's define what liabilities are.

Liability is anything which is a debt.

Examples of Personal Liabilities:

- Rental or other property mortgage

- Home mortgages

- Car loans

- Credit card debt

- Current bills - rent, utilities, insurance, etc

- Home equity loan

- Miscellaneous debts

- Student loans

- Unpaid Income Tax

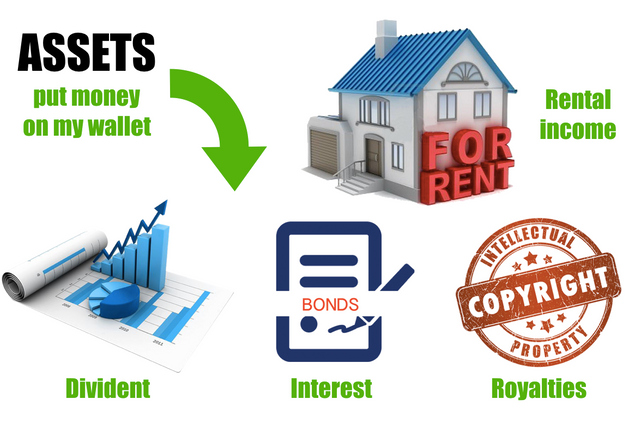

Assets in turn, this is what brings income.

Below I suggest several options for assets that can give you some ideas:

Tangible assets:

- Buildings

- Cash on deposit

- Commercial papers

- Bonds and stocks

- Equipment

- Guaranteed investment accounts

- Land

- Marketable equity securities

- Savings accounts

Personal assets include:

- Artwork

- Jewelry

- Investment accounts

- Retirement account

- Savings account

Intangibles assets:

- Patents

- Trademarks

- Copyrights and business methodologies

- Brand recognition

But remember that you yourself are your most important asset!

Your head! Your education, your skills.

Okay, now think about how do you spend money.

Do you have more spending? Or maybe income is equal to expenditure?

Think about what brings you income and what takes away money.

It may be worth thinking how to save the budget, which will be directed at investment.

Think about how to multiply money.

Look again at the pictures above. Realize the difference between assets and liabilities.

I hope it will become a clue to you.

Keep follow my blog to learn the next lessons from the Rich.

Read also:

Money lessons from Rich Dad #1

Money lessons from Rich Dad #2

Money lessons from Rich Dad #3

Kind regards,

Katy @ladykatybit

I couldn't agree more on your last point. The most profitable investment is in ourselves with a huge ROI.

Surely!