EOSUnion| Understand "Ricardian Contract" in 5 minutes 5分钟带你看懂最近爆火的“李嘉图合约”

For the vast majority of EOS enthusiasts, the Ricardian Contract, can be both familiar and unfamiliar.

Speaking of familiarity, it’s because we have heard about it a lot recently. It was mentioned at the EOS Alliance’s discussion meeting on Constitution, and it was also mentioned in the free market dispute resolution proposed by the EOS New York BP. What is more, after the EOS main net was launched, all of our behaviors in the chain will involve it, so it is familiar to us indeed.

Then why is it unfamiliar? It is because many users in the community, especially those who in the Chinese community, have not understood it so much, so that there are a series of problems including the "werewolf incident". Thomas Cox pointed out that most of the participants lost a lot in the werewolf game because they lacked knowledge about Ricardo's contracts, arbitration, etc., even if they participated in the game and did not look at the contract carefully.

Therefore, the only task today is to explain the "Ricardian Contract" to everyone in detail.

Part1 the background of the birth of Ricardian Contract

The Ricardian Contract appeared in 2000, much earlier than Bitcoin. It was proposed by Ian Grigg and was first used in the Ricardo payment system. Later, it was applied to more systems, such as OpenBazaar system in Bitcoin's era.

Seeing this, maybe everyone has a question: Why are Ricardian Contracts used in financial instruments such as payment systems?

Before answering this question, let us look at how we usually deal with financial instruments such as US dollars, stocks, bonds, futures, etc. Why are we willing to trade and hold these financial instruments?

In fact, every issued financial instrument has a clear contract between the issuer and the holder. Needless to say, the US dollar is a national currency, and we believe that the Fed’s payment system will not break the contract. Similarly, the reason why we are willing to hold financial instruments such as stocks, bonds, futures, etc. is that we believe in the financial payment system behind them.

But who can guarantee that these financial payment systems will not go wrong? How should the issuer and the holder's rights and responsibilities be defined when problems arise (that is, when a breach of contract occurs)? Will there be a situation in which the agency unilaterally tears up the contract because of excessive rights?

With so many questions, there must be something to solve it.

As a result, the Ricardian Contract came into being.

Part 2. What exactly is the Ricardian Contract?

As we all know, the distribution systems (stocks, bonds, futures, etc.) that we are familiar with today have contracts, but they are only used as auxiliary documents to user agreements. Their roles and functions are often affected by various factors.

So Ian Grigg made an innovation and united the financial instruments and contracts that were issued. And this is the core perception of Ricardo's contract: the contract is issued.

The Ricardian Contract, in simple terms, is a document that records the following information in detail:

A contract provided by the issuer to the holder;

Serve the valuable rights of holder ownership and issuer management;

Human readable (like a paper contract);

Program readable (like a database that can be parsed);

Verifiable digital signature;

With secret key and server information;

Attached with a unique security identifier (i.e. hash value, cannot be forged).

This information defines the value of an asset type issued over the Internet, and a standardized contractual standard is defined to clarify the rights and responsibilities of the issuer and the holder, and eliminates the hash by the security mark. The possibility of a unilateral tampering or tearing of a contract protects the rights and interests of the weaker party.

Therefore, we can make a simple definition of the Ricardian Contract: it is a clearly defined, non-tamperable, readable text that is used primarily to clarify the intentions of both parties in the transaction.

Part3. Ricardian Contract and smart contract

When it comes to Ricardian Contracts, we naturally think of another contract on the blockchain, the smart contract.

A smart contract is essentially a set of code that is based on a blockchain and is triggered when a specific condition/event is detected in the blockchain to ensure that the participants execute the promise. Ricardian Contract and smart contract are different, but they complements each other.

In the blockchain world, sometimes there are some vague concepts, which cannot be understood and clarified by smart contracts alone. At this time, combined with a more clearly defined Ricardian Contract, it can bring more accuracy to the execution of smart contracts, and achieve a better integration of human intentions and machine execution. Therefore, the Ricardian Contract is intended to clarify the intention of smart contracts and can be seen as a complement to smart contracts.

Below, we combine the EOS transfer example to see how the Ricardian Contract and the smart contract are combined to achieve the intention of both parties:

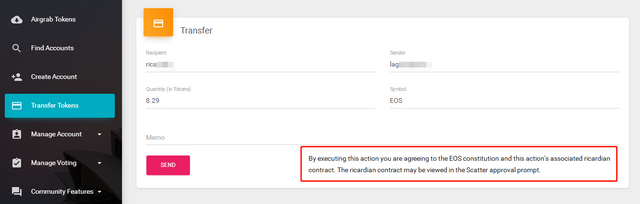

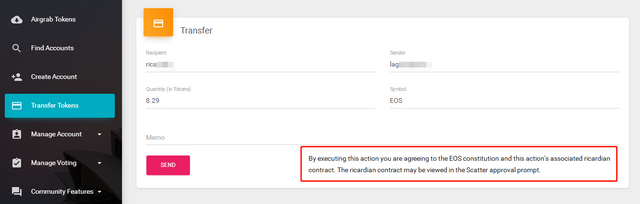

As you can see from the above, eostoolkit reminds us that if you want to initiate a transfer transaction, you need to comply with the EOS Constitution (essentially a smart contract) and also agree onthe Ricardian Contract attached to the transfer.

So how about the Ricardian Contract attached to the transfer?

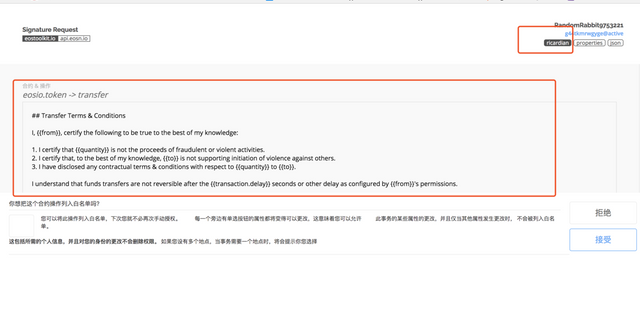

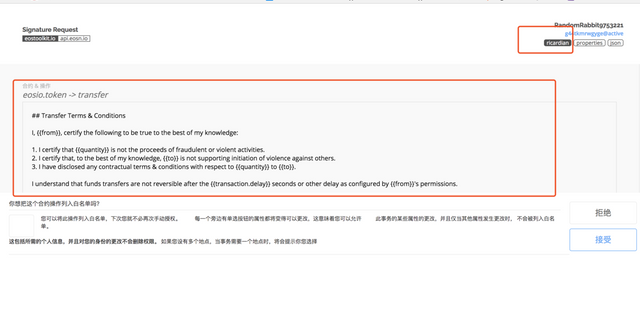

As you can see here, in the Ricardian Contract, some corresponding terms are defined. Therefore, each of our transfers is actually attached to these terms and is used to ensure the intention of the transfer.

Finally, let’s review today's content in two sentences:

The Ricardian Contract defines a digital contract in a clearly defined, non-tamperable, human-readable way. Combined with a smart contract, it allows each transaction to be executed with a clear definition of intention to facilitate timely resolution of disputes.

5分钟带你看懂最近爆火的“李嘉图合约”

李嘉图合约,对绝大多数关注EOS的小伙伴们来说,可以说是既熟悉又陌生了。

说熟悉,是因为我们最近经常能听到和它的相关消息,EOS基金会的公约讨论会议上提到它,EOS纽约节点提出的自由市场争议解决方案也提到它;而且EOS主网启动后,我们所有的链上行为,也都会涉及到它,和它不可谓不熟悉。

那为什么又说它陌生呢?这是因为社区内很多用户,尤其是中国社区的用户没有真正深入了解过它,以至于发生包括“狼人杀事件”在内的一系列问题。Thomas Cox曾一针见血地指出:大多数参与者在狼人杀游戏中损失惨重,是因为他们缺乏关于李嘉图合约、仲裁等相关知识,即使他们参与了游戏也没有仔细去看合约。

所以,我们今天只有一个任务,就是把“李嘉图合约”掰开揉碎,讲给大家听。

一、李嘉图合约诞生的背景

李嘉图合约出现的比比特币还要早,在2000年就已经出现了,它由Ian Grigg提出,最早用于Ricardo支付系统中。后来,它被陆续应用到更多的系统之中,比如比特币同时代的OpenBazaar系统等。

看到这里,也许大家都有一个疑问:为什么李嘉图合约都用在支付系统这类金融工具上?

不急,在回答大家这个问题之前,我们先看看自己平时是怎么和美元、股票、债券、期货等金融工具打交道的,为什么我们愿意交易持有这些金融工具?

实际上,每一种发行的金融工具都是发行人与持有人之间的明确合约。那美元自不用说,因为是国家法币,我们相信美联储这个支付系统不会毁约。同理,我们愿意持有股票、债券、期货等金融工具,也是因为相信它们背后的金融支付系统。

但谁能保证这些金融支付系统不出问题呢?当出问题(也就是发生毁约情况)时应该如何界定发行人与持有人的权责呢?会不会出现机构因为权利过大单方面撕毁合约的情况?

这么多问题,总得有个东西出来解决一下不是?

于是,李嘉图合约应运而生。

二、李嘉图合约到底是什么?

众所周知,我们日常所熟悉的支付系统的发行物(股票、债券、期货等)都有合约,但它们只作为用户协议等辅助文件,它们的角色和功能往往受到各种因素的影响。

所以Ian Grigg做了创新,将发行的金融工具和合约合一。而这正是李嘉图合约的核心认知:合约即发行。

李嘉图合约,简单来说就是一份文档,这份文档详细记录了以下信息:

一项由发行人提供给持有人的合约;

服务于持有人拥有、发行人管理的有价值权利;

人工可读(就像是纸质合约);

程序可读(就像数据库那样可以解析);

可验证的数字签名;

带有秘钥和服务器信息;

附有唯一的安全识别标志(即哈希值,不可被伪造)。

这些信息定义了通过互联网发行的某种资产类型的价值,同时制定了一种规范化的合约标准,来界定发行人和持有人的权利和责任,并且通过哈希值这一安全标识,消除了合约被单方面篡改或撕毁的可能性,保护了较弱一方的权利和权益。

因此,我们可以给李嘉图合约做一个简单的定义:它是一种清晰定义、不可篡改的可读文本,主要用作交易中明确双方的意图。

三、李嘉图合约与智能合约

谈到李嘉图合约,我们自然会想到区块链上的另一种合约,即智能合约。

智能合约本质是一套代码,是基于区块链的,并且会在区块链检测到特定条件/事件下触发,用于保证让参与方执行承诺。它与李嘉图合约各有不同,又互为补充。

在区块链世界里,有时存在一些概念的理解和厘清,仅仅靠智能合约无法完成。这时候,结合具有更多清晰定义的李嘉图合约,能给智能合约的执行带来更多的准确性,实现人类意图与机器执行更好的融合。因此,李嘉图合约是为了更明确智能合约的意图的,可以看作是对于智能合约的一个补充。

下面,我们结合EOS转账的例子,来看下李嘉图合约和智能合约是如何结合,实现交易双方意图的:

从上面你可以看到,eostoolkit提示我们,如果要发起转账交易的话,需要遵从EOS公约(本质就是智能合约),并且,也是对转账所附带的李嘉图合约的同意。

那么转账所附带的李嘉图合约又长怎么样?

在这里可以看到,李嘉图合约之中,定义了一些相应的条款。所以我们的每一笔转账,其实都是附加了这些条款的,用于确保转账的意图。

最后,我们用两句话回顾下今天的内容:

李嘉图合约,用一种清晰定义、不可篡改、人类可读的方式,定义了数字合约。它与智能合约结合,可以让每一笔交易操作,都能够得到明确的意图定义,方便出现纠纷时及时解决。

Some other articles we wrote

EOSUnion BlockChain 101 | Token and Token economy https://steemit.com/eos/@eosunion/eosunion-blockchain-101-or-token-and-token-economy

EOS inflates 5% per year, 1/5 as BP reward, and where is the remaining 4/5? https://steemit.com/eos/@eosunion/eos-inflats-5-per-year-1-5-as-bp-reward-and-where-is-the-remaining-4-5

EOSUnion Supporting EOS Alliance https://steemit.com/eosunion/@eosunion/eosunion-supporting-eos-alliance

EOSUnion| Understand EOS resource allocation logic with 3 pictures https://steemit.com/eos/@eosunion/eosunion-or-understand-eos-resource-allocation-logic-with-3-pictures

EOSUnion Blockchain 101|The 4th class: What is the public chain, private chain and alliance chain? https://steemit.com/eos/@eosunion/eosunion-blockchain-101-or-the-4th-class-what-is-the-public-chain-private-chain-and-alliance-chain

EOS FAQ | The Most Complete EOS Resource Package, Super Practical!!! https://steemit.com/eos/@eosunion/the-most-complete-eos-essential-resource-package-on-the-whole-network-super-practical

EOSUnion Blockchain 101|What is the blockchain fork? After reading this article, I understand! https://steemit.com/eosamsterdam/@eosamsterdam/eos-amsterdam-eos-gov-telegram-channel-summary-august-10-august-12-2018-8-10-8-12

The Global EOS Eco Summit held successfully! https://steemit.com/eos/@eosunion/the-global-eos-eco-summit-held-successfully

Follow us

WeChat: eosunion

Steemit: https://steemit.com/@eosunion

Telegram Channel: https://t.me/EOSUnionChannel

Telegram Chat: https://t.me/EOS_Union

Email: [email protected]

Twitter: eos_UNION

CypherCore⚡Jay @jim380

the Chinese translation was surprisingly accurate.

https://twitter.com/jim380/status/1035285895614623744