A Solution to RAM squatting problem of EOS platform.

(Subtitle: Introduction of RAM Rental Market and RAM Short Selling Market)

1. Purpose

This proposal is about the issue of RAM squatting of EOS dApp platform. We propose introducing new 1) RAM rental market and 2) RAM short selling market that run with the current RAM spot market to ensure inexpensive distribution to dApp developers who need RAM resources on the EOS platform.

2. Drawbacks of the Current RAM Supply Model

The RAM resource is the critical issue because EOS is a platform for various dApps (distributed applications). The dApp platform aims to provide a development environment where various dApps can operate experimentally or practically at a low cost. This eventually increases the likelihood of more killer apps emerging.

2.1 Problems with Current RAM Spot Market

Currently, the EOS Mainnet uses the spot market to distribute the RAM resources provided by BPs. However, as shown in Figure 1 below, the price of RAM is not only very high but also extremely volatile. In particular, Figure 1 highlights that speculation is overheating in the current RAM spot market.

As shown in Figure 1, the peak price of RAM increased about 55 times from the initial price at the time of the Mainnet Launch, and surprisingly, it only took 14 days. Assuming the EOS price is $ 8 (9,000 won), the price of 1GB RAM on July 16, 2018, about a month after launch, was approximately $ 2 million, which is too high.

2.2 The High RAM Price Issue: Trade-off Relationship between RAM Prices and the dApp Platform

However, such high RAM prices significantly increase the entry cost for dApp developers. Most importantly, the high RAM prices and dApp activation are in a trade-off relationship. In other words, the higher the RAM prices, the greater the dApp developers’ costs, which makes it more difficult to vitalize the dApp platform as the price of RAM rises. Thus, it causes fundamental problems that can heavily limit the role of EOS as a dApp platform.

Furthermore, it can be estimated that the reason for the steep rise in RAM prices in Figure 1 was mainly due to the fact that 1) speculators and 2) dApp developers preoccupied RAM resources at low prices first. This is because the actual usage rate of the RAM purchased is about 1 to 2%, which is very small.

2.3 Small RAM Size

The EOS set the available RAM size to 64GB when launching mainnet and introduced a new way to increase available RAM capacity by 1kB per block about two weeks ago. Link

However, assuming the Mainnet provided 1TB from the beginning, 64GB is very small in capacity, accounting for about 5% of the assumption. Why did it start with this small RAM size, even though it could actually provide a large RAM size at once?

We believe the purpose of this RAM distribution method is just to prevent speculation or preoccupation of RAM in the early days of the Mainnet launch and distribute RAM resources at low prices to consumers who purchases later. Although there may be other purposes, we strongly believe that it is better to supply at least 1TB to the network to vitalize the dApp platform. As a result, it may be necessary to offer more compensation to BPs than now. We proposed new BP rewards based on equipment rewards for this. Please see Note 4 for more details.

To sum up the current situation, in order to reduce the speculation on RAM, the current Mainnet 1) allows consumers to use the RAM purchased from the market only for their own use, 2) set the initial available RAM size to 64GB, which is very small, 3) increases the available RAM per block by 1kB each block, and 4) denies the RAM rental market. So we think that a very passive RAM distribution method has used. However, as clearly shown in Figure 1, this method cannot stop speculation in the RAM spot market and does not distribute RAM resources to actual users efficiently.

3. Principles of RAM Resource Distribution

To solve these problems, we present the following principles of distributing RAM resources to users efficiently at a reasonable cost:

1) Ensure that RAM resources are distributed primarily to actual RAM users.

2) Vitalize the platform by lowering the price of RAM as much as possible.

3) Provide sufficient available RAM resources to let EOS serve as a platform.

Thus, this proposal aims for "economic and efficient distribution" of the RAM resources provided by BPs to real RAM users.

4. A New Efficient Method of RAM Resource Distribution

To achieve this goal, we propose running new 1) RAM rental market and 2) RAM short selling market together with the current RAM spot market. However, unless particularly noted in all of the examples below, a 0.5% fee can be charged for each market transaction, and the market price will be determined by Bancor Algorithm or the annual interest rate, etc.. Please see Note 1 for more details.

4.1 Introduction of the RAM Rental Market

This method consists of the spot market where the available RAM can be purchased and the rental market where the RAM purchased can be lent. In the rental market, it can lend the RAM purchased by buyers from the spot market to generate profits. But in the current EOS Mainnet, RAM buyers cannot lend their RAM resources to other accounts .

The specific rental market principles of resolving the current problems are as follows:

As the demand for RAM rises in the spot market due to speculation, the amount of unused RAM increases, which boosts the supply of RAM to the rental market. In other words, the key principle is that the supply of RAM to the rental market increases and RAM prices decline as the speculation in the spot market swells. Therefore, the rental market is a good way to lower the rental price of RAM using speculation on RAM in the spot market.

Moreover, with regard to building in Korea, the ratio of the monthly rental price to the sale price is usually about 1:100. Thus, the rental market is a good way to greatly save on dApp developers’ testing costs.

4.1.1 How to Implement the RAM Rental Market

Examples of how to implement the rental market include the following:

1) RAM Renter

1.1) Deposit a certain amount of EOS tokens in the renter’s account.

1.2) In the rental market, the renter pre-borrows a fixed amount of RAM, for example, on a daily or monthly basis.

1.3) The renter sets the rental period to either ’Fixed’ or ‘Continued’ and then uses the borrowed RAM.

1.4) If the rental period is selected as ‘Continued’ and there are enough EOS tokens for payment in the account, it is possible to borrow a fixed amount of RAM for each settlement date automatically from the rental market, and the corresponding dApp can continue to use the borrowed RAM.

2) RAM Lender

2.1) The lender specifies the RAM size to lend and supplies it to the rental market.

2.2) In the rental market, the RAM resources provided by lenders are priced based on the Bancor Algorithm and distributed to renters, and these prices transform into lenders’ profits.

In this regard, Dan Larimer announced the rental market for CPU/Net but said he is not considering the rental market for RAM. Link

4.2 RAM Short Selling Market: Stabilized RAM Prices by Allowing Two-way Trading

This method is comprised of the spot market and the short selling market, which benefits when the price declines to prevent it from rising due to speculation. The ones who actually purchased RAM from the spot market can earn profits by lending it to the buyers in the short selling market.

The RAM short selling market operates as follows:

1) The RAM buyers in the spot market lend the purchased RAM to the short selling market and earn the profit. This market price can be decided with the Bancor Algorithm, and for example, the transaction fee can be set at 0.5%.

2) The short selling buyer may short-sell the RAM borrowed from the short selling market to the spot market. This method can allow setting the rental period to ‘Continued’ as in the rental market suggested above.

This method can also consist of Spot Market + Short Selling Market + Rental Market (mentioned in the example above). In this case, we strongly recommend it because dApp developers can borrow RAM resources at low prices from the rental market.

However, we do not consider the futures market for RAM. This is because, if it becomes composed of spot market and futures market, the futures market can be linked to the spot market, which can disturb the spot market for speculation.

The figures above are just examples, and we hope discussions will take place on the community site. Transaction fees may be imposed in all markets.

5. Conclusion

We propose two ways to lower the price of RAM, which is the most valuable resource, to vitalize the dApp platform. This is that the RAM spot market operates together with 1) rental market and 2) short selling market. Therefore, it 1) allows dApp developers to purchase RAM resources at low prices from the rental market, while 2) the RAM spot market can achieve price stability thanks to the short selling market.

Note 1. Marketing Pricing Method: Bancor Algorithm

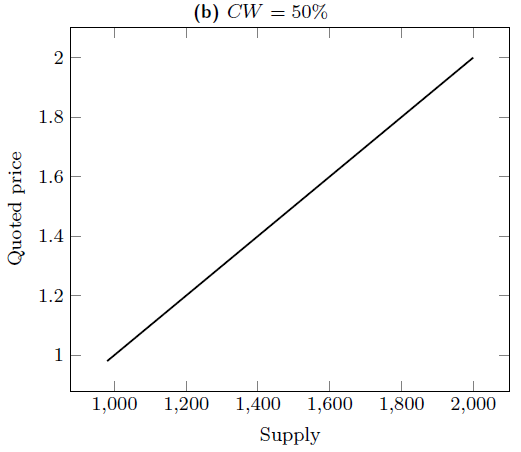

Figure 2 shows an example of pricing based on the Bancor Algorithm in rental market and short selling market. It shows the price for the supply when CW (connector weight) is 50%. As shown in Figure 2, the market price is determined linearly. For example, the market price can be determined by an annual interest rate of 5 to 10%.

Note 2. Self-motivated Infrastructure Growth (SIG)

We have already proposed a method of unlimited RAM supply model through the side chain (multi-chain) to resolve the issue of RAM squatting. We call it Self-motivated Infrastructure Growth (SIG).

Note 3. Application to Stake Method

As for the distribution of RAM resources on Dawn 4.0, the existing stake method has transformed into the current market method. The stake method also distributes RAM resources using the Bancor Algorithm. To be more specific, this method adjusts the price to acquire more RAM resources as more available RAM resources remain when the holder stakes the same number of EOS tokens.

In the current RAM spot market, the number of EOS tokens returned after selling varies depending on the market price. In contrast, the stake method gets back the same number of EOS tokens when re-selling after staking and acquiring RAM resources. This explains the difference between the two methods, but they both equally distribute RAM resources using the Bancor Algorithm. In other words, the fewer RAM resources available to sell, the smaller the size of the RAM purchased with the same EOS tokens.

We prefer the stake method, which can bring less interest from speculators to the other RAM distribution method, and hinder speculators from entering, thus preventing the rental market from overheating.

We are interested in distributing RAM resources in the stake method and can apply the rental market and short selling market mentioned above equally to the stake method. We have already written about it. Link

Note 4. Our new BP rewards Method with equipment rewards

We have proposed a new BP rewards method based on equipment rewards to resolve the issues with the current BP rewards model. It includes new equipment rewards part in the current BP rewards to ensure that standby BPs can maintain a similar level of infrastructure to active BPs. link

This article was translated by Plitto.