Crypto: Ethereum Classic (ETC) - A good purchase on the long run?

Ethereum Classic (ETC)

Ethereum is one of the most promising cryptocurrencies, but as a new or active crypto dealer, you may be stunned by its name sister, Ethereum Classic. In spite of the name, there is indeed a big difference between Ethereum and Ethereum Classic, and in the long run, Ethereum Classic can be a dark horse. I will explain the background for the exciting crypto with a recognizable name.

Ethereum Classic is a crypto and blockchain technology, based on the original Ethereum code. Ethereum Classic originated in 2016 after disagreement in the origin Ethereum team. The disagreement meant that Ethereum was divided into two, so today they have both Ethereum Classic (ETC) and Ethereum (ETH). Ethereum Classic is characterized by a small but dedicated developer team, which highlights the Ethereum Classic for its decentralized nature, handling smart contracts and the possibility of site chains.

Where can Ethereum Classic be bought?

After its birth, Ethereum Classic (ETC) was awarded to all who had owned the original Ethereum, and these users began trading the krypto currency between each other on various platforms. Today, Ethereum Classic is widely accepted in the crypto environment and can be traded in most places.

ETC can be bought at:

About Ethereum Classic (ETC)

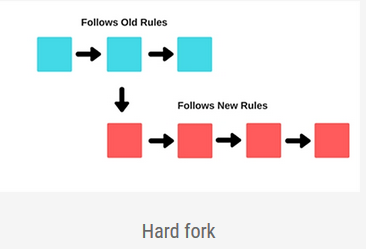

Ethereum Classic came to life in 2016 after disagreement in the environment behind Ethereum. This disagreement ended in a so-called hard fork. A hard fork is a splitting of an existing cryptocurrency into two new parts, after which these two subsequently function as two independent cryptocurrencies:

The majority of the environment retained the name Ethereum (ETH), and a small group was named Ethereum Classic (ETC), and these were now two different cryptocurrencies, which then ran on their own blockchain. The reason for the disagreement arose when Ethereum was exposed to a theft by hacker (s). After this attack, there was disagreement about how to react.

The big Ethereum theft and the history of DAO

In 2016, a fund was established by the people behind Ethereum. The fund was supposed to support start-ups that would base their businesses on Ethereum's blockchain. This fund was called DAO, and Ethereum investors were able to participate in it by buying DAO coins, thus obtaining co-determination of which projects were to be supported.

All of this was handled through Ethereum's "smart contracts", and the fund quickly became extremely popular. Thus, so many DAOs were bought that there was finally a pool of approx. 150 million USD, equivalent to 14% of all then Ethereum.

This pool would then start supporting the start-ups on the Ethereum blockchain, and all owned DAO coins could vote for and against the various companies proposed by the Ethereum Foundation (a powerful group behind Ethereum).

Before it came so far, however, an error was discovered in the way the pool was built and this error opened a back door for hacker attacks. Those who discovered the error published a report about the problem in the hope that the error would be corrected.

However, ethereal developers were too slow to address the problem, and hackers managed to get rid of one third of the pool's holdings, equivalent to $ 50 million - by exploiting only the error described in the report.

The case caused great frustration in the Ethereum environment. Not only had huge sums lost, but the image of Ethereum also caused great nuisance. Many prominent people had supported the new fund, and they now had to admit that the Ethereum team apparently did not control their code.

Therefore something had to be done; The majority of Ethereum people suggested a hard fork solution that would isolate the inventory that had been stolen so that the hackers could not use the funds. The group ended up choosing this solution, and the result became what is today known as Ethereum (ETH).

However, a smaller group was dissatisfied with that solution. They did not mean that the original code would be destroyed, and that the hard-fork solution was just an attempt to save the people who had supported the project (eg Ethereum Foundation). This smaller group of dissatisfied, therefore, chose not to take part in the new development, but instead moved on to the old Ethereum blockchain - this part is known today as Ethereum Classic (ETC).

Ethereum Classic's development after breaking with Ethereum (ETH)

Since Ethereum Classic originated after a disagreement in the Ethereum environment, many of its announcements are of course still related to why the ETC team believes it is better than Ethereum (ETH). Ethereum Classic (ETC) claims:

• Being a less decentralized version of Ethereum

• Being the version of Ethereum that is the most original

• Being the version of Ethereum that sets the code highest (ie with least human interference in the code) = code is allowed

However, Ethereum Classic today is its own blockchain platform and krypto currency, and as such has nothing to do with Ethereum anymore. Both coins still share many of the original ancient ethereal properties, such as to conduct smart contracts (contracts that sell at fixed points and can be created between two parties without the need of intermediaries), but since the wear and tear have both been completely different updates.

The Ethereum Classic has had its own development since it came to the world, and today it also has its own wallets (online punch for cryptocurrency storage), its own miners (helpers who make the system run, by keeping track of who owns what and what transfers are being made) as well as his own visions for the future.

The ETC team

As Ethereum Classic manages decentralization, the team behind has chosen to be relatively anonymous.

However, the team consists of a large number of skilled and experienced developers who actually have the ability to both keep Ethereum Classic running and also develop it in a new direction.

The names of the developers will probably not wake up the big reverberation in most ears, but they are solid developers, with great experience in blockchains.

For a closer look at the team behind, you can do it here: https://www.etcdevteam.com

The unpretentious team can mean that Ethereum Classic releases some of the inflated value that may occasionally occur in a crypto when prominent names are involved.

The difference between Ethereum Classic (ETC) andEthereum (ETH)

Ethereum (ETH) is currently more popular than Ethereum Classic (ETC). This has to do with the fact that Ethereum is better marketed, and that the primary inventor of Ethereum, Vitalik Butterin, and most other prominent names chose to join in what became the ETH solution in connection with hard fork as previously described.

Furthermore, Ethereum (ETH) has a better and more useful website than Ethereum Classic. This means that you can actually access Ethereum's website (https://www.ethereum.org) and, inter alia, Make a cryptocurrency relatively easily and quickly.

However, the Ethereum (ETH) network has become so popular that it is more easily overloaded and the transfer fees are therefore increasing. This can lead to developers and merchants starting to use the Ethereum Classic network instead of simply because this network is less overloaded.

Ethereum (ETH), though, plans to introduce a new technology called Plasma, which can significantly improve network performance, but if this does not happen soon, there may be a transfer of users from Ethereum (ETH) to Ethereum Classic ( ETC). In early March 2018, the Ethereum Classic Network also introduced a new digital coin called Callisto, which was given away to all ETC owners in the 1: 1 ratio. At the time of writing, it is difficult to say what meaning Callisto will have for the network.

Cap and miners

However, there are also other changes that have meant that Ethereum Classic now differs significantly from Ethereum (ETH). This includes cap, and how mines are rewarded for their efforts.

Ethereum Classic has chosen that miners can still "find coins" as thanks for their work - also called PoW (Proof of Work). However, the team has chosen that the last coins will come to the world in 2025 when stock globally hits 210 million.

In comparison, Ethereum (ETH) has no cap - ie, you do not know how many coins will be in the system. This means that there is a great danger of inflation.

However, for Ethereum's (ETH) advantage, the team plans to make it harder for the mines to gain a chance of finding new coins in the future (through a technique called a dirty bomb), while the team will instead make it easier To gain a profit simply by storing coins.

This way, through a reward system, you try to influence the mines from PoW (proof of work) to PoS (proof of stake).

In addition to the bastant and idealistic statements about "decentralization" and "originality", and the differences in the cap and reward system for mining, Ethereum Classic is also, on a technical level, really different from ETH.

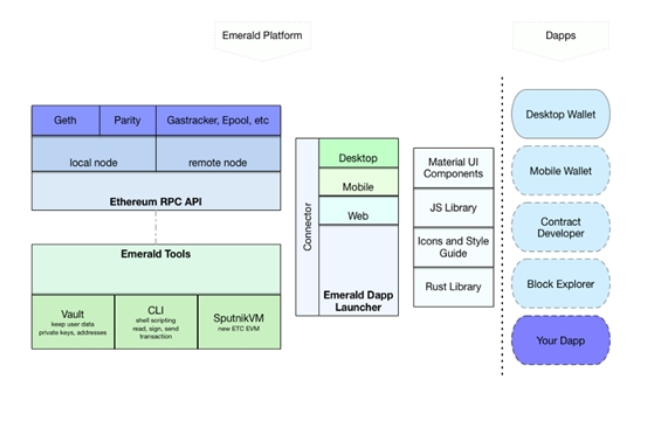

Emerald Platform

Ethereum Classic has recently launched a brand-new project called Emerald Platform, allowing its Ethereum Classic to be stored in Emerald Wallet, and building new Dapps (= apps on the blockchain) via Emerald Software Developer Kit (one can also build Dapps at Ethereum's (ETH ) platform, but Emerald Platform runs only on Ethereum Classic).

In addition, via the Geth client, you can run a full master code at Ethereum Classic, and help me (= help to register transfers) and get payment for that in Ethereum Classic coins.

Geth is a client who was dropped by Ethereum (ETH), but as Ethereum Classics developers have chosen to move on, and now instead have upgraded several times. The client generally helps keep the Ethereum Classic network running and it performs a number of essential features that allow people to interact with the network.

Sidechains

However, the probably most exciting difference between the two coins is that Ethereum Classic has added the opportunity to incorporate side chains when working with the crypto currency.

Sidechains is a really interesting new development in the krypto / blockchain world, where you try to establish channels between the individual blockchains. This will mean that, for example, will be able to drive his Bitcoin onto Ethereum's blockchain, and vice versa.

The development is interesting as the various blockchains have hitherto been running in closed circuits. However, the new side chains that can open up the networks can mean many more choices and collaboration opportunities. And on this point, Ethereum Classic is a good part of the development.

Conclusion

Ethereum Classic is still in the shadow of Ethereum, but on the long run there may be good opportunities in Ethereum Classic. This is because the team behind the digital coin is talented and active and has already implemented some interesting actions that separate the coin from its competitors. The hope is that Ethereum Classic can achieve stable growth because the product is slowly improving and now also associated with the new Callisto coin.

The team behind Ethereum Classic is unpretentious, and instead of bathing in the spotlight, they choose to work hard on their product. This approach can sometimes be missed with some of the other krypto currencies, and the discipline may make Ethereum Classic a good long-term investment.

My favorite exchanges

Binance Click here to register your account

KuCoin Click here to register your account