HitBTC selling Bancor Token (BNT) on IOU 😲😱 - Does this signal the beginning of the end?

Yesterday, June 18th, Bancor - the Ethereum Token protocol project that recently raised an unprecedented amount of money in their ICO - published on their blog that they are going to delay activating their Bancor Token (BNT) Smart Contract for a couple of days.

we are going to take a few more days to ensure the stability of the Bancor protocol smart contract, which activates the BNT smart token. BNT will then be exchangeable for ETH and vice versa

Bancor

On one hand, it's good that they have identified that they are not ready to go live - only though caution can we hopefully prevent another DAO incident. On the other hand, how can we have gotten into a situation where a company raises ~$150m (giving itself an effective valuation of ~$300m) when they aren't even in a position to launch their token... I digress.

So, Bancor have chosen not to activate their token; the concept, of activating a cryptocurrency, might seem a bit strange unless you're familiar with Smart Contracts and how Tokens work, but if you think of a Token contract as a glorified Excel spreadsheet with rows for each address and a column to store the amount of tokens that an address has then you'll be fine. Having some sort of governance mechanism to put the token Smart Contract in a paused state helps to prevent a bad situation spiralling out of control is a reasonable idea while the technology is still in its infancy - the equivalent of temporarily adding a password to the spreadsheet that means that only some administrators can edit it. Doing this means that you can stop any further activity on the contract, patch up a bug and port all of the old balances to the new contract - it is a much better idea than having to have another, messy emergency Hard Fork.

Way before the global financial crisis, many clever people in the banking sector came up with some brilliant ideas for creating new and inventive financial instruments for people to invest in:

- Derivatives - "A derivative is a security with a price that is dependent upon or derived from one or more underlying assets". Not a physical asset like an Equity e.g. Apple's Stock; a stake in the company - but instead a synthetic instrument, that behaves like the stock you like, but doesn't actually give you the benefit of owning the Stock.

- CFD - "A contract for differences (CFD) is an arrangement made in a futures contract whereby differences in settlement are made through cash payments, rather than by the delivery of physical goods or securities". A CFD allows traders not to have to worry about the potentially messy and difficult business of a finalising a commodities contract e.g. buying and selling lorries full of wheat by just trading a synthetic financial instrument that represents that commodity. No wheat ever changes hands, but one trader losses on the trade and the other makes money.

Now, after years of people selling other people mortgages that they couldn't afford, other people creating new financial instruments that represented those mortgages without having to deal with the actual mortgages themselves - creating a new financial instrument that just represented it, and traders trading these financial instruments; the house of cards eventually collapsed.

High mortgage approval rates led to a large pool of homebuyers, which drove up housing prices. This appreciation in value led large numbers of homeowners (subprime or not) to borrow against their homes as an apparent windfall... high delinquency rates led to a rapid devaluation of financial instruments (mortgage-backed securities including bundled loan portfolios, derivatives and Credit Default Swaps).

wikipedia

The problem with creating and trading financial instruments that only represents an underlying asset - but you don't actually have ownership of that asset - is that it removes transparency from the financial market and ultimately makes it less efficient. With this lack of transparency comes the problem of it being harder to asses your exposure and the risk that you are taking.

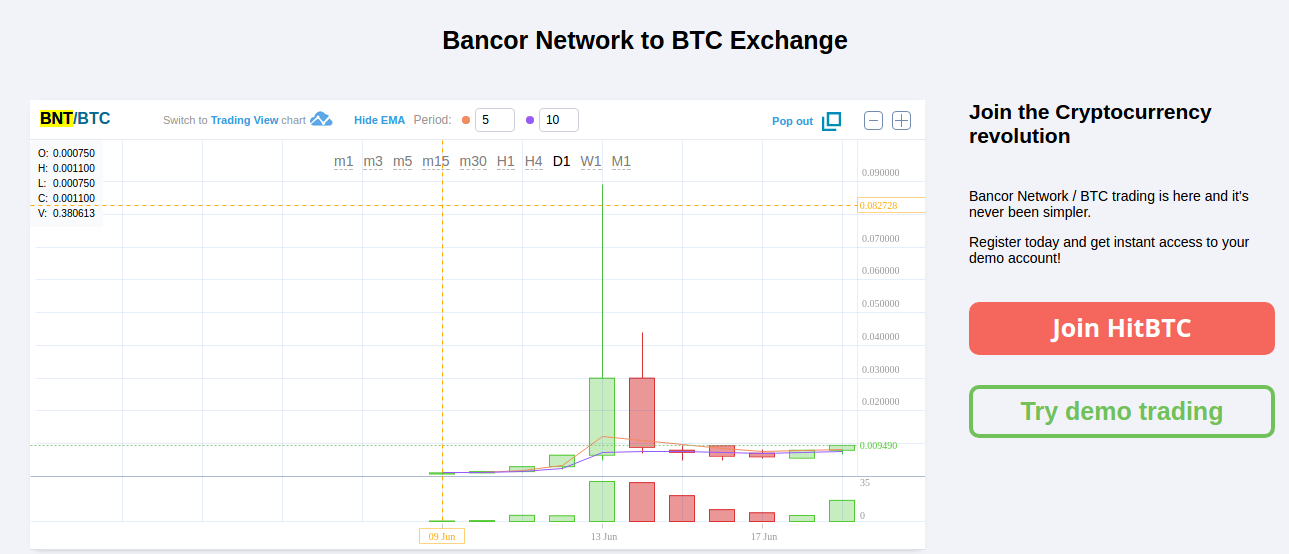

Despite Bancor having not actually made their Token active yet it would seem that the exchange HitBTC are actually up and running allowing trading of the pair BNT/BTC. I've seen people on Reddit describe what HitBTC are doing this as an IOU, but I don't think that, that is completely accurate.

When you transfer your tokens to an exchange, you are effectively given an IOU by the exchange - after all, you don't own the private key for the address that the cryptocurrencies are stored in and as the axiom goes "if you don't own the private key, you don't own the coin". The difference here is that the coins, or Tokens, do exist but you're letting the exchange act on your behalf.

What HitBTC have effectively done is created a synthetic instrument - like a Derivative - around the BNT token... until the Bancor Token goes live.

I have a problem with this for a couple of reasons

- This synthetic BNT token that HitBTC has created has essentially thrown out the benefits of a cryptocurrency - there will exist two ledgers of BNT tokens for a short while; one that HitBTC owns and the actual ledger on the Ethereum blockchain; that will need to be reconciled. This process of reconciliation requires dealing with the issue of trust; the whole point in using a blockchain in the first place.

- If HitBTC has a catastrophic failure, then their records about who bought what IOUs could be completely lost.

- HitBTC could, in theory, sell more than the total amount of tokens.

- We're setting a bad precedent that owning the actual underlying cryptocurrency doesn't matter - just making a profit does.

- We're on the road to repeating the same mistakes of the past.

I believe that cryptocurrencies, and Blockchain Technologies, have the ability to make a huge, global difference, but if we set the precedent that trading these cryptocurrencies (and making a quick profit) is more important than their fundamental principals then we've missed the point; we're opening a door for them to be heavily regulated and we're letting a few people tarnish the name of cryptocurrencies again.

first image original source, modified by @avarice : CC0

forth image original source, modified by @avarice : CC0

Recent posts

- What3Words Contest - 75 SBD prize pool giveaway

- Interactive gaming on Steemit

- Emoji poetry

- Beer saturday

Very good blog. I was about to post a similair thread. Sell the coins that you know nothing about. Do proper research on any coin you buy. If the market falls at least you can hold your coins knowing they have a long term future. This is quite an interesting website I found: https://www.coincheckup.com Supposingly they researched every crypto coin in the scene based on: the team, the product, advisors, community, the business and the business model. They even score the coins stengths. Go to: https://www.coincheckup.com/coins/Bancor#analysis For a complete Bancor Investment research report.