Collectors in China: Art Lover and Tricky Investor

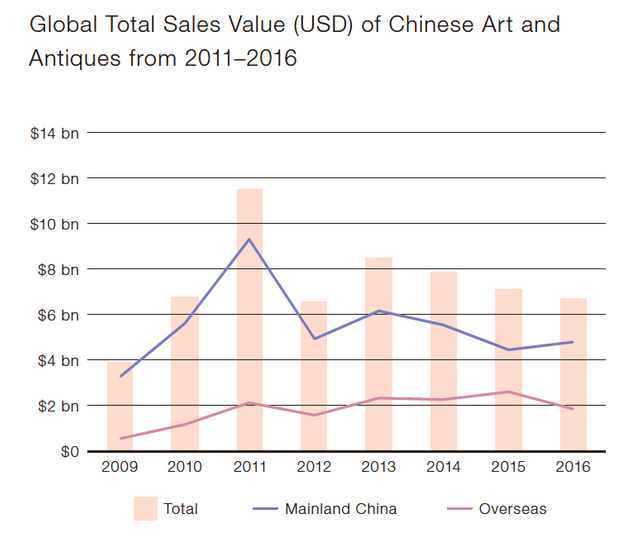

The art market in China is booming in recent decades. More and more collectors spring up with huge wealth and hurl their money into art market. According to the Global Chinese Art Auction Market Report 2016, the total sale value peak at $11.5 billion (77.5 billion yuan) in 2011 because of the Chinese government’s quantitative easing on art market investment. Even though the number declines for recent few years, the total sales value of Chinese art and antiques in Mainland China and overseas accounted for 37% of the total global art auction sales.

Data resources from Global Chinese Art Auction Market Report 2016

http://www.cn.artnet.com/en/assets/pdfs/global_chinese_art_auction_market_report_2016_en.pdf

We have all seen the news of artworks which break the price record again, astonished by the seemingly simple artwork and the incredibly high price. So what are the main factors that render art prices rise? Normally the reasons go to inflation, the status change of artist or perceived value increase of art works in marketplace. In another word, it is reasonable to see valuable artworks’ price going up in a stable time. However, the emergences of unreasonable high price in auction reveal the unusual circumstances behind the market trade.

Due to the secrecy of sellers to buyers and even auction house, artwork trade can be an ideal way for money laundering. Because of the subjectivity of valuation, the value of artworks is evaluated by experts and art agents, which means that a valueless stone can be puffed to millions of dollars as long as it’s certified by those experts. By buying back the items they sell and lose some commission charge to auction house, people launder their illegal money to legal, plus adding value to the artworks. But more and more people choose not to pay after bidding their own item. One of the proper aims for seller is the price certificate of the item, which they can certify the value of the item and get considerable loan from banks. From the report, the non-payment is a chronic problem in mainland China market. The payment rate is only 51% in 2016, drop from 58% in 2015. The Panama Papers leaked in 2016 reveals the secrets of offshore shell companies behind the anonymity, which are used to conceal the ownership of art. The leak of paper compel some auction institutes to strengthen the policy. Christie’s now requires agents of sellers to tell the owner’s names.

Chenghua Chicken Cup (Ming Dynasty, ca 1447-1487 AD), which was bought by a Chinese businessman Liu Yiqian for $36 million at Sotheby's Hong Kong in April 2015.

Photo from https://ferrebeekeeper.wordpress.com/2014/04/08/the-chenghua-chicken-cup/

Liu Yiqian sipped tea out of the Chicken Cup after getting it. Photo courtesy from Sotheby's.

In recent decades, the prevalence of Chinese art collectors tends to be younger. Art collection has become a trend among Chinese second-generation rich kids, who own wealth and well-educated background. Different from older generation Chinese collectors who are lack of knowledge of art and mostly depend on art brokers to search for investing targets, those young investors have passion to arts. Also other than bid for famous artworks with high price, they’re more willing to travel around the world to learn art appreciation and searching for undervalued artworks and less well-known blue chips. This tendency in some extent could diversify the breeds of artworks in Chinese art market, and also amplify the influence of Chinese collectors not only by price records, but their aesthetics and understanding to the art.

Reference:

http://www.bbc.com/capital/story/20160527-children-of-the-chinese-super-rich-arent-all-burning-money

https://makingamark.blogspot.com/2017/04/why-art-prices-rise.html

100% of the SBD rewards from this #explore1918 post will support the Philadelphia History Initiative @phillyhistory. This crypto-experiment conducted by graduate courses at Temple University's Center for Public History and MLA Program, is exploring history and empowering education. Click here to learn more.

Interesting story. I see that the clarity of the money laundering issue, especially as described by The New York Times, is controversial. More here.