If your broke then you should be investing!

That’s right you can still invest while broke!

It might sound like a contradiction but it is actually very possible and in your best interest. I mean if you're broke then you likely need a source of income for the future so why not make some investments? There are multiple ways you could easily turn the equivalent of a few beers or smoothies into a future investment that will help you grow financially. Some of you may be worried about the possibilities of market crashes and events like the 2008 recession but trust me your worries are overblown (I'll prove it to you).

Let’s clear some things up first

So right now you’re probably sitting there thinking how the heck can i invest when im so damn broke?! Well the bottom line is you’re broke partially because of your personal behaviors and habits. It’s time you took the initiative and changed those harmful paradigms. The most harmful paradigm broke people have is that they don’t have enough spare funds to invest in things like stocks. That simply isn’t true unless you have $0 you have something that can be invested. With the advancements if financial technologies it has become very easy to start investing with as little as $1. There are even platforms that allow you to buy portions of stocks so your change can go a long way. Don’t quit before you have even gotten started, confidence is a key skill for seeking financial freedom.

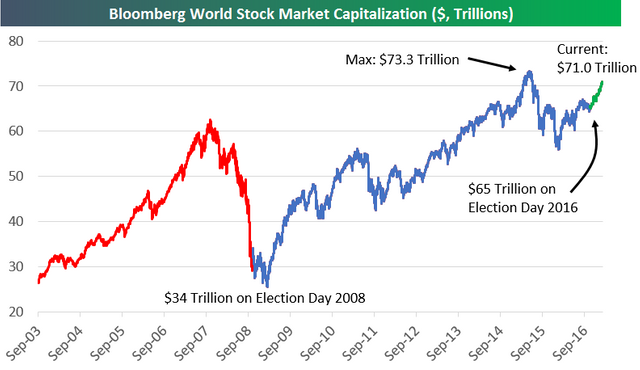

The other thing most broke people worry about when they kink of investing is “what if there is a market crash?!” Well buddy I’m here to tell you that every market crash has always turned around and ended in gains. In the past 10 years since the deepest point of the USA’s recession the market has gained over $30 Trillion USD and is having one of the best decades EVER! The first thing you should understand about economics is that they are like sine waves that go through peaks and troughs on an ever growing trajectory. In the past 30 years stocks have had their ups and downs but as an investor if you invest in value stocks then overall your returns will be positive. Remember Investing is often a long game, when you buy a stock you should plan to hold it for at least a year preferably longer. It is also smart to set milestones for profit taking to you can have a good source of income.

Start doing research

Before making any investments it is a good idea to do at least a few hours of reading on investopedia to get the hang of the basics. I also suggest you do some research on the companies that you use in your daily life chances are they present good buys for investing. While you are doing your research you should look into the market Indicies which provide important information on market and can be invested in as well. At this point you should already be feeling confident that you can invest without breaking the bank.

start investing

After you have done a couple of days worth of research it’s time to start looking into some of the platforms that will allow you to buy stocks. For the broke investor there are two main options that would make the most sense to use. At this point it is best to invest using methods that allow you to use amounts as small as 0.10 cents and grow them over a long period. With that being said my first recommendation is the application [Acorns] (https://acorns.com/invite/H3C985).

Acorns is a micro investing app that helps people on even a shoestring budget to save and invest that money into the market. The services provided by Acorns is constantly growing with them now offering IRA accounts alongside their regular investment portfolios. Their main draw is the fact that it allows users to seamlessly invest small amounts by rounding up purchases that you approve. So if you buy a soda for $1.75 it will round up to $2 if you approve the app to do so. Acorns also offers it own debit card that can be used at any retailer and cand spend funds from your Acorns account. The cost of acorns is only $1 but it is only charged after you have invested more than that, it is recommended to start your account with $5. If you sign up at this link you will receive $5 extra after you invest $5 of your own! Acorns is great but it does not give you control of the specific stocks that you are investing in.

If you want a bit more control of the stocks and other financial instruments you choose then The Stash APP is a better choice than Acorns. For those with light pockets stash is a great tool for you to invest into some of the biggest names across the stock market. Just like Acorns the Stash app is a micro-investing app that allows you to invest your pocket change into the stock market. Stash also offers a separate retirement account that can be funded with excess funds if you choose. With stash you will be able to learn about the market and investing in general since they provide an ample amount of material via newsletter and on their site. For the broke investor Stash allows you to invest as little as $0.10 into giants like Apple and Amazon making it the most convenient stock trading app available. Like Acorns stash is also $1 a month but it is only charged from you account and not your bank/ debit card. If you are looking for a new bank account Stash offers banking services that supplement their investment products.

Being broke is a mindstate

I hope reading this article has opened your mind to the opportunities that you have been depriving yourself of. It is important you realize that your financial freedom is in your hands and I can only tell you things that an help. You must make the effort to invest and grow your personal worth. Some people get lucky and strike it rich off of some fortunate circumstance but you can make your fortune by choosing to invest your otherwise wasted money into something you believe in. take the tools that have been created and use them to your advantage, It is only your fears that stand between you and growth. Don’t bullshit yourself and not start investing, it is a decision that will come back to haunt you.

Posted from my blog with SteemPress : https://habarinetwork.com/if-your-broke-then-you-should-be-investing/

Acorns looks and sounds like such an amazing app.

I have checked now and then, but I cant download in my country, which sucks x)

I am not broke and I have invested xD But I would still love to use Acorns :D

Nice post and yes broke is a mindstate I totally agree with you on that :D

You got 79.30% upvote from Yensesa. Thank you for your continues support of Yensesa Exchange and being a member of Yensesa Residual Income