What does it mean to trade Global Macro and how does that relate to Machine Learning

A short post today, June 19th, given the recent movements in FX after some trade tensions from Trump & China. In my earlier days trading I used to gravitate to charts or balance sheets or cashflow statements, depending on what I was investing in. As my experience has grown, I have not forgotten how to dig into a topic, but instead like to frame most of my investments as a mosaic, incorporating a little bit of X, Y and Z. Of course each investment has their own factors that need to be taken account of and that's the secret sauce. Knowing what matters and what doesn't. Even more so in today's information overloaded world.

With that introduction I'd like to give a brief overview of what many people call 'global macro' investing or trading. For some, global macro is a catch all term that means you can and do invest in just about anything that is liquid. Global equity indexes, interest rate derivatives in G10 currencies, FX and some commodities are the usual suspects. But while its easy to go down the rabbit hole and try to understand each asset class, the classic global macro investor tries to look at the big picture, see what asset classes should do well/poorly and then look for trades.

For example, today we have some trade tensions. The market is expressing its concern via FX mostly, with emerging market currencies down quite significantly in the past 3 months (you pick, Brazil, Argentina, Russia, South Africa, Indonesia) along with Australia and Canada, currencies that tend to trade with a high beta, or correlation, to global trade and more importantly global trade sentiment.

So how does a global macro investor, given thier world view, evaluate an investment or trade. Well today they often rely upon quantitative statistics to give a rough idea if the security/instrument they are buying is over or undervalued. They might not be a fundamental expert, but they try to capture the main elements. X, Y, Z. Sticking with the current example, lets take a look at a few Emerging Market currencies, the Brazilian Real, Turkish Lira, Russian Ruble, along with Canada and Australia Dollar in the next series of posts.

For FX, the most important drivers tend to be interest rate differentials (often short term but not always), current account balances and monetary policy direction.

In the chart below, I show the price of the South African Rand (ZAR) in Yellow vs the Yield on the 5 year government of South Africa bond. Notice the tight correlation. Often the ZAR will lead at major levels its good to know where rates are.

Notice that currently rates have blown out, back to levels in mid 2016 (they hit 9.5% in 2016) so in my opnion either something is very wrong with South Africa today or markets are getting ahead of themselves. Remember bond guys are usually the smartest in the room, so pay attention to interest rates.

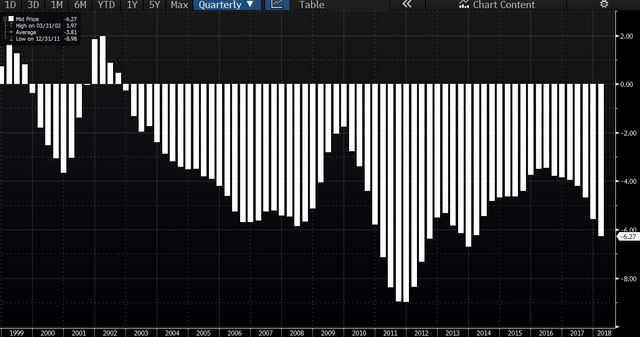

In the next chart, we take a look at another important variable, the current account balance of Turkey. As you can see they have consistently run a large current account defect, which means they are vulnerable to outside funding conditions. Large current account deficit countries are often the first and hardest hit when trade worries suffer and or dollar funding conditions tighten, both of which are occurring now.

The last currency we are going to discuss today is the Russian Ruble. As we all know, Russia is not afraid to get involved politically in international affairs and financial markets often have a love/hate relationship with the grizzly bear. Any easy way to get a feel for what markets see as political risk can be to take a look at the 5 Year CDS on Russian bonds.

In the chart below we see the CDS in white vs the Ruble in Orange. In 2014-2015 with the Ukraine/Crimea sage, financial markets got very worries and thus pushed Russian CDS spreads up very high (along with falling oil prices) but since then, the CDS price has come down until just about a few months ago when it started creeping back up

Putting it all togeather

The skilled macro investor understands what variables to look at, but more importantly they understand what variables matter today. Machine learning models are very good at determining what variables effected outcomes in the past, but since markets are dynamic, the real skill is not figuring what worked before but understanding the narrative today in order to make decisions on what factors will influence tomorrow's prices.