BEST CURRENCY PAIRS TO TRADE IN 2020

What is Currency Trading?

Forex currency trading involves buying and selling currency pairs to take long and short positions in the market to generate profits from currency pair price movements. Knowing which are the best currency pairs to trade requires an understanding of what forex currency trading is, and what currency pairs are.

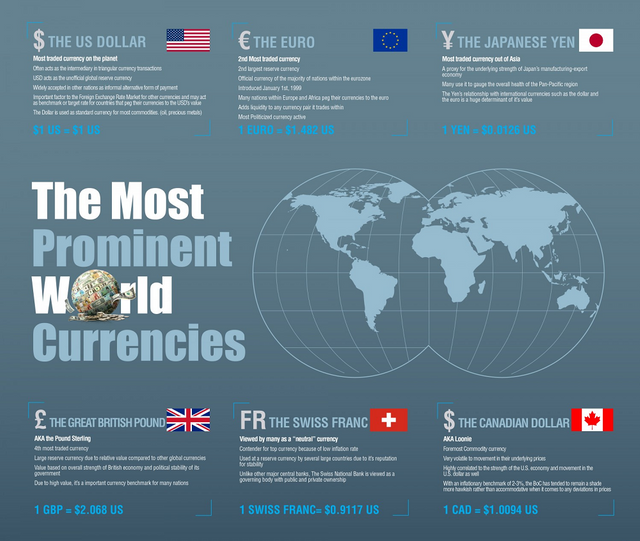

As of 2019, there are 195 countries in the world from which there are 180 official national currencies circulating. Couple that with the fact that cross border commerce/trade amongst the world’s nations is constantly increasing, and consumers all over the world are now able to make small scale online purchases for goods and services from providers in virtually any foreign country, the need for the efficient exchange of different currencies to facilitate international commerce at all different levels becomes inevitable. Whether it’s a nation’s central bank fulfilling the needs of its currency reserves, a large multi-national corporation making large cross border transactions in the course of conducting business, large financial institutions servicing their large international clients, forex traders/speculators taking positions on certain currencies, or even something as simple as a tourist taking a weekend holiday to a neighboring country, all of these activities result in the exchange of one currency for another, hence the need for the Foreign Exchange Market.

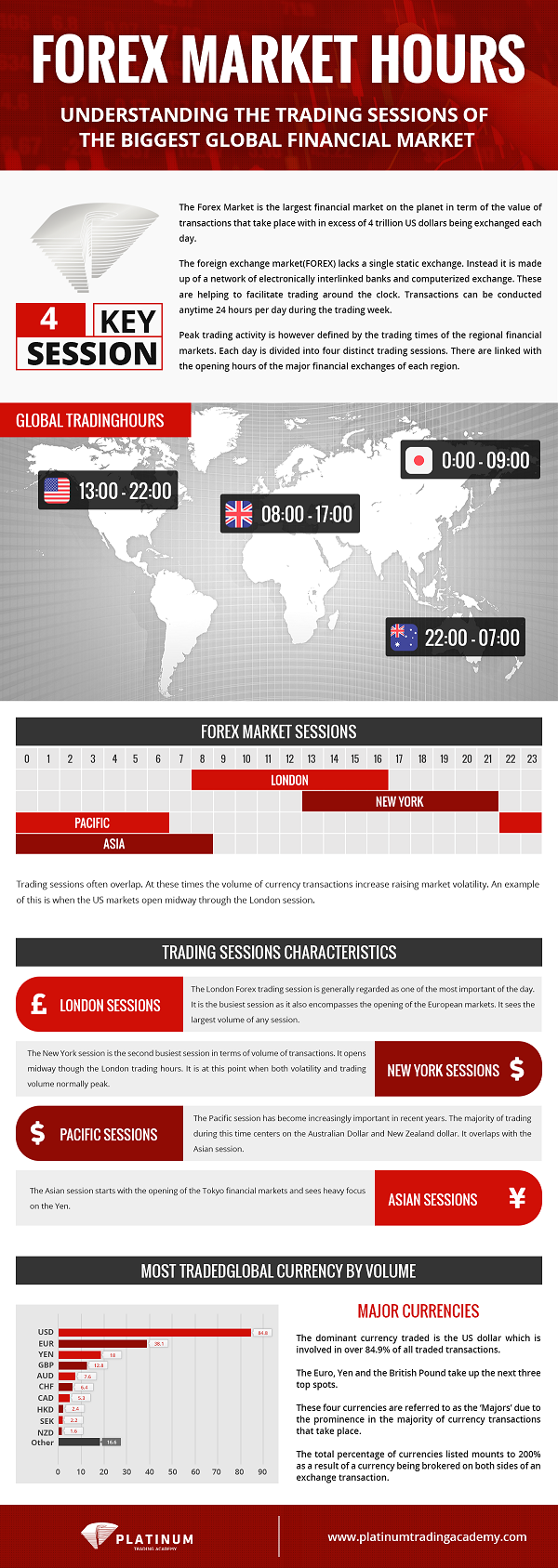

The Forex Market is the efficient exchange for forex currency trading of one nation’s official currency for another nation’s official currency at a market rate that is free-floating and establish by competitive market forces. The Forex Market is not a centralized institution, comparable to what the New York Stock Exchange (NYSE) and the NASDAQ are to the stock market. The Forex Market consists of a vast decentralized network of broker/dealers that buy from, or sell to market participants, all the currencies of all the different nations of the world. Today, the average daily turnover in the forex market is over $5 trillion per day, making it the largest and most liquid market in the world.

Currency Pairs

In the forex market, quoted prices reflect the rate at which one currency is exchanged for another. Each individual currency is identified with a three-letter symbol known as an ISO code (International Organization for Standardization), i.e. USD for US Dollar, EUR for euro dollar, GBP for the British pound, etc. Forex quote symbols for currency pairs are listed by pairing together the symbols of the two currencies being exchanged. For example, the EURUSD represents the currency pair that includes the Euro Dollar against the US Dollar. The GBPJPY represents the British pound against the Japanese Yen. The order in which the symbols list is of key significance in a forex quote. The first of the two symbols is referred to as the base currency, while the second is referred to as the quote currency. The amount quoted indicates how much of the quote currency is required to purchase one unit of the base currency. For example, a EURUSD currency pair quoted as 1.0812 indicates that it takes 1.0812 US Dollars to acquire 1 Euro Dollar. This rate will fluctuate to reflect changes in the supply and demand of the two currencies in the pair. Some of the best currency pairs to trade are the pairs with the most volatile price fluctuations.

Currency Pairs Price Movements

The price of a currency pair increases and /or decreases based on the value of one currency in terms of the other in the pair. Currencies appreciate of depreciate against each other for various reasons, including the government policy, interest rates, trade deficits, and business cycles. It’s very important to understand that currency price movements cannot be viewed in the same way as price movements of other types of assets.

Using stock as an example, it represents ownership in a corporation which conducts business operations to foster constant growth and appreciation in the value of the corporation. Therefore, the price of a stock should consistently increase. Similarly, currency represents the economy of a country. The pairing of two currencies to form a rate, in essence, represents the value of the two economies relative to each other. Consequently, the underlying economic factors of the representative countries will have an effect on the currency rate of exchange. An economy experiencing growth will result in a currency appreciating, and the exchange rate will adjust accordingly depending on how the rate is quoted. The country with the weakening economy will experience currency depreciation, which will also have an effect on the exchange rate.

The important distinction between a stock and a currency is that for a stock, perpetual value appreciation is expected. On the other hand, for a currency rate, too much appreciation can have a negative impact on the underlying economy of one of the countries quoted in the rate. For example, for a country with an appreciating currency, imports become cheaper, which translates to a benefit of lower prices, leading to lower overall inflation. However, that same currency appreciation makes export more expensive to foreign buyers, and ultimately curtails demand for the country’s products. This eventually leads to a reduction in GDP, which is definitely not a benefit. Consequently, the fluctuations in currency rates ultimately reflect the economic and business cycles relative to the underlying economies of each of the countries in the currency pair and are driven by market forces. Many of the best currency pairs to trade are the pairs with the currencies of countries with the most stable and robust economies.

LEARN OUR END OF DAY CURRENCY TRADING STRATEGY TODAY!

Trading Currency Pairs

When trading a forex currency pair, traders trade the pair as a single instrument and the rate of exchange for the two currencies in the pair is the price that traders focus on to generate profit from market fluctuations. These rates (more often referred to as prices by traders) will fluctuate much the same way as stock prices do base on market volatility. Traders are able to profit from these price movements by taking a long or short position using various financial derivative instruments. Additionally, the forex market trades 24-hours a day, 5-days per week allowing for a greater range of daily price movement resulting in more trading opportunities.

Within the forex market exist the spot market. The spot market is the most popular forex market used for speculative forex trading. Itis a standardized market in which forex pairs can be bought and sold using standardized spot contracts of 100,000 units of the base currency referred to as lots. Forex lots can be bought and sold very similarly to how stocks are bought and sold in the stock market. The value of a standard lot is determined by the quoted rate multiplied by 100,000. However, the amount of capital necessary to buy or sell a lot to assume a long or short position is determined by the margin requirements of the broker that is used. These requirements vary widely from broker to broker. Standard lots can also be broken down to smaller contract denomination. A mini-lot is 10,000 units, and a micro-lot is 1000 units of the base currency. Using smaller lot sizes allows forex traders to trade with smaller capital requirements and helps to better manage risk.

Best Currency Pairs to Trade

Price volatility, volume, wide intraday price range, and tight spreads are key elements required in order for a trader to successfully generate profits from forex currency trading. The best currency pairs to trade in the forex market are those that possess an abundance of these key elements. Currency pairs vary with respect to their trading attributes.

Watch this video: What are the most traded currency pairs? (03mins 32secs)

All 180 official currencies are paired with each other to form a currency pair for the purpose of completing cross-border financial transactions. But not all pairs are suitable for trading. Currency pairs that are associated with theUS Dollar and are the most widely used currencies are categorized as major currencies. These include the GBPUSD, EURUSD, USDCHF, USDJPY, AUDUSD, and USDCAD. These are by far the best currency pairs to trade in the forex market. They are the most liquid, and therefore have the tightest spreads. They are all paired with the benchmark US Dollar, so they exhibit a wide daily price range and volatility. These are all attributes that traders desire in a tradable asset. The major currency pairs account for a significant portion of the daily trading volume in the forex market.

Currency pairs referred to as “crosses” or “minor currencies” are not considered by many traders to be the absolute best currency pairs to trade, but some nonetheless are worthy of trading. Many of the pairs that fall into this category, including the GBP/JPY, EUR/GBP, EUR/CHF, etc.have sufficient volume, range, and volatility to allow for generating profits, they just have to be traded using different strategies than those used to trade the major currencies.

Successful forex currency trading ultimately relies on entering positions that capture price movements resulting from inefficiencies in the supply and demand of a currency. The currency pairs that consistently exhibit these price movements are the best currency pairs to trade. The major currencies can always be relied upon to provide such price volatility on a daily basis.

LEARN OUR END OF DAY CURRENCY TRADING STRATEGY TODAY!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.