HOW TO TRADE FOREX ? - CURRENCY TRADING 101

The forex market is the largest financial market in the world. This blog will discuss how to trade forex successfully and how to build a strong forex trading strategy. Before we delve into how to trade forex, let’s start with a brief review of forex trading.

What is Forex Trading?

Forex trading involves the trading of one currency against the other. Similar to other financial markets, the goal in any forex trade is to make a profit. The forex market is the largest trading market in the world, boasting a daily volume of approximately $6.6 trillion. The global forex market completely dwarfs the world’s equity markets, which trade around $200 billion each day. In the stock market, a trader will buy and sell the stock of a particular company, such as Amazon or Facebook. However, in the forex market, traders buy and sell currency pairs; a single currency cannot be traded ‘by itself’. Examples of a currency pair are EUR/USD (Euro Dollar), GBP/USD (Pound Dollar) or USD/JPY (Dollar Yen).

Like the stock market, the forex market is constantly fluctuating. However, since the actual movement of currencies is usually very small, most pairs are quoted to the fourth decimal place, which is called a pip. In forex trading, the basic unit of measure is a pip.

Watch this video: Learn To Trade(02mins 15secs)

Forex Trading Steps

How to trade with forex? Let’s look at some simple but important steps, which will help us learn how to trade forex successfully.

1) Choose a currency pair

As we discussed above, when trading forex, you always trade currencies in a pair. There are dozen of currencies that you can trade, but if you looking for how to trade forex for beginners, we suggest that you select one of the major currency pairs, such as EUR/USD.

2) Research and Analysis

In order to learn how to trade profitably, you will need to become familiar with the forex market, which is dynamic and challenging. It is important to thoroughly research the currency pair that you have selected to trade. The two most popular methods of analysis for forex trading are fundamental analysis and technical analysis, which are beyond the scope of this article. Take some time to review these two methods. You can then use one or both of them as part of your trading strategy for how to trade forex.

3) Reading the Forex Quote

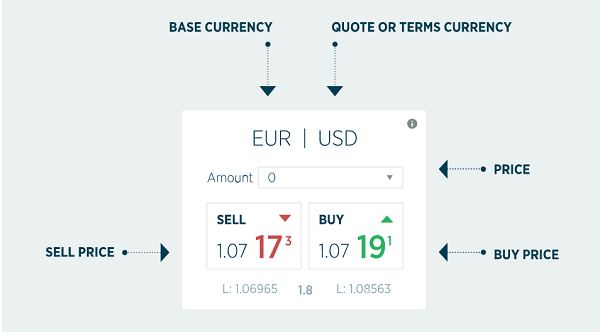

In order to make a forex trade, we need a market quote (price). In the case of forex, there are two prices – the buy price and the sell price.

Let’s use the quote below, which is EUR/USD:

Source: Forex.com

The sell price (1.0717) is the price at which you can sell EUR/USD. This means that 1 Euro is selling for US$1.0717 (we can ignore the fifth decimal for now). The buy price (1.0719) is the price at which you can buy EUR/USD. This means that in order to buy 1 Euro, you would have to pay US1.0719. The difference in the buy and sell price is called the spread, which is the amount that the forex dealer charges for making the trade.

4) Choose Your Trading Position

The next step in how to trade forex is taking a position on a currency pair. This means that you are speculating that one currency will go up, while at the same time the other currency goes down. In our example above, you can enter a buy position or a sell position:

Buy position– you purchase EUR/USD at 1.0719, believing that the pair will move higher. Later in the day, the pair is trading at 1.0749. The pair has moved higher, so if you now sell, you will have made a profit of 30 pips. If the pair dropped to 1.0700 and you decide to close your position, you would have a loss of 19 pips on the trade.

Sell position– If you feel that EUR/USD will drop, you would enter a sell position, at 1.0717. If your hunch was correct and the pair dropped to 1.0703, you could then close your position and make a profit of 14 pips. If the pair went up to 1.0725 and you decide to close your position, you would have a loss of 8 pips on the sale. It is the constant movement in the forex market which allows traders to make a profit. Of course, it is you the trader who decides how long to hold onto a position. Inevitably, there will be ups-and-downs when trading; however, developing a trading strategy and being disciplined will make you more successful in your journey of how to trade forex.

Why Trade Forex?

Let’s take a look at some of the benefits that come along with trading forex:

Lifelong Skill

Forex trading is a skill that can be developed, mastered and put to good use. In order to become a successful forex trader, you must be willing to educate yourself, work hard and adhere to certain guidelines, which we call a trading strategy. Trading will inevitably have its ups-and-downs, but as you develop your trading techniques, you are learning an important skill that will last you a lifetime. As a trader, you will develop attributes such as patience, mental toughness and adaptability. These traits are certainly beneficial in all aspects of life.Time vs. Money

Every day, each of us has to deal with the issue of time vs. money. Time is a finite resource, so when you are paid for your job, you are trading (no pun intended) time for money. The income that you are earning is limited by the number of yours that you work. As a trader, however, your profit on a single trade could be as much as your income from hours of work! Thus, forex trading enables you to increase your money at a much faster rate than if you were working. Trading has its risks of course, but as you develop a successful trading strategy, you will increase your earning potential.Extra Source of Income

It is no secret that many workers don’t like their jobs, and it’s certainly a blessing if you wake up with a smile as you think about the workday. Even if you do enjoy work, it’s always a good thing if you can develop an additional source of income. Don’t expect to get rich off forex and quit your day job, even if you pass a forex course with flying colours. At the same time, if you become successful at forex trading, you will have developed an additional source of income and become more financially independent.

Leverage

We mentioned earlier that currencies usually move in very small increments. So how can a trader make a profit on such small moves? The answer is through the use of leverage, which allows a trader to hold large positions, without the need to put down large amounts of capital.

Let’s take a look at how we can use leverage, this time trading GBP/USD:

Suppose GBP/USD is trading at 1.2900. If you purchase 100,000 British pounds, this has cost you $129,000. If later in the day GBP/USD rose to 1.2950, GBP/USD has increased by 50 pips – if you decide to sell your pounds, you will receive $129,500, which leaves you with a profit of $500 (129,500 – 129,000).

The profit sounds great, you say to yourself, but the last time I looked, I didn’t have a spare $129,000! Well, not to worry. When you purchase 100,000 British pounds with U.S. dollars in the above example, you aren’t expected to literally put down $129,000 into your trading account. Through the use of leverage, a trader can open a position which is much larger than the amount of capital which she needs to put down. If a broker is providing you with 100:1 leverage, for example, this means that you can control a position of 100,000 pounds with only 1,000 pounds in capital. While leverage allows a trader to control very large positions, keep in mind that leverage carries with it significant risk, so it is essential to always “handle leverage with care”. A key component of how to trade forex is making use of leverage in a responsible and disciplined manner.

How to Build a Strong Forex Trading Strategy?

In order to learn how to trade forex market with success, you will need to develop and follow a trading strategy. As you may have already guessed, there is no “one-size-fits-all, perfect trading method. Each trader has their own temperament, risk tolerance and understanding of the forex market. Similarly, every trader has to develop a strategy that fits their needs and goals – it is likely that you will need to make changes to your strategy, as you learn more about the markets and gain experience as a trader.

At the same time, you don’t have to create a trading strategy from scratch. Let’s look at some ideas that you can incorporate into a winning system for how to trade forex:

Time Frame– Your first step in designing your trading strategy is to determine what type of trader you want to be. Are you interested in day trading, or do you want to hold onto a position for days or even weeks at a time? Once you’ve established your time frame, you can then learn which trading signals are relevant to your trades and use them as part of your trading system.

Indicators– It is important to become very familiar with forex indicators. These indicators are your signal to forecast price changes in the market. There are many indicators out there (some can even be contradictory).You will want to choose a few and incorporate them into your trading strategy.

Define Your Risk Tolerance- Any trader will tell you that “you win some and lose some”. Of course we like to think that a trade we make will be a winner, but it is always prudent to keep in mind the potential loss of a trade. Risking all of your capital on one trade is never a good idea. Risk tolerance will vary from trader to trader, so you will need to define how much risk you can live with. An old rule of thumb for how to trade forex is that if you are losing sleep over a trade that you made, then it was too risky a move.

Define Entries and Exits- At what point should you enter the market, and when should you get out? There is no magic answer, of course. However, as you learn more about forex and the various indicators, you will learn to identify potential entry and exit points. It is also recommended to try various exit and entry points on a demo account – this will help you identify those points which work best for you.

Follow Your Plan- It is all well and good to research forex and learn about the market, but all that work on how to trade forex will go by the wayside if you don’t translate it into an effective plan of action. It is the disciplined trader who stands to be most successful. Make sure that you write down your plan – this will make it easier to follow than if you have a few ideas floating in your head. Stick with your trading strategy, always!

Practice (and practice some more)- Once you have your trading strategy in place, it’s time to try it out on a demo account. Some experts suggest trading on a demo account for up to two months before switching to a live account. Be patient and learn the ins-and-outs of trading before you trade on the live markets. You want to feel comfortable and confident with your trading strategy, and the ideal place to put it to the test is your demo account – there will be plenty of time later to trade on the live forex market.

LEARN TO TRADE THE TOP FINANCIAL MARKETS IN 2020!

Why Trade With Platinum Trading Academy?

Many traders jump into the forex arena with little or no preparation, confident that they will ‘figure out on the go’ how to make money trading currency. However, these individuals have a lack of knowledge about the forex market and have failed to prepare a trading strategy. More often than not, these traders are left disappointed, after seeing their capital quickly disappear. Taking steps in order to learn online trading is essential to becoming a successful trader - this point cannot be overemphasized. In order to learn how to trade currency and make money, every trader needs discipline and a trading strategy that fits his or her needs and goals.

Platinum Trading Academy is tailored for a trader at any level, whether a relative beginner or an experienced trader. We provide each of our students with a private forex mentor, rather than a “one size fits all” seminar or webinar course. With Platinum’s step-by-step mentoring and in-depth training courses, you will learn how to trade online and how to develop an effective trading strategy. If you are looking for an online forex trading course that will build your confidence and produce consistent results, then Platinum trading offers a superb online forex trading experience.

Online Forex Trading and Education

Years ago, the only way a trader could execute trades from home was to make a telephone call to his broker to execute a trade. Trading in this method was, of course, cumbersome and inefficient. Fast forward to 2020, and online forex trading is a breeze, thanks to modern technology and the internet. Traders can now utilize their computers, laptops or even smartphones to execute trades and continuously monitor the forex markets, which are constantly fluctuating. Since online forex trading is ‘over the counter’ and not limited to a particular trading exchange, forex traders have the ability to execute trades at any time of day or night, five days a week.

There are literally hundreds of forex brokers on the internet that will enable you to participate in online forex trading. It is critical that you choose a reputable broker before you start to trade fix online. However, even before you begin to look for the right broker for you, you should first take advantage of what the internet has to offer and learn online trading free! That’s right – there’s no risk and no charge when you take a free online course. Bottom line? Before you jump into the forex markets, it’s important to take a step back and take a course to learn to trade forex online. A search on the internet will show dozens of online forex trading courses, many of which are free.

In addition to forex courses, an ideal way to learn how to trade online is to enrol in an online trading academy. Essentially, an online trading academy is a school where you will learn how to trade online, without having to pack a lunch and commute to class!

A solid understanding of the forex market is essential to becoming a successful trader - this point cannot be emphasized enough. In order to learn how to trade currency and make money, every trader requires discipline and a trading strategy that fits his or her needs and goals.

Summary

Forex trading involves trading currency pairs, which are constantly moving up or down. In order to trade large positions without having to put down large amounts of capital, traders utilize leverage. It is essential to develop a trading strategy that matches your needs, goals and risk tolerance. Once this is in place, it is strongly recommended that you practice trades on a demo account before placing trades on the live forex market.

LEARN TO TRADE THE TOP FINANCIAL MARKETS IN 2020!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.