THE IMPACT OF GLOBAL EVENTS ON THE AUSTRALIAN DOLLAR - OUR AUD/USD FORECAST & ANALYSIS

Today we’re looking at the impact of global events on the AUD/USD pair, such as the Economic Crash of 2008 when the housing market caused major financial collapse around the globe, with many economists considering it the most impactful financial crisis since the 1930s’ Great Depression, and now the Coronavirus Pandemic, which has seen markets take major hits unseen for many years.

We’re also going to look at how you can trade AUD/USD news events, even during these difficult times, as well as our AUD/USD forecast and analysis so that you too can discover how to trade the AUD/USD with perfection and finesse.

The Impact of the 2008 Financial Crisis

We live in a very interconnected world, one where even a localised event can have an impact on a host of global financial markets such as the currency market (BREXIT for example). And the currency markets are highly sensitive to any global event. The Australian dollar is especially susceptible due to Australia’s reliance on both the Chinese and United States economy. One example of such a global event where the AUD/USD was impacted was the 2008 recession.

From about July 2008 – October 2008, the AUD depreciated while the USD appreciated. This drop in the AUD/USD exchange rate was due to the demand for AUD dropping and demand for USD increasing.

But what caused this shift in the AUD depreciating and the USD appreciating?

- Investors moved their money to a safe haven currency like the USD and to safe haven assets like GOLD. This increased the demand for USD and decreased demand for AUD.

- Consumers consumed less due to economic pressures, which in turn means there was less demand for goods. This will impact the exports from Australia which again means less demand for AUD

- Global companies with debt denominated in USD, had to secure USD to meet their debt obligations.

From this it is clear to see why the AUD/USD depreciated so much. Recovery in the AUD/USD only started around March 2009 (8-9 months later), and about 80% of the depreciation was recovered by December 2009. Thus, it took about 18 months from the start of the depreciation cycle, to recover to normal levels.

The Impact of the Coronavirus Pandemic

Looking at the recent COVID-19 pandemic, we know that there is going to be major economic impact due to the lockdown that is being implemented globally to stem the spread of the virus (greater than the 08/09 crisis). Countries have restricted the movement of people across borders and implemented social distancing measures and the result has been major disruptions to economic activity across the world. It is likely to remain the case for now as efforts continue to contain the virus.

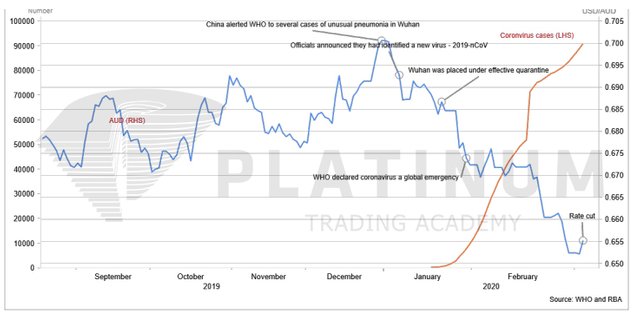

The virus outbreak started in China, which is also the first country to implement lockdown measures. Given Australia’s heavy reliance on the Chinese economy, we can say that the AUD is a proxy for the Chinese Yuan. Thus, as the cases of COVID-19 increased in China and the Chinese economy slowed, the AUD depreciated against the USD.

AUD/USD Analysis

The decline in the AUD was not solely in response to the Outbreak of COVID-19. The AUD has been slowly depreciating since early 2019, partly due to the trade war between USA and China and partly due to the disastrous bush fire season. Normally a depreciation of the AUD benefits Australian exporters (weaker AUD increases demand for exports and tourism). However due to the COVID-19 pandemic, the circumstances have not allowed for an increase in demand for exports and tourism. This together with the rapid global spread of the virus has decrease the demand for the AUD, causing a major depreciation of the AUD against the USD.

The current drop in the AUD/USD price is due to the shock of the virus as the economic impact of the virus has not yet been seen in economic numbers. The drop is mostly due to investors moving their money to a safe haven currency like the USD. This means that the demand for AUD has decreased and the demand for USD has increased. As previously stated, global companies with debt USD is also in need of USD to meet their obligations. To ensure sufficient supply of USD, the RBA and Federal Reserve came to an arrangement where the Federal Reserve would swap USD for AUD (19 March). This has had an effect of a recovery in the AUD/USD exchangerate from 0.55 on 19 March to 0.63 on 10 April.

AUD/USD Forecast

Now let’s get into our AUD/USD forecast. Given that the economic data has not yet shown a lot of strain (U/E rate has actually improved MoM from February to March), and that there is no sign yet of an end to lockdown/social distancing, I feel the AUD is still going to feel a lot of downside pressure in the coming weeks/months. As soon as we start to see the economic data showing the full strain of COVID-19, AUD will start to depreciate more. And if the 2008/09 crisis is anything to go by, the downturn would happen over quite some time (few months) before there will be any recovery.

Above is a daily graph of AUD/USD. We can see that prior to the COVID-19 shock, the AUD/USD was moving along a declining trend line. After the initial shock, the AUD/USD recovered to again touch this descending trendline, but not breaking through the trendline. The yellow dash-lines represent areas of support and resistance.

What I would look for is for the AUD/USD to continue downwards, breaking through the 61.8 Fibo level, which then shows a downward trend has developed. The AUD/USD should then continue downward with support at the 100 and 161.8 Fibo levels. If the AUD/USD can break below the 18 year low of 0.55, then there is room up to (and perhaps even lower) than the 261.8 level.

My first sell order would be when the AUD/USD has a first candle closing below the 61.8 level, and we have the necessary economic data that will back up a downwards trend in the AUD/USD.

Our Previous AUD/USD Forecast & The Results

In the video below, we look at our previous AUD/USD forecast(s) over the past couple of weeks as the Coronavirus pandemic has been going on. You will see exactly what our clients are provided with each week, and the professional level of analysis that you can expect from our Platinum Traders. We provide an updated AUD/USD forecast each and every week, along with our other major currency pairs, as well as opportunities to trade AUD/USD news events.

Watch this video: Top Tips for Trading the AUD/USD (04mins 10secs)

Trading AUD/USD News Events

The Coronavirus Pandemic has had a major effect on global markets as stated above, but it’s not the only news event that’s moving the markets right now. While most of us are stuck at home, unable to do anything, our respective governments are trying to keep out relative economies afloat through various stimulus packages, bailouts, and so on. These are major market movers, as they will determine how strong our economies will continue to be once this pandemic has passed us by.

When it comes to trading AUD/USD news events, you have to adopt similar principles to the ones you would when trading some of the other major currency pairs, and remember that if there is already an expected result, a lot of the impact of a particular AUD/USD news event will already be priced into the markets, and there may not be as large a move as you might expect on release.

If you would like to trade AUD/USD news like a professional, or simply learn how to create your own AUD/USD forecast, then simply get in touch and we would be more than happy to assist you in furthering your trading career. Join us below to get started!

FURTHER YOUR TRADING CAREER TODAY WITH THE PLATINUM TRADING TEAM!

Thank you for reading our blog, we hope you make good use of the knowledge that you’ve gained, our AUD/USD forecast, and our insight on trading AUD/USD news events.

Hopefully, you have enjoyed today’s article.

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.