GDAX

Ranked #7 of 10

GDAX is an advanced cryptocurrency trading platform owned and operated by Coinbase. Launched in early 2015 as Coinbase Exchange, it benefits from many of the same advantages held by Coinbase itself, including ease of use, solid security measures, and good liquidity. That said, it is focused on experienced, high-volume traders and therefore allows a range of advanced trades, from stop and limit orders to good ‘til cancelled and fill or kill orders. Its trading fees are competitively low, while it doesn’t charge anything for cryptocurrency deposits or withdrawals. This makes it a very good exchange overall, even if its customer support can be slow, and even though it supports only four cryptocurrencies and doesn’t allow margin trading.

Pros

Very easy to use

Low fees

Strong security

Cons

Limited range of cryptocurrencies

Support can be slow

Trusted

Average Fees

Fast

Easy to use

Fees

Fees are impressively low on GDAX, although they’re cheaper with bitcoin trades than with trades in either ether or litecoin.

For those who put a new order on the books when buying or selling (i.e. “makers”), there’s no trading fee whatsoever, and this applies for all cryptocurrencies.

With bitcoin, those who buy or sell cryptocurrency from an existing order on the book (i.e. “takers”) pay a 0.25% fee. This is already competitive compared to such exchanges as Poloniex and Kraken, but users also receive a rebate depending on their volume of trades over 30 days. This is shown in the table below, which also underlines just to what extent GDAX is more for the serious trader:

User 30-Day Volume Taker Fee

0 % (~0.00 BTC) 0.25%

1 % (~6,792.37 BTC) 0.24%

2.5 % (~16,980.93 BTC) 0.22%

5 % (~33,961.86 BTC) 0.19%

10 % (~67,923.72 BTC) 0.15%

20 % (~135,847.44 BTC) 0.1%

Yet with either ether or litecoin trades, takers pay a 0.3% fee. However, this decreases to 0.24% and then all the way down again to 0.1% depending on the volume

As for deposits and withdrawals, these are both entirely free if the user is transferring cryptocurrency or making an ACH deposit or withdrawal. Otherwise, they require the user to pay the following flat fees:

SEPA Deposit: €0.15 EUR

SEPA Withdrawal: €0.15 EUR

USD Wire Deposit: $10 USD

USD Wire Withdrawal: $25 USD

Together with the free cryptocurrency withdrawals, these flat fees mean that GDAX is one of the cheapest exchanges currently in operation. For instance, Bitfinex charges 0.1% of any bank transfer in euros, which would mean that someone wanting to withdraw €10,000 would have to pay €10, whereas a GDAX customer pays only €0.15.

Background

Launched in January 2015 and owned by the same company that operates Coinbase, GDAX is geared more towards professional traders than its more accessible stablemate. It allows for a variety of order types, ranging from the obvious limit and stop orders to advanced orders such as good ‘til canceled (GTC). It doesn’t, however, allow margin trading, and compared to other advanced exchanges it lets users trade in only a small range of cryptocurrencies: bitcoin, bitcoin cash, litecoin, and ether. That said, it does give users the ability to trade their US dollars and euros directly for cryptocurrencies.

Perhaps unsurprisingly for an exchange that’s paired with Coinbase, its security is generally very strong. 98% of customer cryptocurrency funds are held offline, while the 2% held online are insured, meaning that any customers who lost money as the result of a hack would receive full compensation. Added to this, the pairing with Coinbase provides an added degree of convenience and simplicity, in that users who’ve already registered and verified an account with Coinbase will have no need to do the same with GDAX.

Security

Security is another of GDAX’s strong points. As stated above, only 2% of its customers’ cryptocurrency funds are held online, and these are insured in the case of loss. Similarly, all deposits in US dollars are covered by FDIC insurance up to $250,000, while deposits in euros are still legally held in custodial accounts belonging to the customer, meaning that GDAX or its creditors couldn’t seize them in the unlikely event of the exchange’s collapse.

Meanwhile, the exchange adopts a variety of measures to ensure that its system remains secure:

Two-factor authentication is used on all accounts

All website traffic is encrypted using the SSL (secure sockets layer) cryptographic protocol

All wallets and wallet keys are encrypted using AES-256 encryption

All employees have to undergo a security check and must encrypt their hard drives

Perhaps most reassuringly of all, GDAX has a registered BitLicense with the New York Department of Financial Services. This requires it to submit annual financial audits, which demonstrate that the exchange has sufficient liquidity and remains soundly managed.

And while GDAX is still a relatively young exchange, it has never suffered any kind of hack.

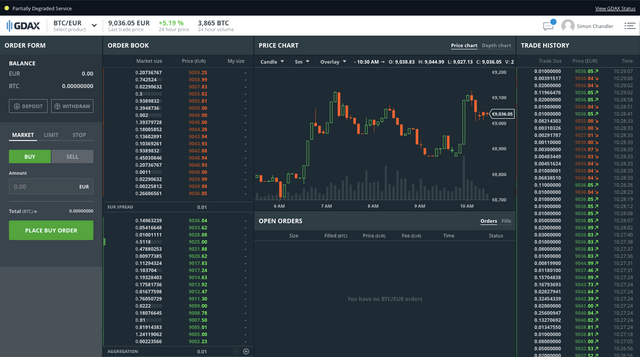

Usability

GDAX may be an exchange for professional traders, yet it’s one of the most usable and easiest to navigate. All the trading info a user needs is laid out on its dashboard, which is cleanly designed, responsive, and easily understood. Making trades is quick and painless, with the trading sidebar on the dashboard letting users choose and execute their desired trade with the click of a couple of buttons. Unfortunately, a mobile app isn’t currently available, yet the platform is so well-arranged that it’s still possible to use it on a smartphone without much trouble.

Perhaps the only significant downside to GDAX’s usability is its customer support. The platform’s support pages are informative enough, but the support team can sometimes take several days to respond to requests, especially during busy periods. That said, this is a common complaint with popular exchanges, and GDAX is certainly no worse than other platforms that have a reputation for being slow in supporting their customers, such as Kraken or HitBTC.

Deposit/Withdrawal Methods

Depositing funds into a GDAX account is generally straightforward. Euros can be deposited directly using a SEPA bank transfer, while US dollars can be deposited using a standard bank wire or via an ACH deposit. For UK customers, direct deposits in GBP aren’t currently possible, so they’ll have to make a deposit in euros and then exchange this for the equivalent in GBP.

That said, GDAX’s linkage with Coinbase means that users with a Coinbase account can in fact deposit any fiat currencies (or cryptocurrencies) they have to GDAX without paying any fee. The same is essentially true of withdrawals, although in this case these are limited by GDAX’s daily withdrawal limit, which begins at $10,000.

As for withdrawals of fiat currencies into bank accounts, these work in the same way as deposits. Euros can once again be withdrawn using a SEPA transfer, which take one to two days to complete. US dollars can be withdrawn using an ACH transfer or a bank wire, while withdrawals in British pounds aren’t possible.

And while fiat currency deposits and withdrawals are limited to some degree, users can deposit and withdraw all the cryptocurrencies traded on GDAX. All they need is an external wallet for each digital currency being traded.

USD

EUR

GBP

BTC

ETH

Supported Currencies

Buy / Sell

Bitcoin (BTC)

6920.00 / 7602.39

Ethereum (ETH)

539.92 / 599.77

BitcoinCash (BCH)

970.50 / 1104.42

Litecoin (LTC)

107.53 / 119.207

NEM (XEM)

0.22282 / 0.25224

Dash (DASH)

275.721 / 307.231

Exchange rates

and other info

Exchange

Payment methods

Bank Transfer, Credit Card, Debit Card

General info

Founded: 2015

Web address: gdax.com

Support contact: +1 (855) 577–1727

Parent Company: Coinbase, Inc.

Company address: 548 Market Street #23008, San Francisco, CA 94104, USA

©Cryptonews.com

Telegram

Facebook

Twitter

YouTube

Bitcoin

Adoption

Blockchain

Cryptocurrency

Regulation

ICO

MARKETS

Ripple

Bitcoin Cash

South Korea

Exchange

Ethereum

Ether

Japan

Mining

Community

Trading

China

Society

Hack

Investing

Litecoin

Security

Market

Banking

Scam

USA

Bithumb

Russia

Investment

Investments

Fraud

Legal

Altcoins

Coincheck

Ban

Monero

India

NEO

Coinbase

Crime

Venezuela

retail

Petro

NEM

Binance

Tax

Facebook

Cryptojacking

UK

About Us

Contact Us

Terms & Conditions

Privacy Policy

Disclaimer

News

Bitcoin News

Ethereum News

Altcoin News

Blockchain News

Exclusives

People In Crypto

Opinions

Features

Videos

Ethereum Videos

Altcoin Videos

Bitcoin Videos

Blockchain Videos

ICO Videos

Market Videos

Trading Videos

Security Videos

Guides

Blockchain

Bitcoin

Cryptocurrency

ICO

Ethereum

Reviews

Events

Price Tracker

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.