Understanding Coinbase/GDAX ETH crash and how to protect your investments

GDAX the exchange from Coinbase company has recently executed all the buy orders all over to almost 10 cents.

All started with a multimillionaire sell that executed orders dropping from $342.02 to $296 what created a chain reaction on the stop-losses positions that in a matter of seconds dropped the price all to almost 10 cents and got recovered seconds after.

No money got stolen or lost in that wasn't also a bug, but the way it should work. To proceed I will explain a few key points:

- How a stop-loss order works

- What is a circuit-break

- Why circuit-break doesn't work with cryptocurrencies

- How GDAX could avoid that problem

Disclaimer, I'm not a professional trader and this is not a trade advice post.

How a stop-loss order works

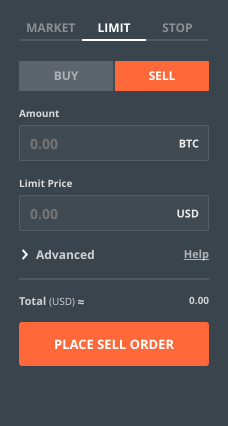

As you can see in the image on the left when the market hit the limit price the amount will be traded until it's all converted or the market goes above the sell limit.

What is a circuit-break

In the regular stock market, when a chain reaction happens and the percentage wise change is too high, it will trigger a circuit-break and shut down all the transactions for a period of time, adding time to people think and do not panic react to the situation.

A good example is that a few weeks ago Brazilians had a circuit-break when after an investigation went public that potentially could impeach the president, too many USD orders started to be executed dropping the value of the BRL with the uncertain future panic. This circuit-break hold the transactions for an entire day and after the panic pass, they resume the operations with a lower volume being traded and stopping the devaluation of BRL related to USD. More details.

Why circuit-break doesn't work with cryptocurrencies

Most of the assets exchanges are centralized. Fox example, US companies stocks have their US exchanges to trade it, when the company has stocks in another country the trades must happen in that country exchange. So a circuit-break make sense in those markets. When they're activated nobody can trade.

That is not possible with cryptocurrencies or assets based on public blockchains. Imagine the situation where GDAX implement a circuit-break and there is a crash on the Etherium, where it is losing huge amounts the value over all exchanges, that would trigger a "circuit-break" in GDAX, but potentially would not in the other exchanges.

In a situation like that, who is trading at GDAX would have an exchange disadvantage, since they're locked and can't liquidate their assets, and they will keep looking it lose value until the "circuit-break" is disabled where people in other markets can freely trade their undervalued assets.

"With great powers, comes great responsibilities".

This problem was a human mistake and if the people had a better understanding of the tools they use that problem would not happen. What that leads to my next topic.

How GDAX could avoid that problem

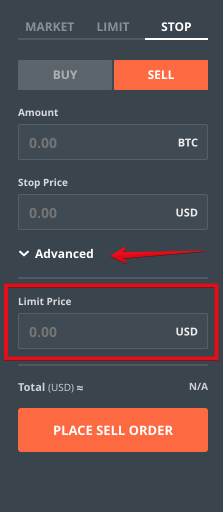

The Advanced option hidden by default allows the trader to set where he wants to stop trading. However, if the user doesn't set that option, the limit will be 0 what can lead to a chain reaction like that.

GDAX not should only always display that option, but also warn the users that a zero value in that field can lead to unpredictable consequences.

Conclusion

GDAX is a new exchange and with Coinbase introduces all their users to advanced trading tools without any tutorial or deep explanations of how each tool in the exchange works.

They failed to provide a good users experience and induced their amateur traders to do a very dangerous operation while in their minds they thought the limit-sell would protect their funds.

The tools worked as correctly as expected, there are no ways to revert the losses for who fall in that trap and many people probably profited from those poor traders.

If you liked this post, please upvote, I will be happy to help you further.

If you are not a Steem user and my post save you some crypto losses, you can donate to me.

Bicoin

1DhWEwa3YhXC8JbbZjwpxiZKqb9dfYRAyY

Ethereum

0xe05342A02D8F6708cd007a9E7a722ef8427cb640

Thank you. Was trying to work out why this happened. Keep up the great posts :)

My pleasure, I really hope that GDAX gets this notice and fix their trading platform in the future to help new traders to not lose by mistake.

Great post and a very important topic especially for non-professional traders who have no idea whatever who they give their money to and how it's 'managed'.

To sum up your article and make it short and sweet:

You do not use stop-loss orders in volatile markets PERIOD. The reason being that as soon as the decline in market price is anything less than ultra smooth you will end up in a position where your order becomes a trade when the market reopens which it potentially does at a SIGNIFICANTLY lower price. The logic being that at reopen the order checks for market price and triggers because the stop-loss price has been breached. It then sells everything at the next best highest price (like 11 cents instead of 9).

If that option converts your GDAX stop-loss into a stop-limit that'd be good but I'd carefully read the fine print on that given the reputation of these exchanges.

People please for the love of god do not let an exchange manage or store your crypto! That's calling for disaster. Keep it offline, buying and selling is just as easy only this type of stuff cannot happen.

If you are a professional trader and do this every day, day in day out and fiddle with some chunk on an exchange fine. But then you would NEVER use a stop-loss order in an unstable and volatile market such as cryptos.

Thanks for your comment, I'm glad that it was insightful.

I think that stop-loss and stop-limit, when used correctly, can, in fact, save a lot of money when let you leave in the first wave ensuring most of your profit. You need to know what you're doing or this tool can be even more dangerous than hold.

Absolutely true, buy and hold would be my suggestion for non-traders anyway but that's just me.

Thing is Coinbase is just a sketchy disaster, no customer support, throttling users when price is down so they can't buy and generally just unstable as hell.

Someone once said buying gold is flying in a 747 and buying silver is flying in an F-16 - same speed but vastly different flight experience. Cryptos is about 10 times worse than an F-16 in terms of volatility. If you know that and act accordingly you're good.

I would like to inform that the user @mrakodrap did a post with updates from GDAX where they announce to keep the orders, but reimburse the users losses from GDAX company found. More details in his article: https://steemit.com/cryptocurrency/@mrakodrap/gdax-to-compensate-traders-for-eth-flash-crash

Great explanation. Thank you. Followed :)

Congratulations @gartz! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Congratulations @gartz! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!