RNC Minerals (TSX : RNX): Production NR, 2H18 Financials & Future

Third blog entry about RNX, elaborating impact of the high-grade gold resource to company’s financials and probable future. Expecting the Production NR to be published on Monday 10/22 or within same week.Please read the Disclaimer / Disclosure first. You can find more about RNX here.

- 2018-10-21 Draft – Work In Progress (WIP)

- 2018-10-22 Fixed Valuation using only C$1560/oz or $1200/oz and aligned costs in cash flow (was too high)

- 2018-10-22 Added RNC’s other assets..

RNX Valuation available in printed PDF Format or in Libre-Office ODS Format.

First I like to emphasize that the Father-Day’s-Vein (FDV) finding at Beta-Hunt was no accident, not a one-off, but a result of persistence since its acquisition in 2016, knowing its low-cost gold production potential withing the multi-million ounce regional gold mineralization system.

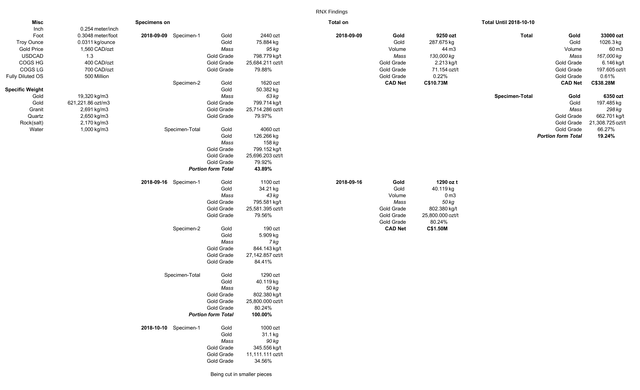

Current 33,000 ozt High-Grade Findings

What have they found so far? Roughly 33,000 ozt or 1026.3kg as of 2018-10-02, upgraded from 9000 ozt and 24,000 ozt earlier. This finding is worth around C$44.5M net at C$1800/ozt and assuming C$450/ozt cash costs inclusive royalties – which still might be too high due to direct shipment to Perth Mint’s smelter. The finding is located within the initial FDV 60m3 or 167,000kg of mass, giving an astonishing 197 ozt/t or 6kg/t.

RNC Minerals other Asset’s

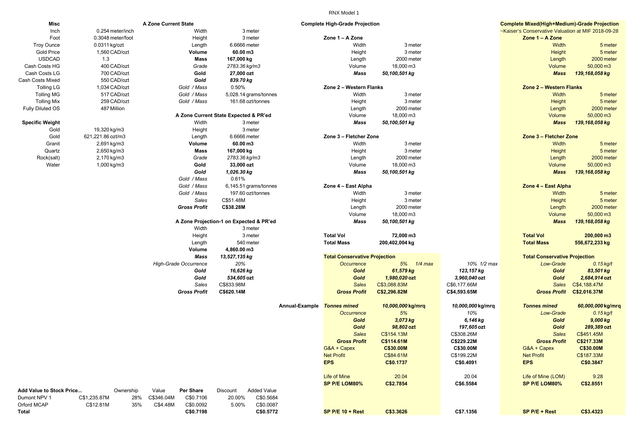

Biggest other asset is the Dumont Project with an after tax NPV8% C$1137M, of which RNC currently owns 28% and is the managing party. Waterton owns the majority of the remaining portion. A feasibility study update shall be completed mid 2019 and company intends to start planning construction thereafter.Additionally RNC owns 35% of Orford Mining (TSXV : ORM), which is currently traded around C$13M MCAP and is a 100% owner of the promising Qiqavik Project. Recently they released positive 2018 drilling program results.Giving Dumont a 20% discount and Orford an additional 5% discount, we would end up at C$281M or C$0.5772 per share @ 487M fully diluted OS. An extreme high Dumont 50% discount would lead to C$177M or C$0.364 per share. This indicates that Beta Hunt is given quite a low valuation at this point.

High-Grade Resource Estimate

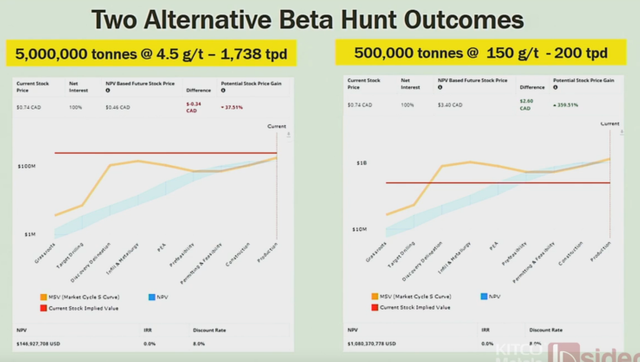

We assume continuation for the high-grade gold within four shear zones, each about 2km long – totaling at least 8km of potential high-grade gold. See the 10/3 presentation for details.While continuing mining low-grade and high-grade following the current vein structure, company will also complete their mapping via historical data and new diamond drilling to prove the new high-grade resource model. Beta-Hunt became a commercial production mine on 2017-06-20.Access to two shear zones already exists, A-Zone and the adjacent Western Flanks, while Fletcher Zone access is not fully build out and East Alpha must be still developed. However, this gives access to at least 2.5 hot-spot shear zones, roughly 5km.On 2018-09-28 Kaiser was the first tossing out an resource estimate of 2.4M oz gold with 500,000 tonnes @ 150g/t and 200 tpd

Our own basic model comes very close to above estimate by using just 5% chance of high-grade gold occurrence and adding the low or medium grade on top of it

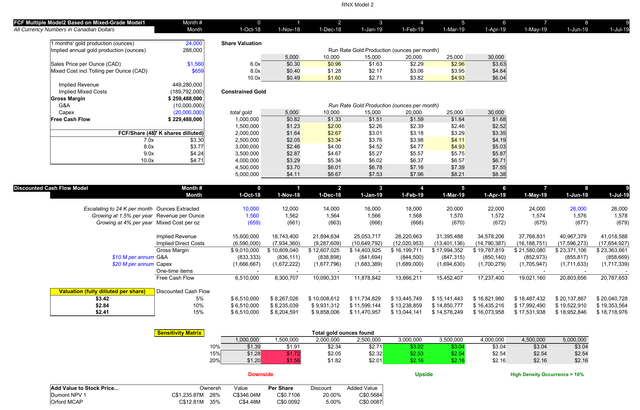

Note that the mixed-grade includes 1/4 of low-grade tolling & milling costs. In case company is able to build their own mill for low-grade processing, these margins will rise significantly and hence such development is highly recommended. As of today, low-grade adds not too much in annual profits but with higher contract utilization or said own mill this will also change to the better by a high margin.We end up in an estimate of 1.98M – 2.68M ozt, which is still below the maximum assumption of 8M ozt as leaked on 2018-09-28 in the Midas Letter RAW69 interview with Marc Selby (CEO). We assume moderator’s rudiment calculator number is a reflection of earlier communication between the two. At least 8M ozt gold are within the theoretical range using 20% of high-grade chance within the shear zones.Given more conservative 1.98M – 2.68M estimate results in C$2.02B – C$2.30B gross profits total @ C$1560/oz or SP @ P/E LOM80% C$2.79 – C$2.86 with Life of Mine (LOM) ranging from 9 – 20 years.Same numbers are visible within a cash flow model

Financial Impact of 33,000 ozt High-Grade Gold

How will the currently assumed 33k ozt impact the balance sheet?

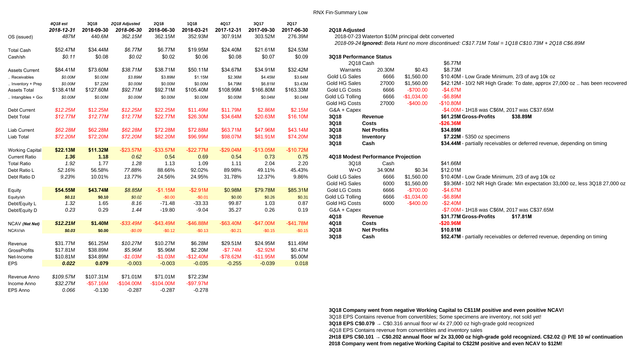

Above pro-forma 2H18 calculation dismisses any further findings beyond given 33,000 ozt high-grade gold. This already significantly impacts company’s financials:

- 3Q18 Company went from negative Working Capital to C$11M positive and even positive NCAV!

- 3Q18 EPS Contains revenue from convertibles; Some specimens are inventory, not sold yet!

- 3Q18 EPS C$0.079 → C$0.316 annual floor w/ 4x 27,000 oz high-grade gold recognized

- 4Q18 EPS Contains revenue from convertibles and inventory sales

- 2H18 EPS C$0.101 → C$0.202 annual floor w/ 2x 33,000 oz high-grade gold recognized. C$2.02 @ P/E 10 w/ continuation

- 2018 Company went from negative Working Capital to C$22M positive and even NCAV to $12M!

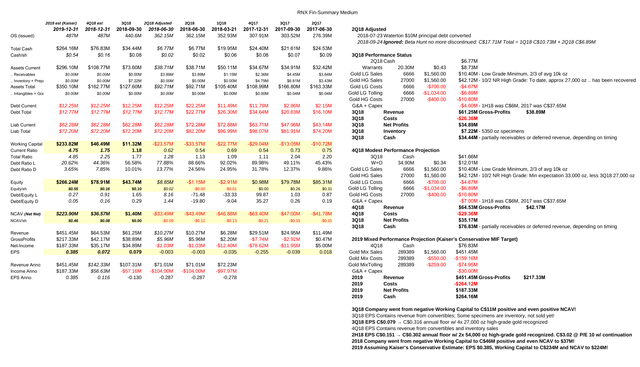

Even the above low-estimate pro-forma financial should allow a C$2/sh valuation based on a reasonable projection of high-grade gold continuation.Assuming 27,000 ozt high-grade gold findings for 4Q18 while operations continue and adding 2019 annual production of 289,000 ozt from our estimate results in the following pro-forma financial estimate

This furthers 2H18 performance significantly and 2019’s performance indeed looks to be out of this world, as 10% owner Eric Sprott commented on 2018-10-19 in his Sprott Money Show.

- 2H18 EPS C$0.151 → C$0.302 annual floor w/ 2x 54,000 oz high-grade gold recognized. C$3.02 @ P/E 10 w/ continuation

- 2018 Company went from negative Working Capital to C$46M positive and even NCAV to $37M!

- 2019 Assuming Kaiser’s Conservative Estimate: EPS $0.385, Working Capital to C$234M and NCAV to $224M!

October 22, 2018 by SeaOfSand

reposted here , not original

Congratulations @cadream! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!