DOUBLE WHAMMY: Gold and BTC Surge In TANDEM!

Dollar alternatives – particularly cryptocurrency and gold – have been moving higher, even in the face of a strong USD trading pattern. That is extremely rare. 2018 now looks like a bad dream that never really happened as Bitcoin and precious metals break through one short-term resistance level after another.

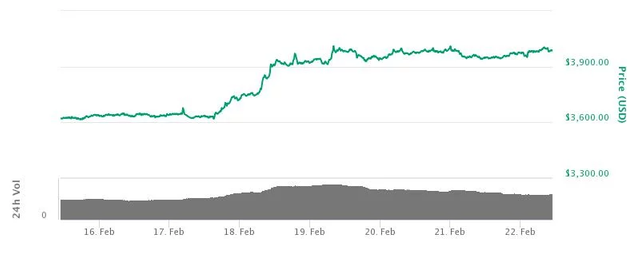

For Bitcoin, which comprises 52% of the broader cryptocurrency market – the psychologically significant $4,000 resistance level is likely to be in the rearview mirror soon. The world’s largest cryptocurrency recently touched the $4,000 price point for the fourth time this month, and it’s up nearly 10% in the last week.

Courtesy: coinmarketcap.com

Since Bitcoin is the bellwether among digital currencies, other popular cryptocurrencies are following in its footsteps. Ethereum’s incredible weekly price gain of 21% and Ripple’s impressive weekly increase of nearly 7% indicate that this is a broader move. Meanwhile, the aggregate cryptocurrency market capitalization has remained elevated but stable at around $135 billion.

I want to make sure you’re in the loop on what’s happening in the bigger picture. For example, OKEx, the third largest cryptocurrency trading market as measured by daily trading volume, just announced that they’re now allowing users to buy and sell Ripple and Bitcoin Cash with five world currencies: the British pound, Chinese renminbi, Vietnamese dong, Russian ruble, and Thai baht.

So as you can see, the crypto industry is literally going global. As such, the torch is being passed in more ways than one: the Lightning Network, the payment protocol that acts as a second layer on top of a blockchain, has passed on its famous Lightning Torch to financial derivatives giant Fidelity Investments.

Courtesy: Fidelity Digital Assets

This is a symbolic gesture but it has great significance in the community. Fidelity Investments is a powerhouse in the world of finance. It manages more than $7.2 trillion in client assets; for them to give symbolic recognition to the Lightning Network is essentially a seal of approval for cryptocurrency and the blockchain from a world-class investment firm.

Much like Bitcoin’s recent renaissance, gold has also experienced an exhilarating bull run after a stretch of range-bound price action that frustrated long-term investors for years. After banging its head on $1,300 multiple times in January, gold blasted through its resistance point, thus adding rocket fuel to an impressive run that began in November.

Courtesy: barchart.com

Dollar strength is no threat whatsoever as investors pile into the gold trade with $1,350 and $1,400 in view. Perhaps they know what I’ve been saying all along: 2018’s dollar strength is not likely to be repeated in 2019, and once the dollar falls, the floodgates will open up to investors on the sidelines waiting for an excuse to get into the gold trade.

Gold has proven itself as a rock-solid, long-term investment in all market conditions. Without a doubt, fiat money is going to have a tough time maintaining its momentum from last year.

Best Regards,

Brad Robbins

President, PureBlockchainWealth.com

Legal Notice:

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.Please read our full disclaimer at PureBlockchainWealth.com/disclaimer

Original Article Available HERE