Goldfinch protocol as a Decentralized lending alternative

Goldfinch appear a decentralized protocol. With its help, you can get a cryptocurrency without special provision. In further, the protocol will be able to use the collective assessment as a signal to automatically distribute capital.

The principle of operation protocol Goldfinch

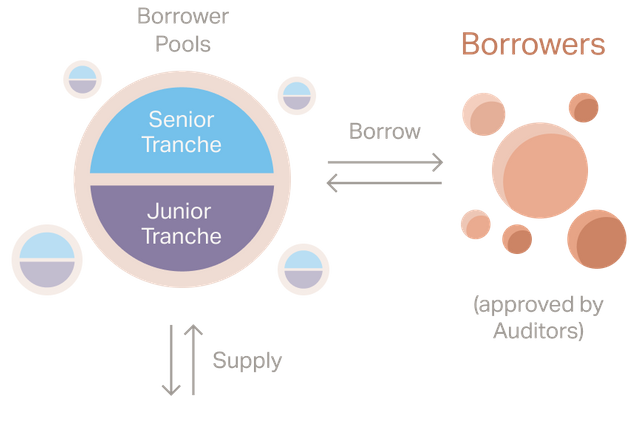

The Goldfinch protocol includes 4 main participants. Each of them performs its own separate function:

Borrowers. This category includes participants who are in search of funding. They offer pools of borrowers for sponsors for them to performing the assessment. The most commonly used terms are interest rates and repayment schedules.

Backers. They are necessary for evaluating the pools of borrowers. Backers determine whether it is necessary to provide capital for the first loss. After providing the capital, borrowers will be able to borrow or repay the pool of borrowers.

Liquidity providers. They provide capital to the senior pool. The main goal consists of getting passive profit.

Auditors. They vote in order to approve the borrower. Choosing a protocol is carried out in random order. It is the auditors who are engaged in verification to prevent fraudulent actions and protect a person.

Each participant performs its own function to borrow cryptocurrency without provision.

How does Goldfinch differ from DeFi?

The DeFi segment has a different work structure. If we minutely consider the principle of operation, then we can give such an example. Each participant borrowed 2 dollars, and the borrower provided assets for 5 dollars. In this case, the system starts to brake. In DeFi, you can increase your own working capital for people who already have some assets. Herewith, some of the funds will be blocked in the protocols, and not sold. There are often situations when a borrower needs a loan at a time when he cannot provide funds.

Goldfinch is trying to completely change the situation. Participants do not need to provide a pledge. In this case, there is an opening of access to capital, where proven and reliable companies offer their credit terms. At the same time, they are checked, so only successfully developing organizations are included in the list. The sponsors will make the final decision to invest the pool or reject the application.

Key differences between Senior pool LP and Backer role

The main difference with LP and Backer is that there is a simple bargain here. Liquidity providers are not necessarily to perform work and they are not set tasks. They will be able to provide their own capital in the form of stable coins within a short time. USDC is most often used. API earnings occur without risks.

Another difference is the amount of income. On average, sponsors can earn up to 25% per annum from one concluded loan transaction. In LP, you can get only up to 7% per annum from the senior pool. If we talk about the absence of risks, then this is a good result.

The developers of Goldfinch strive to create a unique decentralized credit platform. It will open up unlimited opportunities for every person. You can become a lender. Soon it is planned to improve the protocol in order to support even minimal lenders who do not yet have a loan servicing infrastructure. Thanks to this, even private person will be able to receive money.