GST HAS DIVIDED SURAT

The Textile Industry is crying for help!

A year ago — the days before the GST was implemented — textile traders in Gujarat’s second largest city came out on to the streets, fiercely opposing the new tax. The 5% tax slab included fabric, and Surat is a hub of fabric. The traders were anguished as fabric was never taxed in independent India, though yarn — the raw material from which fabric is prepared — was covered by value-added tax. For 18 days, the city’s textile industry, with 65,000 wholesalers spread across 150 markets, stopped work. Surat was the only city to see such fierce opposition to the GST.

.jpg)

The textile traders also received support from a section of diamond merchants, who were unhappy with the 3% GST on cut and polished diamonds. But the anger of the city’s diamond industry evaporated when the GST Council slashed the rate to 0.25%. Surat has about 4,000 diamond factories, directly and indirectly employing seven to eight lakh people.

The knife of GST had cut the city’s trading community into two. On the one side is a diamond industry that remains largely unaffected by the GST. On the other side is the textile industry, which is crying for help and sending SOS messages to the Centre.

The new tax regime has impacted 60% of marginal traders, those with an annual turnover of less than Rs 5 crore. The 5,000-6,000 traders who earn Rs 10 crore or more have been insulated from the GST.”

Union Finance Secretary Hasmukh Adhia has another view on why Surat traders are opposing GST. “Traders are not willing to come under the tax net mainly because of the fear that they will have to report their correct turnover, which may have consequence on the direct tax side,” says Adhia, who, as the head of the revenue department, is also the ex-officio secretary of the GST Council, the apex body that approves changes in the indirect tax regime.

But a number of traders told ET Magazine they were paying income tax honestly, and added that the transition from cash to cheque transactions was taking a toll on business volume.

Unlike most textile units, the diamond industry is better organised. The GST has just been an add-on procedure for this section.

.jpg)

Imported raw diamonds land in Mumbai through the banking channels before being ferried by the angadias, the unofficial courier men, to Surat. The diamonds are processed in Surat, Saurashtra and other parts of Gujarat before being exported. Angadias charge fee in cash, giving scope for manipulation.

the government’s 0.25% GST on rough diamonds is basically meant for tracking the transit of diamonds rather than mopping up any additional revenue for the government.

.jpg)

“In diamond trade, a polisher can become a factory owner”

Babubhai N Gujarati, who rose from being a diamond polisher to a factory owner, explains why GST has no impact on the diamond businesses in Surat

I started as a polisher in late ’60s, working over 10 hours a day. It was quite a struggle till I set up a diamond factory in Surat in 1992. I named the company B Mahesh. B is Bharat, my elder son who now manages our office in the headquarters, Mumbai.

And Mahesh is my younger son who looks after our factory in Surat. We have 400 employees and make an annual business of `80-90 crore. Today, GST has no impact on the diamond business here. I became the president of the Surat Diamond Association in August.

Why Textile Industry required help?

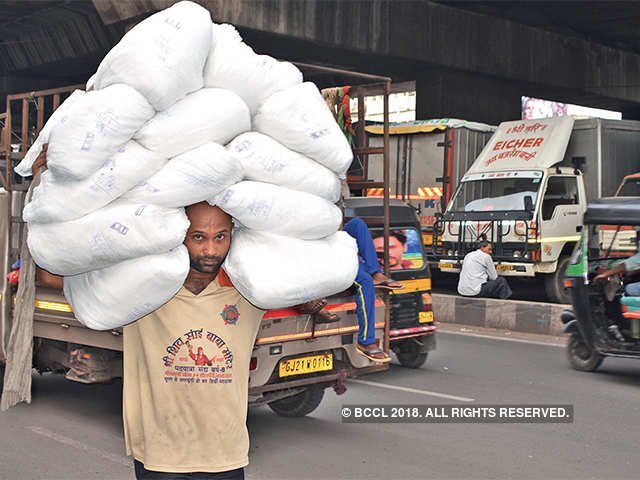

Vikash Patil’s siesta inside his mini-cargo truck, parked outside Surat’s Vankar Textile Market, comes to an end when his colleague Anwar Khan returns from a wholesaler’s office. All the paperwork has been done and the duo will now have to transport the goods in the truck — bundles of clothes — to a bigger vehicle some distance away. From there, the clothes and others from across Surat will be taken to a factory, where these will be dyed and embroidered — all part of its journey to becoming an apparel.

Patil and Khan are part of an industry that is trying to find a footing after being hit hard by the roll-out of the new indirect tax regime. The goods and services tax (GST), implemented on July 1, 2017, subsumed 17 taxes under five slabs. It was supposed to ease tax process and intra-state trade. But a year since, GST remains an unpleasant term for small trader.

“You ask everyone here — from porters to a seth (merchant) — GST is the most feared word even now,” says Patil, showing the 15-digit goods and service tax identification number on the challan in Khan’s hands. This document is crucial for tax processes.