How to Calculate HEX Pumpability

The question is often asked in response to predictions of HEX rising to 33¢ in 2020 (a gain of roughly 10000% or 101x): How much money must flow into HEX for such a price rise? The answer: not as much as you may think

To perform the calculations, let us first gather the necessary variables

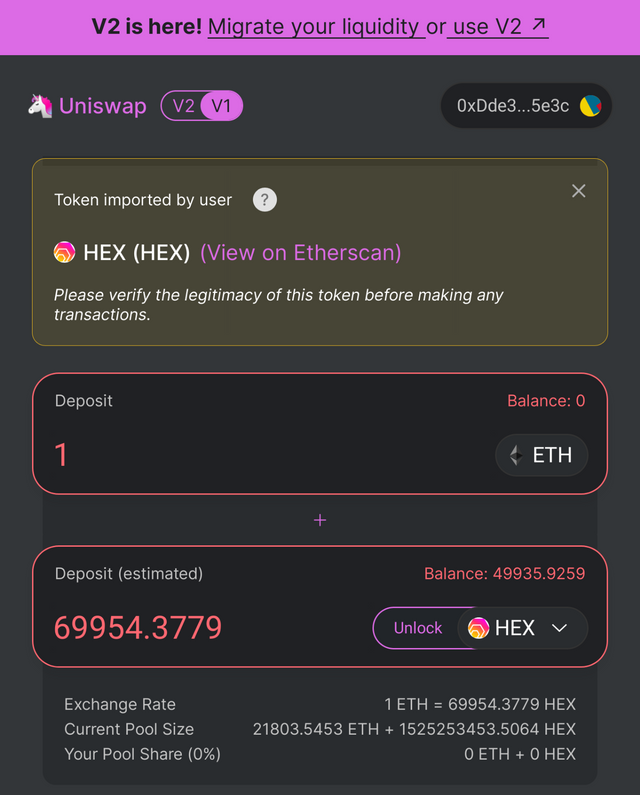

You may head over to https://v1.uniswap.exchange/add-liquidity to check out current stats of the HEX Uniswap v1 pool

Currently, Uniswap v1 contains:

ETH_pool_begin 21 803

HEX_pool_begin 1 525 253 453

To calculate the INVARIANT, multiply ETH_pool_begin and HEX_pool_begin together

INVARIANT = ETH_pool_begin * HEX_pool_begin

INVARIANT = 21 803 * 1 525 253 453

INVARIANT = 33 255 101 035 759

33 is coincidentally Richard Heart's favorite number 🧐

In this example we will utilize a 200 000 ETH buy order to illustrate and analyze HEX pumpability

Buyer sends 200 000 ETH to Uniswap. Let us calculate the ETH pool size after an infusion of ETH is made:

ETH_pool_after = ETH_pool_begin + ETH_buy_order

ETH_pool_after = 21 803 + 200 000

ETH_pool_after = 221 803

We will now calculate the size of the reduced HEX pool:

HEX_pool_after = INVARIANT / ETH_pool_after

HEX_pool_after = 33 255 101 035 759 / 221 803

HEX_pool_after = 149 930 799

The following calculation outlines the amount of HEX the buyer can expect to receive:

received = HEX_pool_begin - HEX_pool_after

received = 1 525 253 453 - 149 930 799

received = 1 375 322 654 HEX

Now let's calculate the new price of HEX:

New_HEX_price = HEX_pool_after / ETH_pool_after

New_HEX_price = 149 930 799 / 221 803

New_HEX_price = 676 HEX per ETH

Current price of ETH is $229

Divide 229 by 676 = 33.8¢ per HEX after a 200 000 ETH buy on Uniswap

200 000 ETH is currently $46 million, which is less than 5% of Bitcoin's daily real volume as reported by Messari.io

Edit: June 26 2020, The following content of the article was created after receiving calculation method updates from Jackmerius (@4thehex on Twitter), great to have his insight!

If you would like to calculate another pumpable value, we may simply plugin to the following equation, for example (you may click the image to edit yourself):

z is the desired HEX price

y is the current ETH price

j is amount of HEX in the uniswap v1 ETH/HEX pool

k is amount of ETH in the uniswap v1 ETH/HEX pool

x will return the amount of ETH needed to pump HEX to the desired value

Energy required to pump to $0.01 is roughly 17k ETH

Let us calculate the amount of economic energy required to propel HEX to $1

The equation returns 360 000 ETH, or $82M USD

Equates to about 1% of CoinMarketCap's reported daily ETH volume, or 1/3rd of Messari.io's reported daily real ETH volume

Ok last last example, promise. $10 for fun

Returns 1 180 000 ETH required to pump HEX to $10. This represents roughly 1% of the total ETH supply or an equivalent of around 28 000 Bitcoin. 25 Bitcoin addresses alone hold this number of coins (source: https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html), not to mention whales who spread their coins over multiple addresses. In 2014 Tim Draper bought 30 000 Bitcoins for kicks, as an example.

HEX to 33¢ by end of 2020

Check out the Uniswap Whitepaper for further insight into how these calculations were made: https://hackmd.io/@Uniswap/HJ9jLsfTz

In order to simplify this article, the calculations made did not include fees paid to liquidity providers. Fees are small enough that no appreciable error in calculations should be realized

If you enjoyed this article, and would especially like to see more of the same in the future, please consider donating HEX to the GoodTexture Long-Term Staking Fund.

0xD3D4080cCE2635d65EcDEeBD1f4ce9F2741a259D

If you owned Bitcoin in early December 2019, consider safely claiming your free HEX. Act quickly, as your reward decreases daily.

https://go.hex.win/transform/?r=0xD3D4080cCE2635d65EcDEeBD1f4ce9F2741a259D

The concept of "economic energy" moving the price of the token is a fascinating one. Lot's of unknowable's to deal with, but the fact that we are dealing with a completed, fully codified product gives me a lot of hope. If it hit's a dime, I'm done with work, and living on an island in Belize until I run out of $$ or time...whichever comes first.

Great analysis as always.

Uniswap Whitepaper link: https://uniswap.org/docs/v1/