Steemit Crypto Academy | Season 3: Week 5 || Death cross & Golden cross, How to use Binance P2P trade|| Homework post for @yousafharoonkhan

Greetings to Respected professor @yousafharoonkhan and dear steemitian friends. Let me introduce myself before starting the homework task. I am Atul Pathak lives in state-Bihar, India. I am an agriculturist and help farmers with different planting techniques. I am also a crypto lover and I always try to learn different trading strategies. Now I am starting my homework..jpg)

Introduction

Also, I will describe the P2P method of trading in Binance. Here we will see the advantage and disadvantages of P2P trading and also I will take a real example of P2P trading to provide a clear understanding to the reader.

Question 1.

A. Define Death Cross and Golden Cross in your own words.

Death cross and Golden cross are a very important indicator which is formed on the chart by the interaction and crossing of two Moving Averages and indicates the possibility of higher selling in case of Death Cross formation and higher buying in case of Golden Cross formation.

There are two moving averages in this indicator. One is for the short term and another one is for the long term. Now, the concept of DC and GC is that when the short term moving average (typically 50) moves upwards and crosses the long term indicator(typically 200), this forms the Golden Cross which means there is the possibility of buying the asset by the traders and thus it may be considered as Bull signal. Opposite to this, when the long term moving average crosses the short term moving average from above, this forms the Death Cross which means there is a possibility of selling the asset by traders and it may be considered as a Bear signal.

B. What is the significance of DC and GC in trade and what effect do these two have on the market? (in your own words.)

Death Cross and Golden Cross and having much importance as it helps in decision making of traders.

The formation of the Death Cross means there is a chance of starting a downtrend in the market. So, a trader can perform money management and can start selling his crypto coins slowly to maximise his profit or minimise the loss.

Also, Stop loss can be put in order so that he can save himself from the loss of capital. Opposite to this, the formation of the Golden Cross means traders are in the mood to buy the asset or crypto coins. So, from the point of the Golden cross, there may be chances of the pump in the market. So, on the identification of GC, he may start accumulating the coins.

Question 2.

Explain the points given below.

A. How many days moving average is taken to see Death cross and Golden cross in the market for better results and why?

This question has different types of answers. Different traders apply the different settings on Moving Averages. The settings of the Moving average totally depend on the nature of the traders. Some traders like scalping, some traders like swing trades and other traders want long term trade. The answer to this question is,a) For scalpers- 5 min and 15 min or 15 min and 60 min moving averages may give the best signals.

b) For swing traders- 1 day and 3 days moving average combination can be the best indicator combination.

c) For long term traders- 30 days and 90 days or 50 days and 200 days can give the best results.

But according to my opinion, 50 and 200 moving average combination can be considered as best because if we think of long term trade average calculation of closing price give a most accurate result. Also, on using the short time moving average for the death chart and golden chart observation, it may happen that most of the time DC and GC appears frequently on the chart which may result in the false signal which could cause confusion.

.png)

B. How to see the death cross and a golden cross on the chart.

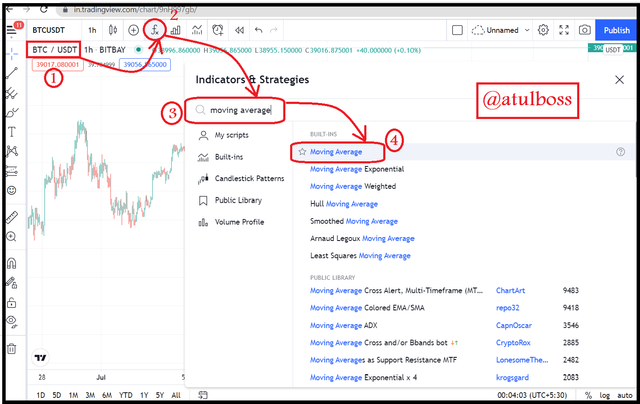

To see the death cross and golden cross on the chart first of all I will apply these moving indicators on tradingview website. Now, I am firstly choosing the BTCUSDT chart to see the Death chart and Golden chart. Then after clicking on the fx, the indicator section will be open. We will get the Search box for the indicators in which we will write the name of the indicator.

Now, I am firstly choosing the BTCUSDT chart to see the Death chart and Golden chart. Then after clicking on the fx, the indicator section will be open. We will get the Search box for the indicators in which we will write the name of the indicator.For DC and GC, we will apply the Moving average.

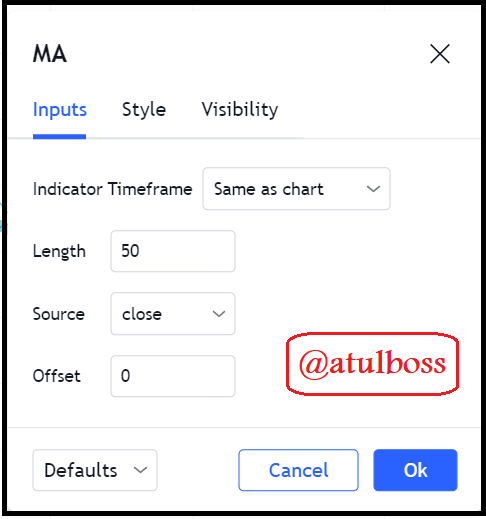

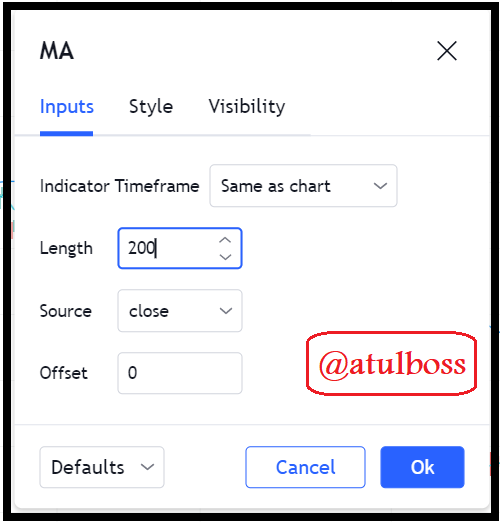

We will click on the settings of Moving average and will change the input to 50 and 200 for best results.

To recognize the MA lines more clearly we will change the colour of MA lines. I am using one light colour(sky blue) and one contrast colour(red) for my chart.

**Chart is shown below with explanation.

C. Explain the Death cross and Golden cross on the chart, (screenshot necessary)

Now, our chart is ready with the best suitable indicator for the Death Chart and Golden Chart.

Here, the red moving average line is long term(200 days) and the blue moving average line is short term(50 days).

In the above chart, we can clearly see that when the red line(long term) is crossing the blue line(short term) from the above, it means the market is in a downtrend motion. But when the blue line is crossing the red line in an upward direction, it means the market is in an uptrend. So it clearly helps the trader in taking the decision to gain good profit.

Question 3

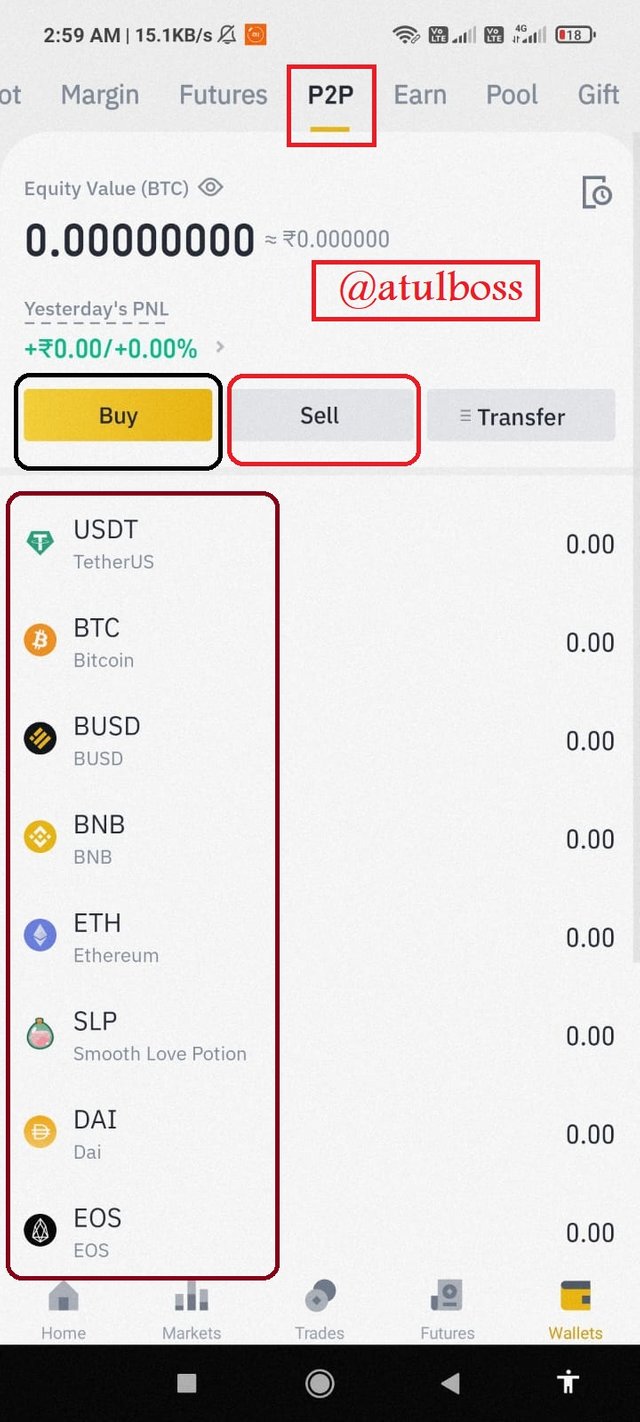

What is Binance P2P and how to use it?

How to transfer cryptocurrency to a p2p wallet?

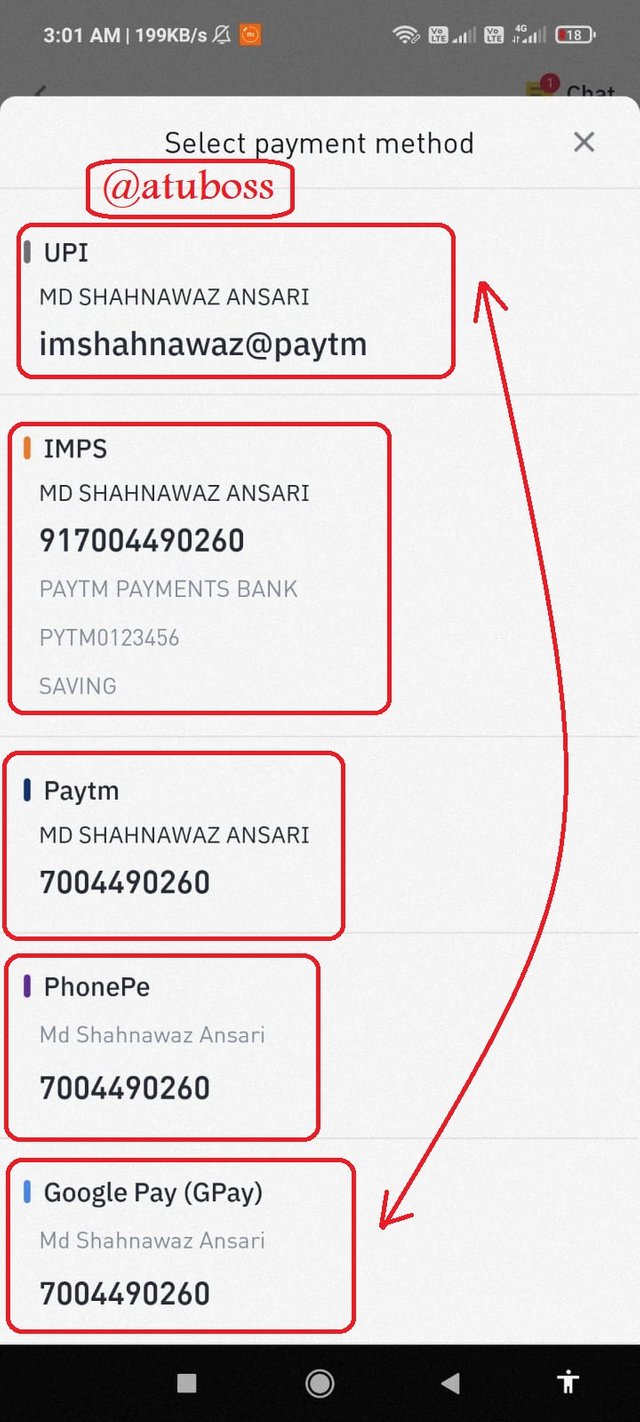

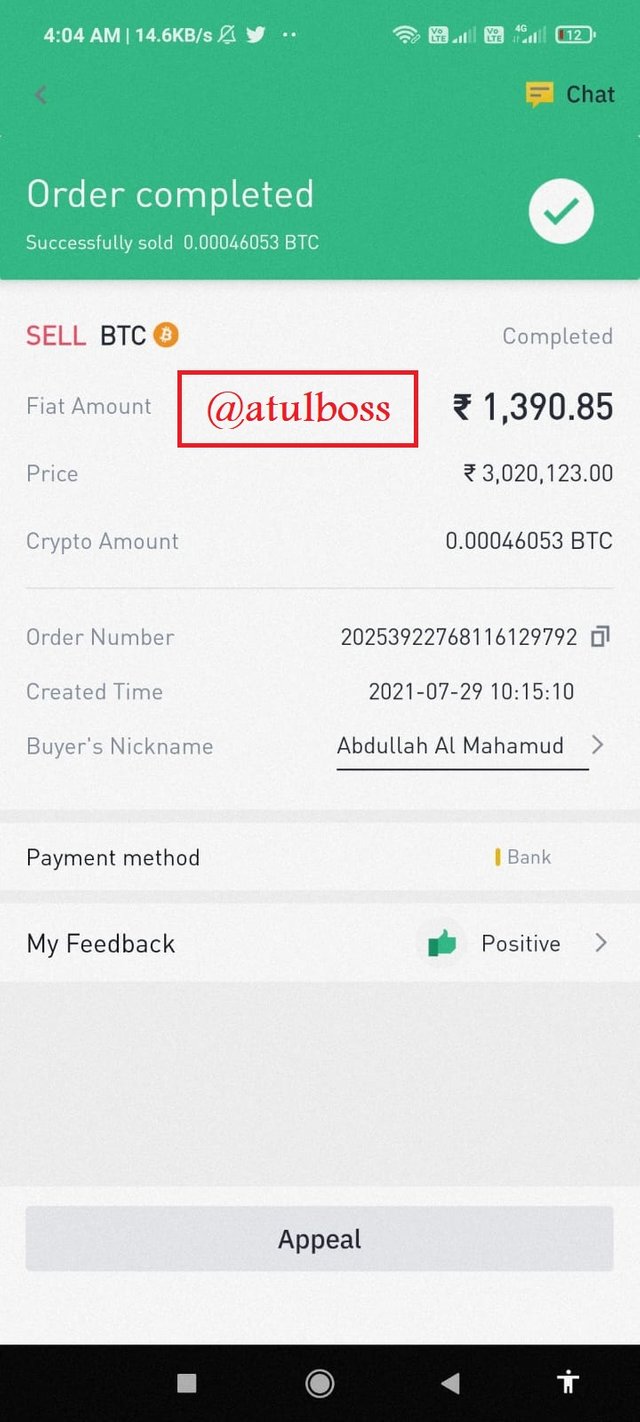

How to sell cryptocurrency in local currency via p2p (any country or coin)(screenshot necessary to verify account)

Binance P2P is the facility given by Binance to its users so that they can trade cryptocurrencies in their local currencies and directly receive them in a bank/wallet. Here P2P means peer to peer. There is a good thing here that a trader is independent to trade with anyone he/she wants to trade. There was a day 3-4 years ago when we used to buy bitcoin via Zebpay. There was no competition in exchanges so there was the monopoly of Zebpay in the market. People used to buy bitcoin at a very higher price and sell at a very lower price than the current price of that time. Then P2P facility came to place and it reduced the monopoly in the market.

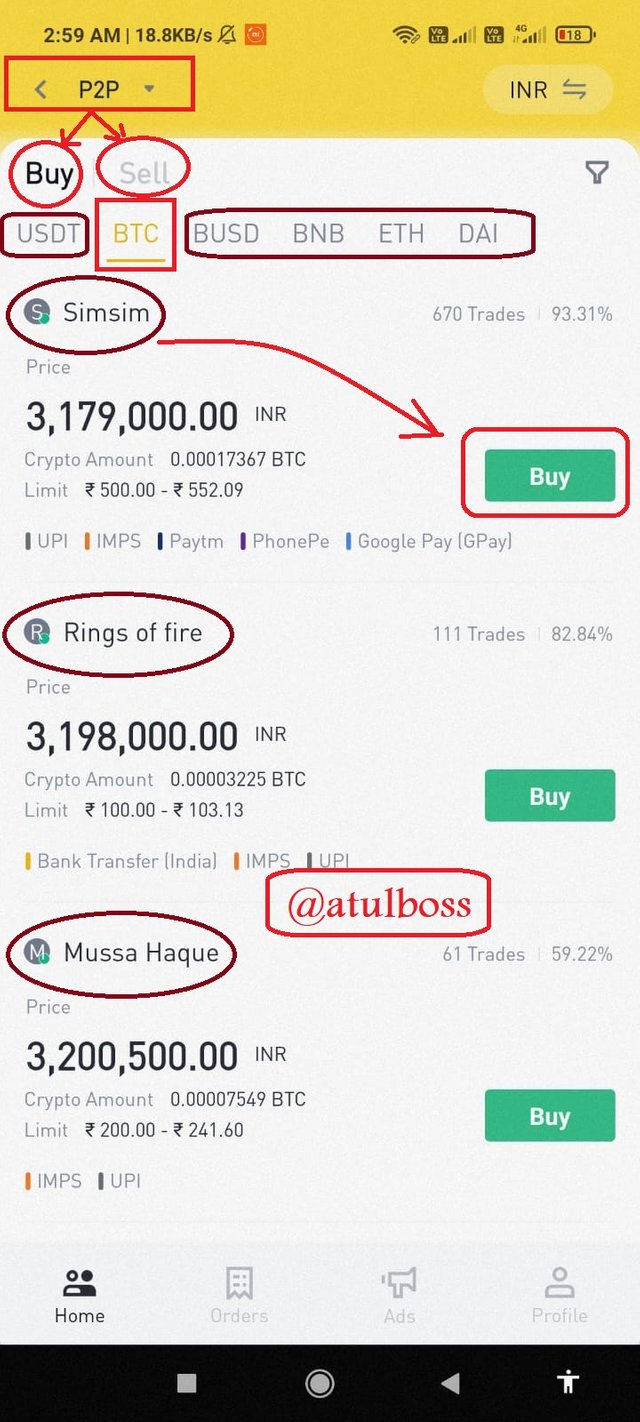

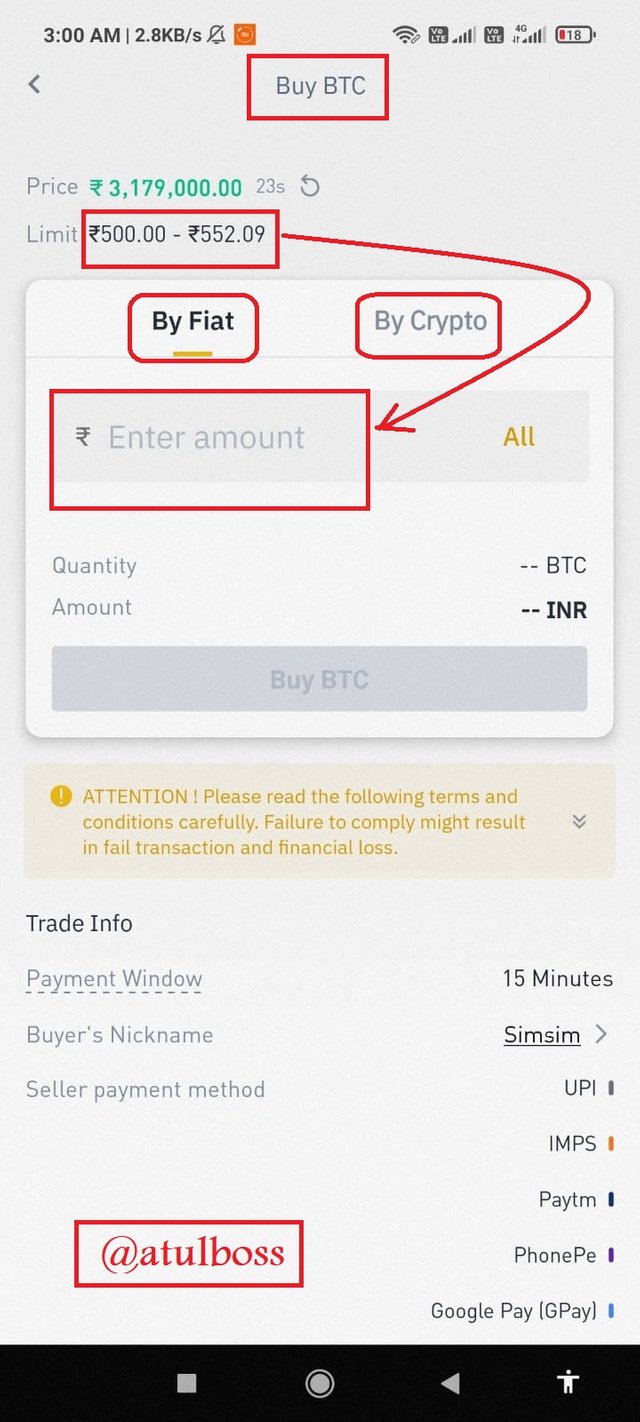

How to use the P2P

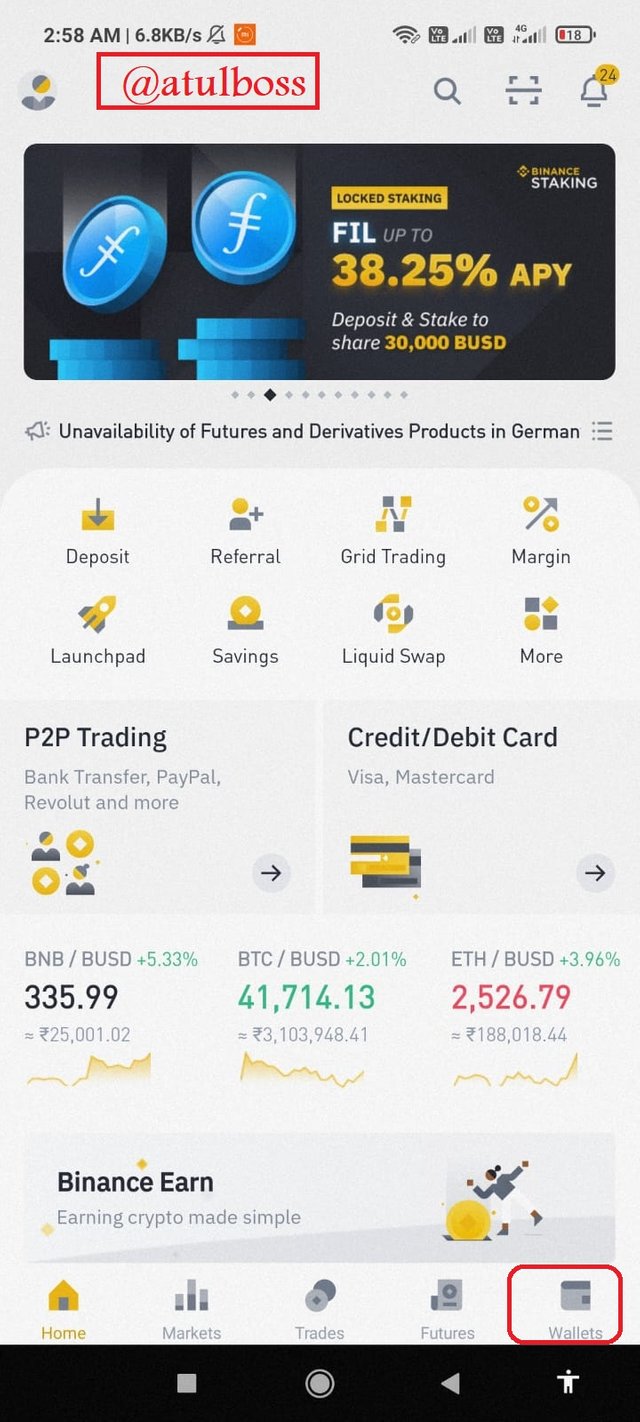

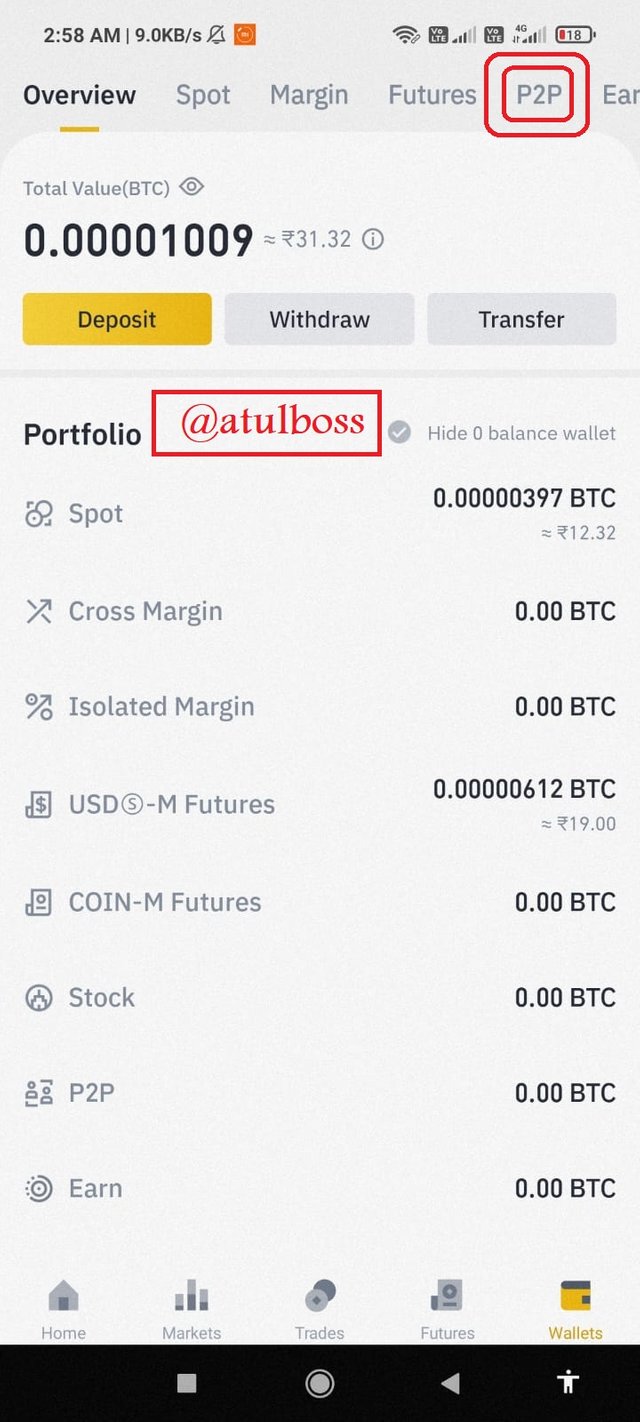

To learn how to use the P2P we are going to log in to the Binance.

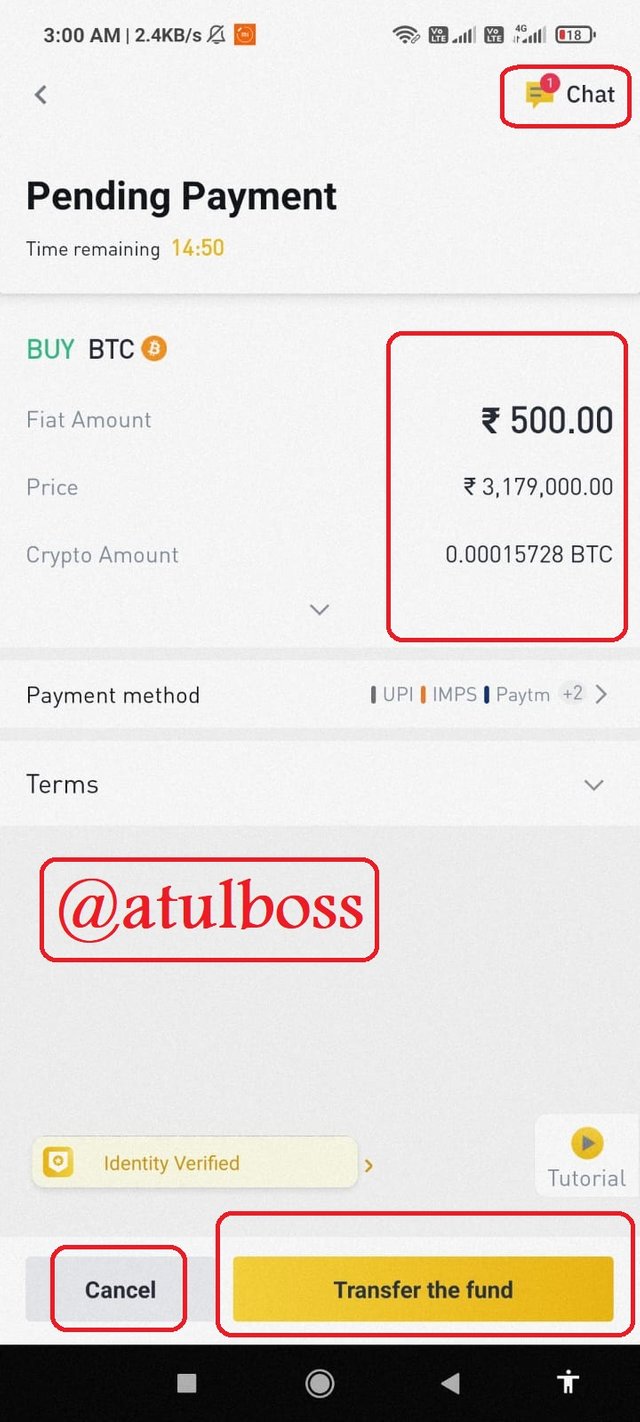

After paying by the given methods of payment, the trader will release the crypto.

Here I have explained how to BUY. But I will show my recent trade in which I sold steem in BTC pairs and that BTC was sold via P2P. I am attaching the screenshots.

Question 4

What are the things to keep in mind during P2P trade and describe its four advantages and disadvantages.(own words)

The important thing which is to keep in mind is:

a). Always trade with the online trader.

b). Chat before paying the amount

c). Use your personal account to pay.

d). Send the exact amount of local currency.

e). Try to be quick but avoid mistakes because of a hurry.

f). Read the guidelines given by the trader.

g). If you are selling, be patient till the buyer pays.

h). If you are a seller, don't believe the buyer words, check the payment in your bank account then release crypto because it is irreversible.

Advantages:

- It reduces the monopoly of exchanges.

- P2P has an escrow system that locks the assets until completed from the buyer end. This prevents cheating.

- It don't have margin or commission of exchanges.

- It allows the choice of the trader and doesn't bound to trade with only one trader.

Disadvantages:

- Sometimes funds may be lost because of a mistake done by the trader and the company doesn't take any responsibility.

- Some fake people make IDs and try to cheat new people.

- If a trader is not online, trade becomes very slow until he comes online.

- In the case of delay done by trader on the other side, if you cancel the trade 3 times you will be suspended for some time.

This was all from my side.

Thanks for reading my homework.

Respected first thank you very much for taking interest in SteemitCryptoAcademy

Season 3 | intermediate course class week 5

thank you very much for taking interest in this class

Thanks sir for evaluating my homework.

Unfortunately, i missed that part of question in a hurry.